1. CEMAC's regional integration remains shallow despite its ambitious Vision 2025 goals. Recorded intra-CEMAC trade is only 2-5% of members' total trade, the lowest among African blocs.

2. The 2014-15 oil price shock severely impacted CEMAC economies and renewed commitment to deeper integration. Under PREF-CEMAC, reforms aim to improve fiscal coordination, accelerate regional integration, enhance the business climate, and diversify economies.

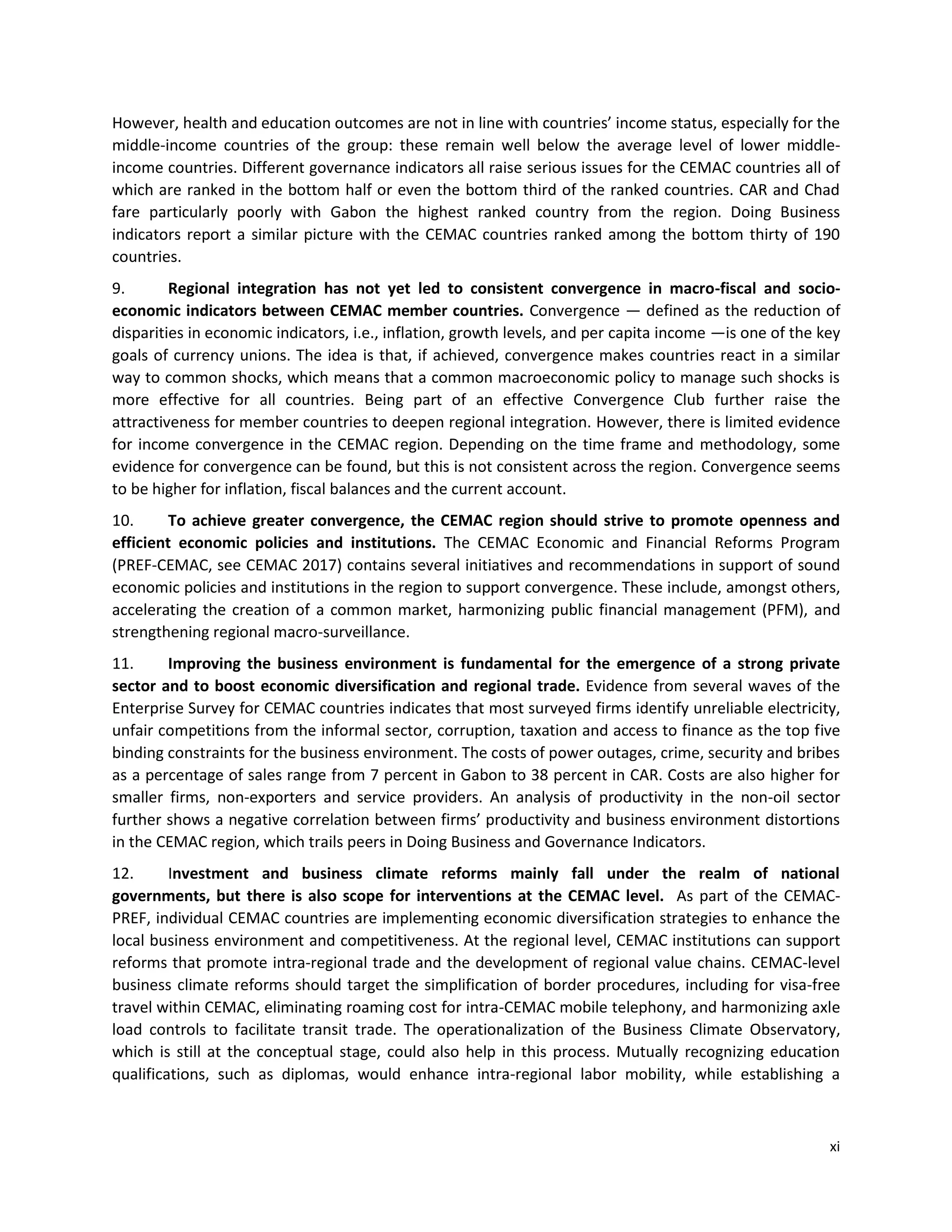

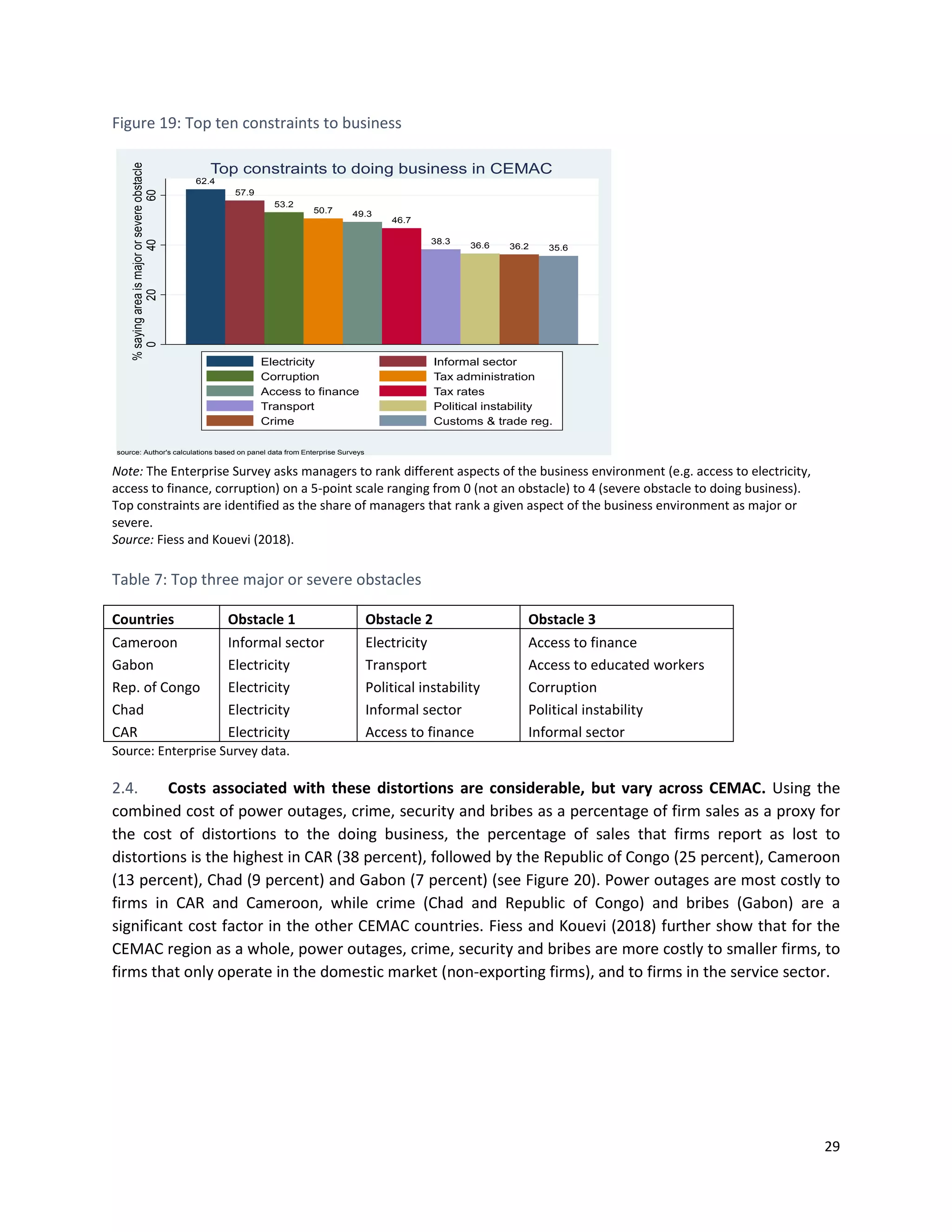

3. Analyses indicate significant growth gains from deeper integration by removing obstacles to trade, capital flows, and labor mobility. However, CEMAC must strengthen implementation of its common policies and address political obstacles to full regional cooperation.