Developing a Soft Linkage between a detailed dynamic input-output macroeconomic model and a MarkAl energy system model

- 1. Developing a Soft Linkage between a detailed dynamic Input-Output macroeconomic model and a MarkAl energy system model François Briens [email protected] and Nadia Maïzi nadia.maï[email protected] Center for Applied Mathematics, Ecole des Mines Paristech (France) 19/11/2014

- 2. CONTENT 1. Current challenges to hybrid Energy-Economic modelling approaches 2. Our Input-Output Macroeconomic Model 3. Linking our Input-Output model to a MarkAl Model 4. Conclusion 2

- 3. 1. Current challenges to hybrid Energy-Economic modelling approaches 3 High level of aggregation of the economic sphere: • Specificities of societies and their economies? • Structural changes? (impact on energy consumption & dependency) • Economy is about: What do we want to produce and consume? How? For who? => GDP is NOT a satisfying indicator Strong & restrictive assumptions on the economy and economic agents behavior E.g.: • Constant Elasticities • Utilitarianist approaches and optimality (inaccurate and sometimes irrelevant) =>Many models are fundamentally « growth oriented » (normative stance) Endogeneity is NOT a Graal. • Complexity VS. Intelligibility • Prospective modeling: a tool for political and societal choices

- 4. 1. Current challenges to hybrid Energy-Economic modelling approaches 4 Interest of dynamic features wrt. Static/Equilibrium models • Transitional dynamics Ex: Investment « Wall effect » ; What if « critical » evolutions of the system? • Accounting for demographic evolution impacts (ex: active population ; health & education expenditures ; evolution of lifestyles) Other important issues to reflect: Public debt, waste production, poverty, etc. Source: INSEE, 2005 Avg size of households vs. age Impact on Building sector?

- 5. CONTENT 1. Current challenges to hybrid Energy-Economic modelling approaches 2. Our Input-Output Macroeconomic Model 3. Linking our Input-Output model to a MarkAl Model 4. Conclusion 5

- 6. 2. Our Dynamic Input-Output Model 6 -> Home-made Dynamic Simulation Model with STELLA ® -> Based on French National Accounts -> Focus on Structural (rather than conjonctural) issues (Long term concerns) Sectorial Production targets, Added Value (GDP) Input-Output Analysis Output Energy Consumption, GHG Emissions, Employment, Poverty, Government budget balance, public debt… Scenarios for Sectorial DemandScenarios for Sectorial Demand

- 7. 2. Our Macro-economic Model 7 The Model - Sectorial Final Demand • Total Final Demand in goods and services For each branch i of the economy: Total Final Demandi = Final Consumption i (households) + Investment in products i + Export i - Import i

- 8. 2. Our Macro-economic Model 8 The Model - Sectorial Macro Final Demand 𝑭𝒊𝒏𝒂𝒍 𝒄𝒐𝒏𝒔𝒖𝒎𝒑𝒕𝒊𝒐𝒏 𝒐𝒇 𝒉𝒐𝒖𝒔𝒆𝒉𝒐𝒍𝒅𝒔 = 𝑃𝑜𝑝𝑢𝑙𝑎𝑡𝑖𝑜𝑛 𝑜𝑟 ℎ𝑜𝑢𝑠𝑒ℎ𝑜𝑙𝑑𝑠 × 𝐹𝑖𝑛𝑎𝑙 𝑐𝑜𝑛𝑠𝑢𝑚𝑝𝑡𝑖𝑜𝑛 𝑝𝑒𝑟 𝑝𝑒𝑟𝑠𝑜𝑛 𝑜𝑟 ℎ𝑜𝑢𝑠𝑒ℎ𝑜𝑙𝑑 Population - Cohorts Model - 9 scenarios from INSEE up to 2060: Final Consumption per person or Households: Exogeneous, using surveys (political-behavioral parameters) 0- 2 3- 10 11- 14 15- 17 18- 24 25- 29 39- 49 50- 54 55- 59 60- 64 65- 74 75- 84 85 &+ Demography Immigration LOW MEDIUM HIGH LOW MEDIUM HIGH Source: http://www.insee.fr/fr/ppp/bases-de- donnees/irweb/projpop0760/dd/pyramide/pyramide.htm

- 9. 2. Our Macro-economic Model 9 The Model - Sectorial Final Demand • Total Final Demand in goods and services For each branch i of the economy: Total Final Demandi = Final Consumption i (households) + Investment in products i + Export i - Import i

- 10. 2. Our Macro-economic Model 10 The Model - Sectorial Macro Final Demand Capital Stocks and Investment (1/2) Capital Stocks Survival laws: Asset Life expectancy following a normal distribution (avg lifetime;std) for each branch i and each asset type j 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡𝑖,𝑗 𝑡 ∗𝑡=𝑡𝑖𝑚𝑒 𝑡=−∞ 1 − 𝑆𝑖,𝑗 𝑡𝑖𝑚𝑒 − 𝑡 with Sij the survival coefficient, and (1-Sij) following a cumulated normal distribution Different asset types Housings Other buildings Transport equipement IT equipment Cultivated assets Softwares Etc. 0 0.2 0.4 0.6 0.8 1 1.2 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 Asset type 1 Asset type 2 Asset type 3

- 11. 2. Our Macro-economic Model 11 The Model - Sectorial Macro Final Demand Capital Stocks and Investment (2/2) Investment: So as to match a capital stock target corresponding to the production level, using the capital productivity (= 𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 𝐾 ) of branch i 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 𝑏𝑟𝑎𝑛𝑐ℎ 𝑖,𝑎𝑠𝑠𝑒𝑡 𝑡𝑦𝑝𝑒 𝑗(𝑡) = 𝑝𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛𝑖 𝑡 + 𝑑𝑡 𝐾𝑝𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑣𝑖𝑡𝑦𝑖,𝑗 𝑡 − 𝑠𝑡𝑜𝑐𝑘 𝐾𝑖,𝑗(𝑡) 0 20 40 60 80 100 120 K Target= Forcstd Production/Kproductivity Scrappage Initial stock of K Δ=Investment needed to match K target

- 12. 2. Our Macro-economic Model 12 The Model - Sectorial Final Demand • Total Final Demand in goods and services For each branch i of the economy: Total Final Demandi = Final Consumption i (households) + Investment in products i + Export i - Import i

- 13. 2. Our Macro-economic Model 13 The Model - Sectorial Macro Final Demand (7/7) Foreign Trade Import: Using import coefficients for final consumption, investment and intermediate consumption 𝑻𝒐𝒕𝒂𝒍 𝑰𝒎𝒑𝒐𝒓𝒕𝒊 = 𝐹𝑖𝑛𝑎𝑙 𝐺𝑜𝑜𝑑𝑠 & 𝑆𝑒𝑟𝑣𝑖𝑐𝑒𝑠𝑖 𝑖 ∗ 𝐼𝑚𝑝𝑜𝑟𝑡 𝑆ℎ𝑎𝑟𝑒𝑖 + 𝐼𝑛𝑡𝑒𝑟𝑚𝑒𝑑𝑖𝑎𝑡𝑒 𝐺𝑜𝑜𝑑𝑠 & 𝑆𝑒𝑟𝑣𝑖𝑐𝑒𝑠𝑖 𝑖 ∗ 𝐼𝑚𝑝𝑜𝑟𝑡 𝑆ℎ𝑎𝑟𝑒𝑖 + 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝑓𝑜𝑟𝑚𝑎𝑡𝑖𝑜𝑛𝑖 𝑖 ∗ 𝐼𝑚𝑝𝑜𝑟𝑡 𝑆ℎ𝑎𝑟𝑒𝑖 Export: Proportional to import, or exogeneous

- 14. 2. Our Macro-economic Model 14 Sectorial Production targets, Added Value (GDP) Input-Output Analysis Output Energy Consumption, GHG Emissions, Employment, Poverty, Government budget balance, public debt… Scenarios for Sectorial Demand Input-Output Analysis

- 15. 2. Our Macro-economic Model 15 The Model - Input-Output Analysis • Input-Output Analysis - 38 Branches Hypothesis : Macro Supply = Macro Demand 𝑇𝑜𝑡𝑎𝑙 𝐷𝑜𝑚𝑒𝑠𝑡𝑖𝑐 𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 = 𝐼𝑛𝑡𝑒𝑟𝑚𝑒𝑑𝑖𝑎𝑡𝑒 𝐶𝑜𝑛𝑠𝑢𝑚𝑝𝑡𝑖𝑜𝑛 + 𝐹𝑖𝑛𝑎𝑙 𝐶𝑜𝑛𝑠𝑢𝑚𝑝𝑡𝑖𝑜𝑛 𝑥1 = 𝑎11. 𝑥1 + 𝑎12. 𝑥2 + ⋯ + 𝑎1𝑛. 𝑥 𝑛 +𝑦1 𝑥2 = 𝑎21. 𝑥1 + 𝑎22. 𝑥2 + ⋯ + 𝑎2𝑛. 𝑥 𝑛 +𝑦2 𝑥… = 𝑎…1. 𝑥1 + 𝑎…2. 𝑥2 + ⋯ + 𝑎…𝑛. 𝑥 𝑛 +𝑦… 𝑥 𝑛 = 𝑎 𝑛1. 𝑥1 + 𝑎 𝑛2. 𝑥2 + ⋯ + 𝑎 𝑛𝑛. 𝑥 𝑛 +𝑦 𝑛 with: 𝒙𝒊 = Total output of branch i 𝒚𝒊= Final demand for products i domestically produced 𝒂𝒊𝒋= Intermediate consumption of domestic product j used to produce one unit in the branch I => [X] = [A] [X] + [Y] Solving for [X], we have: [X]= [I-A]-1 . [Y] where [I-A]-1 is called the Leontief Inverse

- 16. 2. Our Macro-economic Model 16 Sectorial Production targets, Added Value (GDP) Input-Output Analysis Output Energy Consumption, GHG Emissions, Employment, Poverty, Government budget balance, public debt… Scenarios for Sectorial Demand Output Energy Consumption, GHG Emissions, Employment, Poverty, Government budget balance, public debt…

- 17. 2. Our Macro-economic Model 17 The Model – Main Outputs (1/3) • Energy, GHG and Waste from production: Using « Intensity coefficients » (estimated from Eurostat Data, INSEE, World Input-Output Database, Evolution rates to be fixed by the modeler) 𝐹𝑖𝑛𝑎𝑙 𝑬𝒏𝒆𝒓𝒈𝒚 𝑪𝒐𝒏𝒔𝒖𝒎𝒑𝒕𝒊𝒐𝒏 𝑓𝑟𝑜𝑚 𝑝𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛(𝑡) = 𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛𝑖 𝑡 × 𝐸𝑛𝑒𝑟𝑔𝑦𝐼𝑛𝑡𝑒𝑛𝑠𝑖𝑡𝑦𝑖 (𝑡) 𝑏𝑟𝑎𝑛𝑐ℎ𝑒 𝑖 𝑮𝑯𝑮 𝒆𝒎𝒊𝒔𝒔𝒊𝒐𝒏𝒔(𝑡) = 𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛𝑖 𝑡 × 𝐺𝐻𝐺 𝐼𝑛𝑡𝑒𝑛𝑠𝑖𝑡𝑦𝑖 (𝑡) 𝑏𝑟𝑎𝑛𝑐ℎ𝑒 𝑖 NB: Output detailed for: SOx, NOx, NH3, CO, NMVOC, CH4, N20, CO2, PM10, PM2.5, and CO2equivalences 𝑾𝒂𝒔𝒕𝒆 𝒑𝒓𝒐𝒅𝒖𝒄𝒕𝒊𝒐𝒏(𝑡) = 𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛𝑖 𝑡 × 𝑊𝑎𝑠𝑡𝑒 𝐼𝑛𝑡𝑒𝑛𝑠𝑖𝑡𝑦𝑖 (𝑡) 𝑏𝑟𝑎𝑛𝑐ℎ𝑒 𝑖 NB: So far, output detailed for 14 types of waste (Glass, wood, lether, metal, plastic, rubber, mineral, hazardous and non-hazardous waste, etc.)

- 18. 2. Our Macro-economic Model 18 The Model - Main Outputs (2/3) • Public Budget and Public Debt APU Revenue APU Expenditure (by function: classification COFOG) Fiscal Revenue Taxes on Products (D21) V.A.T., Taxes on Imports, Other (TICPE, tabacco, beverages, etc.) General Services APU (inc. Debt repayment…) Taxes on Production (D29) Tax on Wages and Labour, Other taxes on production « Defense » (or « attack ») Impôts courants sur Revenu et Patrimoine (D5) IRPP, CSG, CRDS, Impôt sur les sociétés, taxe d’habitation, impôt foncier ménages, ISF, etc. Public order and « safety » Economic Affairs Taxes in Capital (D91) Environmental protection Social Contributions (employeurs et ménages) Housing and community amenities Non-Fiscal Revenue Property Income Investment Revenue (D41 & D42), Land and Deposits rents (D45) Recreation, culture and religion Education Health Production Income Social Protection

- 19. 2. Our Macro-economic Model 19 The Model - Main Outputs (2/3) • Public Budget and Public Debt special focus on: • Education (11% Public exp. in 2012) =>Cohort model: 𝐸𝑥𝑝. = (𝑝𝑒𝑜𝑝𝑙𝑒 𝑎𝑔𝑒 𝑖 × 𝑠𝑐ℎ𝑜𝑜𝑙 𝑒𝑛𝑟𝑜𝑙𝑚𝑒𝑛𝑡 𝑎𝑔𝑒 𝑖, 𝑙𝑒𝑣𝑒𝑙𝑗 × 𝑐𝑜𝑠𝑡 𝑝𝑒𝑟 𝑠𝑡𝑢𝑑𝑒𝑛𝑡𝑙𝑒𝑣𝑒𝑙 𝑗) 𝑎𝑔𝑒 𝑖;𝑙𝑒𝑣𝑒𝑙 𝑗 • Health (15% Public exp. in 2012) =>Cohort model (similar to [Geay and Lagasnerie, 2013]), accounting for age effect, end-of-life effect, health quality: 𝐸𝑥𝑝. = (𝑝𝑒𝑜𝑝𝑙𝑒 𝑠𝑢𝑟𝑣𝑖𝑣𝑖𝑛𝑔 𝑛𝑜𝑛 − 𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖 × 𝑐𝑜𝑠𝑡 𝑠𝑢𝑟𝑣𝑖𝑣𝑜𝑟 𝑛𝑜𝑛 − 𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖 +𝑝𝑒𝑜𝑝𝑙𝑒 𝑠𝑢𝑟𝑣𝑖𝑣𝑖𝑛𝑔 𝑤𝑖𝑡ℎ𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖 × 𝑐𝑜𝑠𝑡 𝑠𝑢𝑟𝑣𝑖𝑣𝑜𝑟 𝑤𝑖𝑡ℎ 𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖 +𝑝𝑒𝑜𝑝𝑙𝑒 𝑛𝑜𝑡 𝑠𝑢𝑟𝑣𝑖𝑣𝑖𝑛𝑔 𝑛𝑜𝑛 − 𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖 × 𝑐𝑜𝑠𝑡 𝑛𝑜𝑛 𝑠𝑢𝑟𝑣𝑖𝑣𝑖𝑛𝑔 𝑛𝑜𝑛 − 𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖 +𝑝𝑒𝑜𝑝𝑙𝑒 𝑛𝑜𝑡 𝑠𝑢𝑟𝑣𝑖𝑣𝑖𝑛𝑔 𝑤𝑖𝑡ℎ 𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖 × 𝑐𝑜𝑠𝑡 𝑛𝑜𝑛 𝑠𝑢𝑟𝑣𝑖𝑣𝑜𝑟 𝑤𝑖𝑡ℎ 𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖) 𝑎𝑔𝑒 𝑖 • Social Protection (43% Public exp. in 2012) =>High level of disagregation : Retirement Pensions, Unemployment, Family and child, housing, Illness and disability, Social Exclusion (rsa…) , Basic Income

- 20. 2. Our Macro-economic Model 20 The Model - Main Outputs (2/3) • Public Budget and Public Debt APU Revenue APU Expenditure (by function: classification COFOG) Fiscal Revenue Taxes on Products (D21) V.A.T., Taxes on Imports, Other (TICPE, tabacco, beverages, etc.) General Services APU (inc. Debt repayment…) Taxes on Production (D29) Tax on Wages and Labour, Other taxes on production « Defense » (or « attack ») Impôts courants sur Revenu et Patrimoine (D5) IRPP, CSG, CRDS, Impôt sur les sociétés, taxe d’habitation, impôt foncier ménages, ISF, etc. Public order and « safety » Economic Affairs Taxes in Capital (D91) Environmental protection Social Contributions (employeurs et ménages) Housing and community amenities Non-Fiscal Revenue Property Income Investment Revenue (D41 & D42), Land and Deposits rents (D45) Recreation, culture and religion Education Health Production Income Social Protection Budget Balance = Public Deficit/Surplus 𝑷𝒖𝒃𝒍𝒊𝒄 𝑫𝒆𝒃𝒕 = 𝑷𝒖𝒃𝒍𝒊𝒄 𝑫𝒆𝒇𝒊𝒄𝒊𝒕 𝒕

- 21. 2. Our Macro-economic Model 21 The Model - Main Outputs (3/3) • Employment & Unemployment Total amount of working hours required to match a given level of production using Labour productivity ( 𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 𝐻𝑜𝑢𝑟𝑠 𝑤𝑜𝑟𝑘𝑒𝑑 ) 𝐻𝑜𝑢𝑟𝑠 𝑊𝑜𝑟𝑘𝑒𝑑 𝑏𝑟𝑎𝑛𝑐ℎ 𝑖 𝑡 = 𝑝𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 𝑖 𝑡 𝐿𝑎𝑏𝑜𝑢𝑟 𝑝𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑣𝑖𝑡𝑦 𝑖 𝑡 Nb: evolution of labour productivity can be extrapolated or chosen by the modeler with considerations on possible combinations of (K,L) 𝐸𝑚𝑝𝑙𝑜𝑦𝑒𝑑 𝑝𝑒𝑜𝑝𝑙𝑒 𝑏𝑟𝑎𝑛𝑐ℎ 𝑖 𝑡 = 𝐻𝑜𝑢𝑟𝑠 𝑤𝑜𝑟𝑘𝑒𝑑 𝑖 𝑡 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑤𝑜𝑟𝑘𝑖𝑛𝑔 𝑡𝑖𝑚𝑒 𝑝𝑒𝑟 𝑝𝑒𝑟𝑠𝑜𝑛𝑖 𝑡 NB: Additional informative output-> composition of « active » population in Socio-Professional categories using initial shares of each « CSP » in each branch. Unemployed people= Total Active population – ∑Employed people With: (cohort model) 𝐴𝑐𝑡𝑖𝑣𝑒 𝑝𝑜𝑝𝑢𝑙𝑎𝑡𝑖𝑜𝑛 = 𝑃𝑜𝑝𝑢𝑙𝑎𝑡𝑖𝑜𝑛 𝑎𝑔𝑒 × 𝐴𝑐𝑡𝑖𝑣𝑖𝑡𝑦 𝑟𝑎𝑡𝑒 𝑎𝑔𝑒 𝑎𝑔𝑒

- 22. 2. Our Dynamic Input-Output Model 22 Global Macro-Economic Modelling Approach Survey results Sectorial Production targets, Added Value (GDP) Input-Output Analysis Output Energy Consumption, GHG Emissions, Employment, Poverty, Government budget balance, public debt… Scenarios for Sectorial Demand Political proposals (e.g.: frugality, “commoning” and sharing (cars, equipment, etc.), repairing, reusing, recycling –durability of goods-, fiscal policy and redistribution, Working time policy, re-localization, small scale organic farming, not- for-profit organizations, etc.)

- 23. CONTENT 1. Current challenges to hybrid Energy-Economic modelling approaches 2. Our Input-Output Macroeconomic Model 3. Linking our Input-Output model to a MarkAl Model 4. Conclusion 23

- 24. 3. Soft Linkage between dynamic Input-Output simulation model & MarkAl model 24 Macro socio- economic Model Input-Output Simulation Model Main Outputs: Production & Added Value, Employment per sector and Unemployment, Poverty, Public Budget, Energy Consumption, GHG Emissions, Waste, etc. Hypotheses on the evolution of Final Consumption of Goods & Service Bottom-Up Energy System Model Markal Main Outputs: “Optimal” Allocation of energy technologies /processes and resources/ commodities, GHG intensity of energy, “global” energy price First Estimate of Global Final Energy Demand for the production, transport and residential sectors -Dispatching of the energy demand between branches Oil/Gas & Electricity, -Share of electric vehicles,… -GHG intensity of the Energy sectors -Change in Relative Price of Energy Political Proposals

- 25. CONTENT 1. Current challenges to hybrid Energy-Economic modelling approaches 2. Our Input-Output Macroeconomic Model 3. Linking our Input-Output model to a MarkAl Model 4. Conclusion 25

- 26. 8. Conclusion (1/2) 26 Importance of dynamic features, disaggregation, flexibility of the economic sphere for the study of a diversity of contrasted scenarios of demand About our macroeconomic model: a quite simple, accessible, powerful tool for common understanding and collective debate Next steps: Surveys Scenario Building, Modeling, soft-linking and Analysis

- 27. Thank you for your attention Q & A?

- 28. Éléments de bibliographie Assoumou, E. (2006). Modélisation MARKAL pour la planification énergétique long terme dans le ccontext français. PhD thesis, Ecole des Mines de Paris. Crassous, R. (2008). Modéliser le long terme dans un monde de 2nd rang: Application aux politiques climatiques. PhD thesis, Institut des Sciences et Industries du Vivant et de l’Environnement (Agro ParisTech). Duesenberry, J. S. (1949). Income, Saving and the Theory of Consumer Behavior. Cambrige (Mass.) Harvard University Press Janssen, M. A. and Jager, W. (2001). Fashions, habits and changing preferences: Simulation of psychological factors affecting market dynamics. Journal of Economic Psychology, 22(6):745 – 772. Latouche, S. (2009). Farewell to growth. Robert E. Lucas, J. (1976). Econometric policy evaluation: A critique. Carnegie-Rochester Conference Series on Public Policy, 1(1):19–46. O’Neill, D. W. (2012). Measuring progress in the degrowth transition to a steady state economy. Ecological Economics, 84(0):221 – 231. Victor, P. and Rosenbluth, G. (2007). Managing without growth. Ecological Economics, 61(2-3):492–504.

- 29. 2. Our approach 29 -> Home-made Dynamic Simulation Model with STELLA ® -> Based on French National Accounts -> Focus on Structural (rather than conjonctural) issues (Long term concerns) Survey results Sectorial Production targets, Added Value (GDP) Input-Output Analysis Output Energy Consumption, GHG Emissions, Employment, Poverty, Government budget balance, public debt… Scenarios for Sectorial Demand Political proposals (e.g.: frugality, “commoning” and sharing (cars, equipment, etc.), repairing, reusing, recycling –durability of goods-, fiscal policy and redistribution, Working time policy, re-localization, small scale farming and agroecology, not-for-profit organizations, etc.)

- 30. 6. Our approach 30 Survey- Focus Groups • Purpose: participative building of scenarios for the evolution of final demand in goods and services • Using the classification in Products or functions of consumption (COICOP) • For each function: -> Discussing its possible, desirable/acceptable evolution per person or per household with respect to current level -> And possible ways to operate this evolution (e.g. gross reduction of service consumption, equipment sharing, repairing, extended lifetime, etc.) FON01 Produits alimentaires et boissons non alcoolisées FON02 Boissons alcoolisées et Tabac FON03 Articles d'habillement et chaussures FON04 Logement, eau gaz, électricité et autres combustibles FON05 Meubles, articles de ménage et entretien courant de l'habitation FON051Meubles, articles d'ameublement, tapis et autres revêtements de sol FON052Articles de ménage en textile FON053Appareils ménagers FON054Verrerie, vaisselle et ustensiles de ménage FON055Outillage et autre matériel pour la maison et le jardin FON056Biens et services liés à l'entretien courant de l'habitation FON07 Transports FON071Achats de véhicules Etc. 1970 1980 1990 2000 2010 2020 2030 2040 2050 ? « How much? » & « How ?»

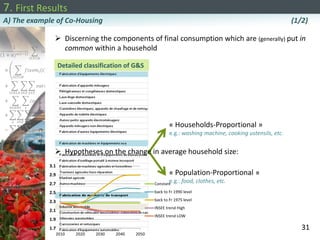

- 31. 7. First Results 31 A) The example of Co-Housing (1/2) Detailed classification of G&S « Households-Proportional » e.g.: washing machine, cooking ustensils, etc. « Population-Proportional » e.g.: food, clothes, etc. Discerning the components of final consumption which are (generally) put in common within a household Hypotheses on the change in average household size: 1.7 1.9 2.1 2.3 2.5 2.7 2.9 3.1 2010 2020 2030 2040 2050 Constant back to Fr 1990 level back to Fr 1975 level INSEE trend High INSEE trend LOW

- 32. 7. First Results 32 A) The example of Co-Housing (1/2) Results: Nota: Evolution of the age-structure of population may counter-balance co-housing behaviors! Source: INSEE, 2005 -11% -5% -3% -4% -4% -12% -9% -4% -6% -6% -22% 7% 4% 2% 3% 3% -25% -20% -15% -10% -5% 0% 5% 10% Total Waste Hazardous Waste GHG Emissions (C02eq) Global Energy consumption Agregate Final Consumption Nb Households Values in 2040 with respect to the constant household size hypothesis Central Projection INSEE HH size 1975 HH size 1990

- 33. 7. First Results 33 B) « Re-Localization » Implementation in our model: Change in Technical coefficients /Intermediate consumptions of Transport in Input-Output Tables Change in import Ratios: 𝐼𝑚𝑝𝑜𝑟𝑡𝑒𝑑 𝑖 𝐷𝑜𝑚𝑒𝑠𝑡𝑖𝑐𝑎𝑙𝑙𝑦 𝑃𝑟𝑜𝑑𝑢𝑐𝑒𝑑 𝑖+𝐼𝑚𝑝𝑜𝑟𝑡𝑒𝑑𝑖 Exports in proportion of Imports Simulations: back to the values of 1980 - 1970 - 1960 Results: -6% -5% 5% 5% 7% 9% -9% -8% 4% 6% 8% 9% -6% -4% 10% 16% 15% 20% -15% -10% -5% 0% 5% 10% 15% 20% 25% Global GHG Emissions Global Energy consumption GHG Emissions Domestic Energy consumption for Domestic Prod Full Time Employment Total Production Values in 2040 with respect to scenario with 2010 values 1960 1970 1980

![2. Our Macro-economic Model

15

The Model - Input-Output Analysis

• Input-Output Analysis - 38 Branches

Hypothesis : Macro Supply = Macro Demand

𝑇𝑜𝑡𝑎𝑙 𝐷𝑜𝑚𝑒𝑠𝑡𝑖𝑐 𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 = 𝐼𝑛𝑡𝑒𝑟𝑚𝑒𝑑𝑖𝑎𝑡𝑒 𝐶𝑜𝑛𝑠𝑢𝑚𝑝𝑡𝑖𝑜𝑛 + 𝐹𝑖𝑛𝑎𝑙 𝐶𝑜𝑛𝑠𝑢𝑚𝑝𝑡𝑖𝑜𝑛

𝑥1 = 𝑎11. 𝑥1 + 𝑎12. 𝑥2 + ⋯ + 𝑎1𝑛. 𝑥 𝑛 +𝑦1

𝑥2 = 𝑎21. 𝑥1 + 𝑎22. 𝑥2 + ⋯ + 𝑎2𝑛. 𝑥 𝑛 +𝑦2

𝑥… = 𝑎…1. 𝑥1 + 𝑎…2. 𝑥2 + ⋯ + 𝑎…𝑛. 𝑥 𝑛 +𝑦…

𝑥 𝑛 = 𝑎 𝑛1. 𝑥1 + 𝑎 𝑛2. 𝑥2 + ⋯ + 𝑎 𝑛𝑛. 𝑥 𝑛 +𝑦 𝑛

with:

𝒙𝒊 = Total output of branch i

𝒚𝒊= Final demand for products i domestically produced

𝒂𝒊𝒋= Intermediate consumption of domestic product j used to produce

one unit in the branch I

=> [X] = [A] [X] + [Y]

Solving for [X], we have: [X]= [I-A]-1 . [Y]

where [I-A]-1 is called the Leontief Inverse](https://image.slidesharecdn.com/wc15-2014-11-19briensworkshopetsaphybridmodelsenergyeconomy-150530100140-lva1-app6892/85/Developing-a-Soft-Linkage-between-a-detailed-dynamic-input-output-macroeconomic-model-and-a-MarkAl-energy-system-model-15-320.jpg)

![2. Our Macro-economic Model

19

The Model - Main Outputs (2/3)

• Public Budget and Public Debt

special focus on:

• Education (11% Public exp. in 2012)

=>Cohort model:

𝐸𝑥𝑝. = (𝑝𝑒𝑜𝑝𝑙𝑒 𝑎𝑔𝑒 𝑖 × 𝑠𝑐ℎ𝑜𝑜𝑙 𝑒𝑛𝑟𝑜𝑙𝑚𝑒𝑛𝑡 𝑎𝑔𝑒 𝑖, 𝑙𝑒𝑣𝑒𝑙𝑗 × 𝑐𝑜𝑠𝑡 𝑝𝑒𝑟 𝑠𝑡𝑢𝑑𝑒𝑛𝑡𝑙𝑒𝑣𝑒𝑙 𝑗)

𝑎𝑔𝑒 𝑖;𝑙𝑒𝑣𝑒𝑙 𝑗

• Health (15% Public exp. in 2012)

=>Cohort model (similar to [Geay and Lagasnerie, 2013]), accounting for age effect,

end-of-life effect, health quality:

𝐸𝑥𝑝. =

(𝑝𝑒𝑜𝑝𝑙𝑒 𝑠𝑢𝑟𝑣𝑖𝑣𝑖𝑛𝑔 𝑛𝑜𝑛 − 𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖 × 𝑐𝑜𝑠𝑡 𝑠𝑢𝑟𝑣𝑖𝑣𝑜𝑟 𝑛𝑜𝑛 − 𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖

+𝑝𝑒𝑜𝑝𝑙𝑒 𝑠𝑢𝑟𝑣𝑖𝑣𝑖𝑛𝑔 𝑤𝑖𝑡ℎ𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖 × 𝑐𝑜𝑠𝑡 𝑠𝑢𝑟𝑣𝑖𝑣𝑜𝑟 𝑤𝑖𝑡ℎ 𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖

+𝑝𝑒𝑜𝑝𝑙𝑒 𝑛𝑜𝑡 𝑠𝑢𝑟𝑣𝑖𝑣𝑖𝑛𝑔 𝑛𝑜𝑛 − 𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖 × 𝑐𝑜𝑠𝑡 𝑛𝑜𝑛 𝑠𝑢𝑟𝑣𝑖𝑣𝑖𝑛𝑔 𝑛𝑜𝑛 − 𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖

+𝑝𝑒𝑜𝑝𝑙𝑒 𝑛𝑜𝑡 𝑠𝑢𝑟𝑣𝑖𝑣𝑖𝑛𝑔 𝑤𝑖𝑡ℎ 𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖 × 𝑐𝑜𝑠𝑡 𝑛𝑜𝑛 𝑠𝑢𝑟𝑣𝑖𝑣𝑜𝑟 𝑤𝑖𝑡ℎ 𝐴𝐿𝐷 𝑎𝑔𝑒 𝑖)

𝑎𝑔𝑒 𝑖

• Social Protection (43% Public exp. in 2012)

=>High level of disagregation :

Retirement Pensions, Unemployment, Family and child, housing, Illness and

disability, Social Exclusion (rsa…) , Basic Income](https://image.slidesharecdn.com/wc15-2014-11-19briensworkshopetsaphybridmodelsenergyeconomy-150530100140-lva1-app6892/85/Developing-a-Soft-Linkage-between-a-detailed-dynamic-input-output-macroeconomic-model-and-a-MarkAl-energy-system-model-19-320.jpg)