Creating an Income Statement with Forecasts: A Simple Guide and Free Excel Template

- 1. Income Statement Automatically updated based on your input

- 2. The income statement is one of the three important financial statements used for reporting a company’s financial performance An income statement is a financial statement that reports a company's financial performance over a specific accounting period. It is one of the three important financial statements used for reporting a company’s financial performance, the other two being the balance sheet and the cash flow statement. The income statement focuses on the revenue, and expenses reported by a company during a particular period. It provides valuable insights into a company’s operations, the efficiency of its management, underperforming sectors, and its performance relative to industry peers. The income statement is also known as the profit and loss (P&L) statement or the statement of revenue and expense. It starts with the details of sales and then works down to compute net income and eventually earnings per share (EPS). The income statement does not differentiate between cash and non-cash receipts (sales in cash vs. sales on credit) or cash vs. non-cash payments/disbursements (purchases in cash vs. purchases on credit). Company Name 2

- 3. The income statement has three primary components Revenue The money earned by the company which includes: • The sale of goods and services • The interest earned • Some investment activities Expenses The Money spent to generate revenue which includes: • Cost of Goods Sold (COGS): The direct costs attributable to the production of the goods sold by a company • Selling Expenses: Cash payments (or equivalent) for marketing services • Administrative Expenses: Costs to the firm to cover items such as salaries • Interest Expenses: Payments made to cover costs of financing • Tax Expense: Payments made to the government to cover income taxes • Depreciation Expenses: Amount of asset usage that is applied to this year Net Income Net Income is referred to as “Profit” or “Earnings,” when not negative and “Loss” when negative. It is the company revenues minus its expenses - = Company Name 3

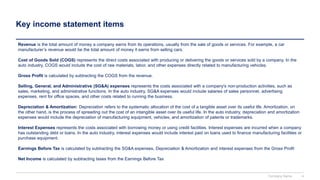

- 4. Key income statement items Revenue is the total amount of money a company earns from its operations, usually from the sale of goods or services. For example, a car manufacturer’s revenue would be the total amount of money it earns from selling cars. Cost of Goods Sold (COGS) represents the direct costs associated with producing or delivering the goods or services sold by a company. In the auto industry, COGS would include the cost of raw materials, labor, and other expenses directly related to manufacturing vehicles. Gross Profit is calculated by subtracting the COGS from the revenue. Selling, General, and Administrative (SG&A) expenses represents the costs associated with a company's non-production activities, such as sales, marketing, and administrative functions. In the auto industry, SG&A expenses would include salaries of sales personnel, advertising expenses, rent for office spaces, and other costs related to running the business. Depreciation & Amortization: Depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life. Amortization, on the other hand, is the process of spreading out the cost of an intangible asset over its useful life. In the auto industry, depreciation and amortization expenses would include the depreciation of manufacturing equipment, vehicles, and amortization of patents or trademarks. Interest Expenses represents the costs associated with borrowing money or using credit facilities. Interest expenses are incurred when a company has outstanding debt or loans. In the auto industry, interest expenses would include interest paid on loans used to finance manufacturing facilities or purchase equipment. Earnings Before Tax is calculated by subtracting the SG&A expenses, Depreciation & Amortization and interest expenses from the Gross Profit Net Income is calculated by subtracting taxes from the Earnings Before Tax Company Name 4

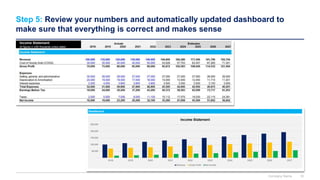

- 5. Step-by-step tutorial to create an income statement 1 Open our income statement template and adjust the periods based on your requirement 2 Adjust the items listed in the income statement based on your specificities 3 Input your numbers in the historical periods of your income statement 4 Input the assumptions that will be used to automatically calculate the future periods of your income statement 5 Review your numbers and dashboard to make sure that everything is correct and makes sense Company Name 5

- 6. Step 1: Open our income statement template and adjust the periods based on your requirement Company Name 6

- 7. Step 2: Adjust the items listed in the income statement based on your specificities Company Name 7

- 8. Step 3: Input your numbers in the historical periods of your income statement. This will automatically update the historical periods of the Assumptions section Automatically updated based on your input Company Name 8

- 9. Step 4: Input the assumptions that will be used to automatically calculate the future periods of your income statement Automatically updated based on your input Company Name 9

- 10. Step 5: Review your numbers and automatically updated dashboard to make sure that everything is correct and makes sense Company Name 10

- 11. Thank you for your attention. www.domontconsulting.com