Considerations for an Effective Internal Model Method Implementation

- 1. Considerations for an Effective Internal Model Method Implementation January 2017

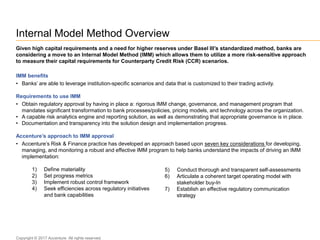

- 2. Internal Model Method Overview Given high capital requirements and a need for higher reserves under Basel III’s standardized method, banks are considering a move to an Internal Model Method (IMM) which allows them to utilize a more risk-sensitive approach to measure their capital requirements for Counterparty Credit Risk (CCR) scenarios. IMM benefits • Banks’ are able to leverage institution-specific scenarios and data that is customized to their trading activity. Requirements to use IMM • Obtain regulatory approval by having in place a: rigorous IMM change, governance, and management program that mandates significant transformation to bank processes/policies, pricing models, and technology across the organization. • A capable risk analytics engine and reporting solution, as well as demonstrating that appropriate governance is in place. • Documentation and transparency into the solution design and implementation progress. Accenture’s approach to IMM approval • Accenture’s Risk & Finance practice has developed an approach based upon seven key considerations for developing, managing, and monitoring a robust and effective IMM program to help banks understand the impacts of driving an IMM implementation: 1) Define materiality 2) Set progress metrics 3) Implement robust control framework 4) Seek efficiencies across regulatory initiatives and bank capabilities 5) Conduct thorough and transparent self-assessments 6) Articulate a coherent target operating model with stakeholder buy-In 7) Establish an effective regulatory communication strategy Copyright © 2017 Accenture All rights reserved.

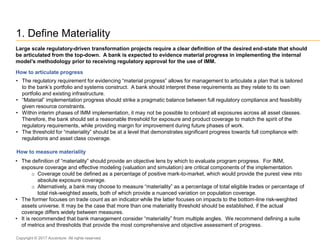

- 3. 1. Define Materiality • The definition of “materiality” should provide an objective lens by which to evaluate program progress. For IMM, exposure coverage and effective modeling (valuation and simulation) are critical components of the implementation. o Coverage could be defined as a percentage of positive mark-to-market, which would provide the purest view into absolute exposure coverage. o Alternatively, a bank may choose to measure “materiality” as a percentage of total eligible trades or percentage of total risk-weighted assets, both of which provide a nuanced variation on population coverage. • The former focuses on trade count as an indicator while the latter focuses on impacts to the bottom-line risk-weighted assets universe. It may be the case that more than one materiality threshold should be established, if the actual coverage differs widely between measures. • It is recommended that bank management consider “materiality” from multiple angles. We recommend defining a suite of metrics and thresholds that provide the most comprehensive and objective assessment of progress. Large scale regulatory-driven transformation projects require a clear definition of the desired end-state that should be articulated from the top-down. A bank is expected to evidence material progress in implementing the internal model’s methodology prior to receiving regulatory approval for the use of IMM. How to articulate progress • The regulatory requirement for evidencing “material progress” allows for management to articulate a plan that is tailored to the bank’s portfolio and systems construct. A bank should interpret these requirements as they relate to its own portfolio and existing infrastructure. • “Material” implementation progress should strike a pragmatic balance between full regulatory compliance and feasibility given resource constraints. • Within interim phases of IMM implementation, it may not be possible to onboard all exposures across all asset classes. Therefore, the bank should set a reasonable threshold for exposure and product coverage to match the spirit of the regulatory requirements, while providing margin for improvement during future phases of work. • The threshold for “materiality” should be at a level that demonstrates significant progress towards full compliance with regulations and asset class coverage. How to measure materiality Copyright © 2017 Accenture All rights reserved.

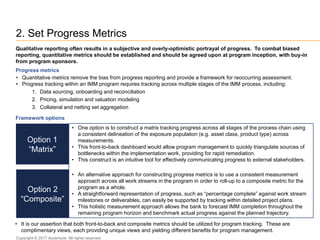

- 4. 2. Set Progress Metrics • It is our assertion that both front-to-back and composite metrics should be utilized for program tracking. These are complimentary views, each providing unique views and yielding different benefits for program management. Qualitative reporting often results in a subjective and overly-optimistic portrayal of progress. To combat biased reporting, quantitative metrics should be established and should be agreed upon at program inception, with buy-in from program sponsors. Progress metrics • Quantitative metrics remove the bias from progress reporting and provide a framework for reoccurring assessment. • Progress tracking within an IMM program requires tracking across multiple stages of the IMM process, including: 1. Data sourcing, onboarding and reconciliation 2. Pricing, simulation and valuation modeling 3. Collateral and netting set aggregation Framework options Option 1 “Matrix” Option 2 “Composite” • One option is to construct a matrix tracking progress across all stages of the process chain using a consistent delineation of the exposure population (e.g. asset class, product type) across measurements. • This front-to-back dashboard would allow program management to quickly triangulate sources of bottlenecks within the implementation work, providing for rapid remediation. • This construct is an intuitive tool for effectively communicating progress to external stakeholders. • An alternative approach for constructing progress metrics is to use a consistent measurement approach across all work streams in the program in order to roll-up to a composite metric for the program as a whole. • A straightforward representation of progress, such as “percentage complete” against work stream milestones or deliverables, can easily be supported by tracking within detailed project plans. • This holistic measurement approach allows the bank to forecast IMM completion throughout the remaining program horizon and benchmark actual progress against the planned trajectory. Copyright © 2017 Accenture All rights reserved.

- 5. 3. Implement Robust Control Framework IMM requires multiple data inputs, including market data, trade data, counterparty and reference data, and collateral information. It is important to demonstrate to regulators that the inputs used within the IMM model are high quality, comprehensive data sets that are consistent with inputs to other related models and reported figures. Golden Sourcing and Reconciliation Data Controls • Where possible, the IMM model should source data directly from golden sources subject to robust data governance practices. • If the current infrastructure does not permit direct golden sourcing, reconciliations ought to be developed to deliver consistency • Reconciliations should be performed routinely and automated with minimal manual intervention. • Data controls are required in order to maintain data quality throughout the IMM process. • Controls should be constructed that certify inputs as “fit for use” prior to processing and confirm outputs as “effectively modeled.” • The controls system should be accompanied by robust break management tools and well- documented remediation processes. Adjustments Data Governance • Data should be adjusted prior to official month-end reporting. • Adjustments should be performed in a controlled manner and executed as far upstream as possible. • Month-end IMM runs should be inclusive of adjustments in order to align to official reporting and bank ledgers. • Clearly documented data and systems architectures should be utilized in order to provide transparency into the reconciliations, controls and adjustments that occur within the IMM process chain. Copyright © 2017 Accenture All rights reserved.

- 6. 4. Seek Efficiencies Across Regulatory Initiatives and Bank Capabilities Your IMM solution design should take into account all ongoing regulatory and business initiatives in order to improve resource utilization and benefits captured. Exploiting synergies across bank initiatives can help yield significant time and cost savings if identified during the IMM program’s initial planning phase. Related bank programs • Some of the regulations that are related and relevant to IMM include Standardized Approach for measuring counterparty credit risk (SA-CCR), Volcker Rule, Uncleared Margin requirements, Basel Committee on Banking Supervision’s regulation 239 (BCBS 239), Office of the Comptroller of the Currency (OCC) Guidelines for Heightened Standards, Basel Coordination Committee (BCC) 15-1, BCC 13-5, Comprehensive Capital Analysis and Review (CCAR), and the Fundamental Review of Trading Book (FRTB). These regulations center around similar themes for IMM such as standardized approaches for measuring CCR exposures, frameworks for margin requirement standards, Risk Data Aggregation principles and governance, Model Risk Management principles and capital analysis and review processes. • A comprehensive review of all regulations should be performed to identify these intersection points. In addition, regulatory impacts and bank programs should be tracked and monitored to avoid duplication of efforts and to improve synchronization across work efforts and proposed target solutions. Active engagement across programs • Senior management o Program sponsors and executive leadership play a critical role in identifying overlapping program needs and opportunities to invest in strategic platforms that can greatly reduce the potential for redundant builds. o A delegate should be assigned to participate in periodic tangential program updates to understand the progress, risks and issues experienced by other bank alliances. o Executive stakeholders should also be vigilant with respect to future initiatives in the pipeline, emerging regulatory trends and evolving risk management and advanced modeling preferred practices. • IMM program participants o All program participants should also be encouraged to consider opportunities to leverage or build strategic solutions that are adaptive to multiple current and future requirements across bank functions (e.g. risk management, credit management and treasury). o In order for all participants to serve as bank stewards, a culture of operational efficiency, risk management and innovation should be promoted by the bank’s leadership. Copyright © 2017 Accenture All rights reserved.

- 7. 5. Conduct Thorough and Transparent Self-Assessments Conducting a self-assessment that is thorough and transparent with a well structured approach is critical to complying with IMM regulations and assessing a banks’ current state and gaps towards IMM approval. Points to consider in an effective self-assessment • Self-assessment process and design structured to encompass all aspects of the regulation, bank functions and processes. • Conducted from an objective standpoint (i.e. third party) while taking input from the bank’s subject matter specialists (SMSs). • Template where data is collected and displayed should include: summary views for leadership review, the ability to have progress metrics on gap identification and closure, bank’s interpretation and adherence to the regulation. • Periodic self-assessments during the path towards finalizing the IMM waiver (at the start of the project, during more mature phases and right before the exam to demonstrate preparedness). • Bank SMSs continuously engaged with roles and responsibilities clearly defined. • Document rationale for exclusions/inclusions in IMM that deviate from the regulation, appropriate business touchpoints and “sign-off” and decisions/outcomes. Benefits • Helps the bank to evaluate conformance to a broad spectrum of IMM-related regulatory requirements with a clear mapping to regulations and their requirements. • Provides insight into IMM readiness across all processes, data, systems, models and technology. • Informs the bank of its weaknesses and strengths accurately, with gaps and accompanied severity and impacts identified. • Provides transparency and common taxonomy regarding the bank’s progress towards IMM compliance and any outstanding gaps requiring management focus. • Allows the bank to identify the right set of capability groups around which to structure the overall IMM program. Copyright © 2017 Accenture All rights reserved.

- 8. 6. Articulate a Coherent Target Operating Model with Stakeholder Buy-In In order to demonstrate a linkage between the regulatory requirements and how the bank expects to deliver on those requirements, the bank should build a target operating model with stakeholder buy-in. Points to consider in an effective target operating model • Construct a comprehensive operating framework that outlines the areas or capabilities involved in the IMM process. • Develop and provide the framework for the bank to be operational in business as usual (BAU) and satisfy IMM requirements. • Align the regulatory requirements to bank-defined performance criteria and thresholds. • Outline, in a requirement format with accompanying performance criteria and thresholds, what is currently being done and changes to processes, systems, policies and procedures. • The guiding principles of the target operating model framework should be clearly communicated across all work streams to articulate how the framework relates to each workstream. • Structure the purpose of the framework with a matrix outlining people, process, technology, models and data. • Define and visualize key processes, process flows and controls. • Address the concept of data quality across trade, reference and market data with a data lineage component to address data population completeness and accuracy. • Evidence of control points should be collected and kept within a central repository for audit traceability. • A technical-architectural diagram should be developed to provide a visual representation of the target platform. Benefits • Allows the bank to evidence a sound IMM infrastructure and processes. • Allows the bank to demonstrate compliance to both the regulators and internal audit. • The performance and corresponding acceptable criteria can be used by the testing group to write use cases for new enhancements. Copyright © 2017 Accenture All rights reserved.

- 9. 7. Establish an Effective Regulatory Communication Strategy Touchpoints with regulators, the Federal Reserve and the OCC, are critical for pro-actively responding to regulatory requirements, addressing open questions and managing overall expectations leading up to regulatory exams. Points to consider in an effective regulatory communication strategy • Regulatory communication strategy should be global and broad in the set of regulators it covers. • Bank should be prepared to cover all pertinent regulatory themes and provide the appropriate level of detail to satisfy inquiries. • Regulatory communication should be standardized and documented to maintain an audit trail that can be recalled as needed. • Timelines should be fully documented with dates and topics covered to have a clear picture on how these will evolve over time. • All documents should be reviewed and vetted before they are sent to regulators and discussed. • Develop a plan outlining stages for the communication, topics and expectation for the touchpoints. • Communication leads should review information to be delivered and be prepared to anticipate questions and topics that might be posed. • Dedicated project management office (PMO) function to centrally manage regulatory requirements, exam dates and deadlines. • Establish roles and responsibilities and communication frequency for program leads. • Determine “fit” given personalities of key stakeholders that interact and connect better with the regulators, and leverage these relationships especially for informal communication. • Understand what has been previously communicated and establish a baseline of information. Benefits • Allows the bank to deliver a robust IMM program. • Allows the bank to appropriately demonstrate a transparent, controlled and comprehensive technology platform and operating model when seeking regulatory approval. Copyright © 2017 Accenture All rights reserved.

- 10. Considerations for an Effective Internal Model Method Implementation 10 Copyright © 2017 Accenture All rights reserved. Disclaimer This presentation is intended for general informational purposes only and does not take into account the reader’s specific circumstances, and may not reflect the most current developments. Accenture disclaims, to the fullest extent permitted by applicable law, any and all liability for the accuracy and completeness of the information in this presentation and for any acts or omissions made based on such information. Accenture does not provide legal, regulatory, audit, or tax advice. Readers are responsible for obtaining such advice from their own legal counsel or other licensed professionals. About Accenture Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions—underpinned by the world’s largest delivery network— Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With more than 394,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. Visit us at www.accenture.com