Introduction on Workday Payroll Management System and Software Solutions

- 2. Workday Payroll Management System Workday Payroll Management system helps any organization to calculate the wages & compensation of any employee in a detailed & organized manner. In this technological world, we all know that Workday plays a vital role in each organization. Even small organizations began to deal with things with Workday. Workday is becoming increasingly popular daily.

- 3. What is Payroll? Payroll reveals the employees who the organization pays accompanying employee data. It involves the procedure for calculating the employees' wages and salaries.

- 4. What is Workday Payroll? Why is it necessary? Workday was established to reduce organizational workload. Calculating wages, salaries have been the biggest task for the Payroll staff and sometimes there is a chance of inappropriate inputs too. Workday comes up with a super useful application, Workday Payroll Software. It provides the control, flexibility, and knowledge you need to support your single organization. It provides the control, flexibility, and knowledge you need to sustain your unique organization.

- 5. Integrated with Workday HCM: Workday Payroll was developed in the context of Workday Human Capital Management (HCM).A unified Payroll and HCM solution allows you to maximize your overall investment in Workday. Leverage Workday's core system of records for employee data across HCM and Payroll to manage changes for benefits, terminations, and life events.

- 6. Flexibility in meeting unique demands: Traditional pay applications provide coded and ready-to-use kits that are often unable to meet particular operational needs. The flexible, intuitive setup of Workday supports your company's advanced requirements. Robust Calculation Engine: Run Payroll calculations as often as you like with the powerful Workday Calculation Engine, built to meet the most complex Payroll needs. Pay processing time is greatly reduced from hours to minutes. Highly configurable: Set up accumulations, balance periods, and balances as per your current calculation and reporting needs. Group employees into pay groups that make sense based on organizational needs. Role and segment-based security: Configurable security improves collaboration, giving business partners outside of Payroll the ability to provide feedback and view results before the end of pay.

- 7. Key benefits of Workday Payroll System: Use a modern computation engine to address complex needs. Define salary criteria for pay cycles and perform several pay groups together. Provide employees with access to mobile and online Payroll records. Offer W-2, W-4 online self-service, tax, and payment options. Conduct comprehensive audits before the last pay cycle. Review pre-defined Workday Payroll Reports to learn more about Payroll results. Get automatic tax updates using the cloud delivery model.

- 9. Comprehensive control over Payroll management Workday Payroll ensures full control over your processes, data, and Payroll costs. Remove sensitivities from legacy systems with intuitive Payroll management and implementation tools. Process Control: Control of how the GFR is calculated for different types of payment transactions. Develop criteria for specific earnings and deductions. Data Control: Get quick access to Payroll results for any employee or period. Execute common predefined reports such as salary balance summary and pay calculation results. Cost control: No more prohibitive fees for reporting, pay components, or service desk calculations. No more mandatory ERP vendor updates that are costly and time-consuming for your business.

- 10. Practical knowledge of Payroll Analytics: Workday Payroll provides integrated analytics, enabling you to run Workday Payroll Reports and audits on all Payroll data. Retrieve Payroll data and immediately follow up with adjustments. Automated audits: Users can define audit criteria and create audit reports at the abstract, pay group, or employee level. Implement complete audits integrated into pay results and drill into audit alerts to investigate details. Visibility of actual costs: Businesses can now see what they are spending globally for their employees. Compare pay outcomes between periods. Complete the pay calculation through a one-click report.

- 11. Workday Payroll Processing: Calculate earnings, deductions, or cumulating for any period. Calculate in bulk mode for pay groups or at the employee level with one click. Support for Mergers & Acquisitions (M&A). Determine how the gross-to-net ratio is calculated for different types of pay operations. Establish specific compensation and deduction criteria, including mark-up calculations.

- 12. Benefits & Deductions: Unlimited earnings/deductions Establish a set of rules for gains and deductions. Intuitive mapping of Workday HCM pays items/benefits. Eligibility criteria and scheduling logic for a specific treatment. Flexible working function for identifying unique allocations. Distribution of labor across employees, positions, and earnings. Configurable overdue calculations and net pay edits.

- 13. Accumulations & Budgets: Easily add or edit stacks. Determine pay periods, even after periods are processed. Account for balances and build-ups.

- 14. Audit & Reporting in Workday Payroll Processing: Perform common predefined reports, such as pay log and pay calculation results. Setup reports displaying earnings, deductions, or balances. Create audit reports at the summary/pay group/employee level. Define criteria for verifying pay outcomes. Comparison of pay results across periods. Calculate pay using a one-click report. Configure specific earnings or hold back views for certain security groups (for example managers, benefits partners). Export a page or report directly in Excel or PDF with one click.

- 15. Bookkeeping and Compliance: Setup account pay plan and set account allocation rules in Workday Payroll Processing The Payroll Accounting Report provides a comprehensive analysis. Work labels make it easier to allocate to projects, cost centers, funds, grants, customized organizations, etc. Workday's cloud model provides fiscal updates seamlessly and automatically. Setup, check, preview, and print W-2s and W-2Cs. Integrate tax filing and web services with any tax filing and filing service you choose.

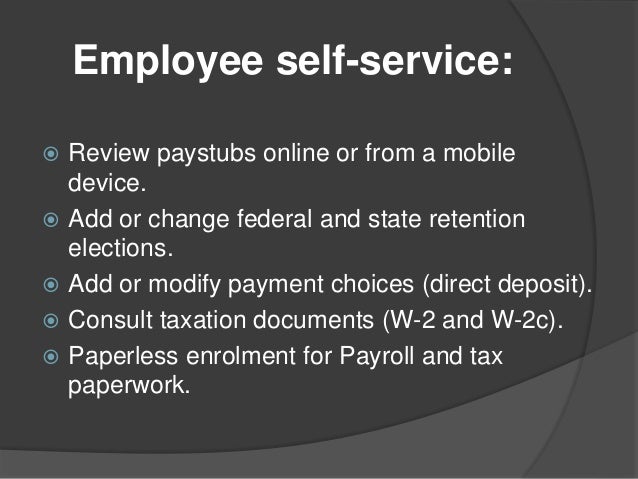

- 16. Employee self-service: Review paystubs online or from a mobile device. Add or change federal and state retention elections. Add or modify payment choices (direct deposit). Consult taxation documents (W-2 and W-2c). Paperless enrolment for Payroll and tax paperwork.

- 17. Contact us Address: 86, Light House Rd, Kollupuram, R.S. Puram, Coimbatore, Tamil Nadu 641001, India Phone no.: ☎ +91 956 604 8693 Email: ✉ [email protected] Website: https://www.erpcloudtraining.com/ Start Your Free Trial! Enroll Now with 35% OFF!