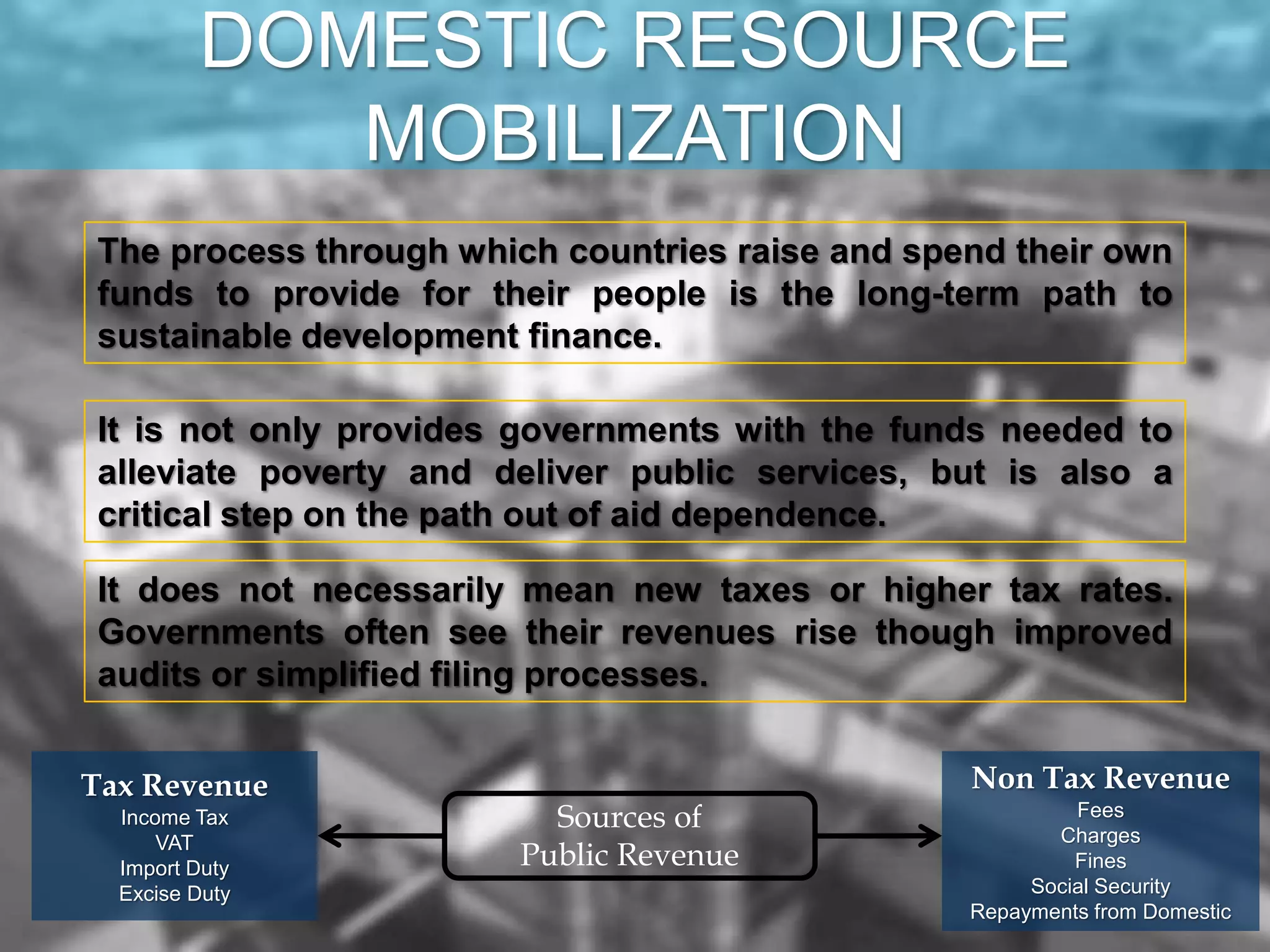

This document discusses various sources and approaches to financing development. It describes financing from international institutions like the IMF and World Bank which provide loans, grants and other funding. It also discusses domestic resource mobilization through taxes and spending by national governments. Private sector financing approaches include blended finance which blends public and private funds, as well as philanthropic funding. Challenges to development financing include situations of conflict and fragility. Innovative financing solutions and partnerships are needed to help address development needs in these difficult contexts.