AI and the Financial Service Segment

- 1. Artificial Intelligence and Financial Services Industry It’s not the big that eat the small, it’s the fast that eat the slow Presented to

- 2. Agenda • Challenges facing the Financial Services Industry • What is Artificial Intelligence, and where did it come from • What is Semantic Computing in AI • How can AI assist the Financial Service Industry • What steps should the Financial Services Industry adopt to get ready

- 3. The Financial Services & Insurance Value Chain

- 4. Three Challenges for Financial Services Industry • Interest Rates • Margins vs revenue • Regulatory Changes • Compliance cost vs safety net • Sharing Economy • Collaborative consumption • New Payment Options • Mobile wallets/apps, web sites • Evolved Customer Expectations • Anytime anywhere any device

- 5. Three Challenges for Insurance Industry • An Industry Ripe For Disruption • Structural Disruption • (self-driving cars, big data, and sharing economy) • New technologies • (Sharing economy (Uber/Airbnb) & coverage. • New Players • (with technology /innovative insurance products fill coverage gaps) • Control for the Consumer • Consumers financial focus • (high medical bills vs a budget) • Millennial Generation • (do-it-yourself approach, mobile technology) • New Platforms • ( increase transparency/efficiency through complex algorithms and big data.

- 6. What is FinTech? • Fintech is • the R&D function of financial services in the digital age • less to do with technology more to do with business model reinvention and customer centric design. • Fintech can be categorised as: • Traditional fintech as ‘facilitators’ with larger incumbent technology firms supporting the financial services sector • Emergent fintech as ‘disruptors’ with small innovative firms dis-intermediating incumbent financial services with new technology http://www.vertafore.com/Resources/Blog/what-is-insurtech-and-harness-disruptive-powers#sthash.CnTyw0WP.dpuf

- 7. What is InsureTech? • InsurTech is new technologies that are disrupting the insurance industry • Eg. smartphone apps, consumer activity wearables, claim acceleration tools, individual consumer risk development systems, online policy handling, automated compliance processing http://www.vertafore.com/Resources/Blog/what-is-insurtech-and-harness-disruptive-powers#sthash.CnTyw0WP.dpuf

- 8. Agenda • Challenges facing the Financial Services Industry • What is Artificial Intelligence, and where did it come from • What is Semantic Computing in AI • How can AI assist the Financial Service Industry • What steps should the Financial Services Industry adopt to get ready

- 10. Artificial Intelligence is an evolutionary process

- 11. Evolution of Data Analysis • AI/ Semantic Computing focus is around the Prescriptive Analytics approach Gartner Descriptive Diagnostic Predictive Analytics**

- 12. Definition of Artificial Intelligence (1955)

- 13. Key Word Search Vs AI/NLP Key Word • Keyword searches do not distinguishing between words that are spelled the same way but mean something different • Search tools still applies the same keyword pairing principles. So you get more refined bad results, not more accurate results. AI/Natural Language • Natural Language search systems focus on meaning and context in the natural way humans ask and offer answers • Natural Language is concept-based, it returns search hits on documents that are "about" the subject/theme you're exploring, even if the words in the document don't match all the words you query. https://www.inbenta.com/en/blog/entry/keyword-based-versus-natural-language-search

- 14. Why AI Now? • Market uncertainties drive simulation techniques to identify new growth opportunities • The 4 Vs(volume, velocity, variety and validity) of data provides new ways of thinking • High volumes and types of data (i.e. text, pictures, audio, video, blogs) is now accessed in real time, providing context for insightful decision making • Analytics technologies have matured & users’ expectations increased (user /domain-centric) capabilities https://www.linkedin.com/pulse/artificial-intelligence-insurance-virtual-reality-sabine-vanderlinden

- 15. AI Tools Available Today

- 16. Different Forms of AI

- 17. Where can AI assist Financial Services?

- 18. Where can AI assist Financial Services? • Machine Learning • builds algorithms to make data-driven predictions on behaviour/ patterns eg forensic analysis, predictive policing • Semantic Computing • understands the context and meanings (semantics) of computational content and expresses these in a machine-processable format • Natural Language Processing • focus on interactions between computers and natural human languages includes Semantic and sentiment analysis (social media) and cognitive customer experience space • Neural Networks • finds relationships among data points by allowing a system to “learn” new categories from collection of data perform predictions • Deep Learning • builds and trains neural networks that learns as it goes. Outputs are usually a predictions. • potential applications include enhanced micro-segmentation, intelligent pricing, prescriptive forecasting and augmented customer experiences https://www.linkedin.com/pulse/artificial-intelligence-insurance-virtual-reality-sabine-vanderlinden

- 19. Agenda • Challenges facing the Financial Services Industry • What is Artificial Intelligence, and where did it come from • What is Semantic Computing in AI • How can AI assist the Financial Service Industry • What steps should the Financial Services Industry adopt to get ready

- 20. Semantic Computing in the Media and Research 2017

- 21. How Does AI tools Work – Data Flow review

- 22. How does Semantic Computing Work?

- 23. What is Resource Description Framework (RDF) • RDF is a general framework for describing website metadata, or "information about the information“ • RDF defines a resource as any object that is uniquely identifiable by an Uniform Resource Identifier (URI) • RDF provides the framework for describing classes and properties in the form "subject", "predicate" and "object" • Enables computers to process data without needing to understand the structure of the data

- 24. Why does RDF work? • Integrates data from different sources without customer programming • It provides interoperability between applications and or machines • Develops relationships can be interpreted computationally, which enables the encoding, exchange and reuse of structured metadata • Data is stored in a Triplestore which is a purpose- built database for the storage and retrieval of triples through semantic queries.

- 25. Example of Industry Ontologies • An Ontology is a formal machine-interpretable definition of concepts in an area of interest (domain) • It describes the properties, features and attributes of those concepts, and highlights any restrictions • It describes the relationships between those concepts

- 26. 26 A Relationship Query of RDF Data

- 27. Semantic Computing in Action

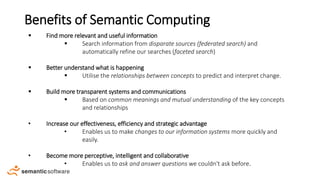

- 28. Benefits of Semantic Computing ▪ Find more relevant and useful information ▪ Search information from disparate sources (federated search) and automatically refine our searches (faceted search) ▪ Better understand what is happening ▪ Utilise the relationships between concepts to predict and interpret change. ▪ Build more transparent systems and communications ▪ Based on common meanings and mutual understanding of the key concepts and relationships • Increase our effectiveness, efficiency and strategic advantage • Enables us to make changes to our information systems more quickly and easily. • Become more perceptive, intelligent and collaborative • Enables us to ask and answer questions we couldn't ask before.

- 29. Agenda • Challenges facing the Financial Services Industry • What is Artificial Intelligence, and where did it come from • What is Semantic Computing in AI • How can AI assist the Financial Service Industry • What steps should the Financial Services Industry adopt to get ready

- 30. Engagement Issues with AI • AI Technology will Augment and enhance Human Work. • AI Systems Still Demand considered Design, Knowledge Engineering, and Model Building • AI Technologies Demand New Skills, Not a New Team https://www.forrester.com/report/TechRadar+Artificial+Intelligence+Technologies+And+Solutions+Q1+2017/-/E-RES136196

- 31. How would AI assist Financial Services Industry • Marketing: • NLP using sentiment analysis, machine learning or pattern recognition better understand their customers’ needs, • Design unique engagement journeys as well as promotional campaigns. • Intelligent Pricing: • Combining a variety of relevant data sources with clever pricing and optimisation engines. • Pattern recognition, deep learning techniques to identify fraudulent behaviour • Claims Management: • Machine Learning/ Deep Learning using algorithms accelerate claims assessment and identify claims leakages , reducing costs & improving the customer engagement. • detection of new sources of claims fraud • design really remedial and preventative actions. http://aitegroup.com/how-financial-services-can-benefit-artificial-intelligence

- 32. Steps to Start • Develop a Data Strategy • Legislations, Clients, Processes • Capture clean, regularised data • Structured and unstructured • Source relevant human capital skills • Industry segment trained, IT literate • Specialist in Data & Analytic tools • Develop environment for Linked Data and Analytics to grow

- 33. Key Questions for AI project? • What’s the best use of AI for your Organisation • What are your present and future business needs? • How does AI support your bank’s strategic objectives? • What tasks could be automated to optimize processes/ staffing? • Do you have a specific AI project ? • Do you have a sponsor? • What is the status of the data required? • Do you know what data is required for analysis? • Do you have access to this data? • Can this data be structured for your AI’s algorithms? • Would additional data source improve the analysis? • Do you have plans to source missing data? • AI Project Funding & Resources? • How will you measure the project’s ROI? • What is the acceptable cost of a proof of concept? • Do you have enough funding for an AI project? • Does your technology team have the bandwidth to for an AI project? • Does your team have skills/IT platform capable of developing AI project? • Do you have an executive / technical team to manage AI project? • What is your AI implementation plan? • Can you develop target deadlines for the pilot and launch? • What are the next steps for your AI strategy after this pilot Developing a Data Management Platform