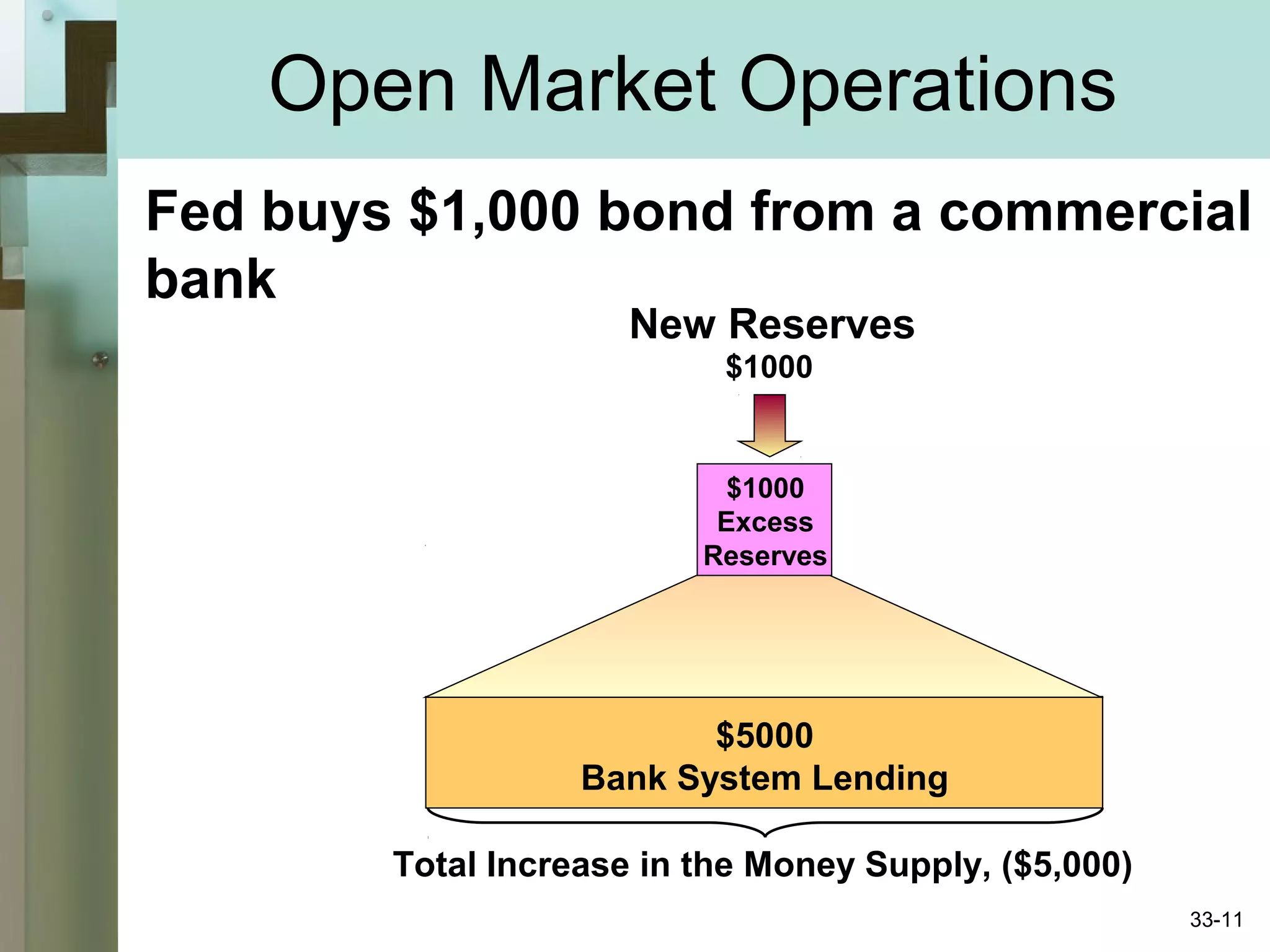

This chapter discusses monetary policy and how central banks like the Federal Reserve influence interest rates and the money supply. It covers the demand for and supply of money, how the Fed uses tools like open market operations and adjusting interest rates to affect the federal funds rate. It then explains how changes in monetary policy can influence aggregate demand, GDP, and inflation in the economy. The chapter also discusses some advantages and challenges of monetary policy.