Diffrerent Modes Of Investment of IBBL-BUBT

- 3. • Objective of the report • Methodology of the report • Limitation of the report • Islamic vs conventional bank • Corporate profile • Theoretical aspect • Analysis. • Comparative analysis • Findings • reccomandation

- 4. To analyze different modes of investment. To seek out all the strengths, weaknesses, opportunities & threats. To compare with other conventional banks. To familiarize with the various investment schemes. To get the practical exposure of the banking activities. To adapt with the corporate environment.

- 6. 2. Data collection method a) Primary source Branch Manager & Second Officer. Face to face conversation with employees and staffs. Practical work experience. Face to face conversation with clients.

- 7. b) Secondary source Annual Report of Islami Bank Bangladesh Limited. Various prescribed forms of investment were analyzed. IBTRA Library. Manuals of Investment of IBBL. Different text books & materials. Website of the Islami Bank Bangladesh Limited.

- 8. Lack of experiences has acted as constraints in the way of meticulous exploration on the topic. Unpublished data have not considered for the study. Shortage of time for preparing the report in order. The study was conducted mostly on secondary data.

- 9. Islamic Banking: A banking system that is based on the principles of Islamic law (also known Shariah) and guided by Islamic economics. Two basic principles behind Islamic banking are the sharing of profit and loss and, significantly, the prohibition of the collection and payment of interest. Collecting interest is not permitted under Islamic law

- 11. In August 1974, Bangladesh signed the Charter of Islamic Development Bank and committed itself to reorganize its economic and financial system as per Islamic Shari’ah. Earlier in November 1980, Bangladesh Bank, the country’s Central Bank, sent a representative to study the working of several Islamic banks abroad In November 1982, a delegation of IDB visited Bangladesh and showed keen interest to participate in establishing a joint venture Islamic Bank in the private sector. Islami Bank Bangladesh limited was established in March 1983 and started its operation in 27th March, 1983

- 12. • To conduct interest-free banking. • To invest on profit and risk sharing basis. • To accept deposits on Mudaraba & Al-Wadeah basis. • To establish a welfare-oriented banking system. • To extend co-operation to the poor, the helpless and the low-income group for their economic enlistment. • To play a vital role in human development and employment generation. • To contribute towards balanced growth and development of the country • through investment operations particularly in the less developed areas. • To contribute in achieving the ultimate goal of Islamic economic systems • To establish a well-balanced economic system.

- 15. BDT (Tk.) US Dollar ($) Authorized Capital 20,000.00 Million 257.23 Million paid-up Capital 14,636.28 Million 188.25 Million Equity 45,511.90 Million 385.36 Million Reserve Fund 29,149.01Million 374.91 million Deposits 473,140.96 Million 6,085.41 Million Investment (including Investment in Shares) 474,015.95 Million 6,096.67 Million Foreign Exchange Business BDT (Tk.) US Dollar ($) Import 285,890 Million 3,677.04 Million Export 205,269 Million 2,640.12 Million Remittance 286,956 Million 3,690.75 Million

- 16. a) Deposit Schemes b) Investment Modes c) Special Scheme e) ATM Services f) Special Services g) Foreign Exchange Business

- 17. • To maintain all types of deposit accounts. • To make investment. • To conduct foreign exchange business. • To conduct social welfare activities through Islami Banking Foundation

- 20. Year Wise Deposits & growth rate of deposit of IBBL Year 2009 2010 2011 2012 2013 Growth Rate of Year Wise Deposit 20.45% 20.87% 19.50% 17.10% 22.23% 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% 2009 2010 2011 2012 2013 Growth Rate In Percentage Years Amount (TK in Millions) 202115 244292 291,935 341853 417844 Growth Rate )%( 20.45% 20.87 % 19.5% 17.10% 22.23% Table 5.1: Amount of Deposit and Deposite growth rate of IBBL source: Annual Report of IBBL (2009-2013) Figure 5.1: Year wise Amount of Deposit of IBBL Figure 5.2: Year wise Deposit Growth Rate of IBBL

- 21. Year Wise Investment to Deposit Ratio Analysis Year Ratio 2009 %89.08 2010 %87.85 2011 %90.17 2012 %87.29 2013 %85.18 89.08% Investment to Deposit Ratio 87.85% 90.17% 87.29% 85.18% 91.00% 90.00% 89.00% 88.00% 87.00% 86.00% 85.00% 84.00% 83.00% 82.00% 2009 2010 2011 2012 2013 Investment to Deposit Ratio Table 5.2 : Investment to Deposit Ratio of IBBL Source: Annual Report of IBBL (2009-2013) Figure 5.3: Investment to Deposit Ratio of IBBL

- 22. Year Wise Investment & Growth Rate Year 2009 2010 2011 2012 2013 Amount(TK in Millions) 1,80,054 2,14,616 2,63,225 3,05,841 3,72,921 Growth Rate )%( 24.24% 19.20% 22.65% 16.19% 21.93% 24.24% 19.20% Growth Rate Investment 22.65% 16.19% 21.93% 30.00% 20.00% 10.00% 0.00% 2009 2010 2011 2012 2013 Growth Rate Investment Table: 5.3: Year Wise Investments source: Annual Report of IBBL (2009-2013) Figure-5.4: Year Wise Investments of IBBL Figure- 5.5 : Investment Growth Rate of IBBL

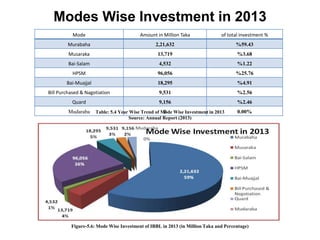

- 23. Modes Wise Investment in 2013 Mode Amount in Million Taka of total investment % Murabaha 2,21,632 %59.43 Musaraka 13,719 %3.68 Bai-Salam 4,532 %1.22 HPSM 96,056 %25.76 Bai-Muajjal 18,295 %4.91 Bill Purchased & Nagotiation 9,531 %2.56 Quard 9,156 %2.46 Mudaraba Table: 5.4 Year Wise Trend of M0ode Wise Investment in 2013 0.00% Source: Annual Report (2013) Figure-5.6: Mode Wise Investment of IBBL in 2013 (in Million Taka and Percentage)

- 25. Investment in Bai Murabaha Year 2009 2010 2011 2012 2013 Investment in Murabaha (Million tk.) 96,2,17 117180 146135 177136 221632 Percentage of Total Investment 53.44% 54.60% 55.52% 57.92% 59.43% 53.44% Investment in Bai Murabaha 54.60% 55.52% 57.92% 59.43% 60.00% 55.00% 50.00% 2009 2010 2011 2012 2013 Investment in Bai Murabaha Table: 5.5 Year Wise Investment in Bai Murabaha Source: Annual Report (2009-2013) Figure-5.7: Year Wise Investment in Bai Murabaha (Million Tk) Figure-5.8 Percentage of Investment in Murabaha

- 26. Investment in HPSM Year 2009 2010 2011 2012 2013 Investment in HPSM (Million tk.) 63159 73871 80093 89070 96056 Percentage of Total Investment 35.08% 34.42% 30.42% 29.12% 25.76% Percentage of Investment in HPSM 35.08% 34.42% 30.42% 29.12% 25.76% 40.00% 30.00% 20.00% 10.00% 0.00% 2009 2010 2011 2012 2013 Trend of Percentage of Total Investment in HPSM Table: 5.6 Year Wise Investment in HPSM Figure-5.9 Year Wise Investment in HPSM (Million tk.) Figure-5.10: Percentage of Investment in HPSM

- 27. Investment in Bai Mujjal Year 2009 2010 2011 2012 2013 Investment in Mujjal (Million tk.) 6550 7318 12393 15912 18296 Percentage of Total Investment 3.64% 3.41% 4.71% 5.20% 4.91% Percentage of Investment in Bai Mujjal 3.64% 3.41% 4.71% 5.20% 4.91% 6.00% 4.00% 2.00% 0.00% 2009 2010 2011 2012 2013 Trend of Percentage of Total Investment in Bai Mujjal Table: 5.7: Year Wise Investment in Bai Mujjal Source: Annual Report (2009-2013) Figure-5.11: Amount of Investment in Bai Mujjal Figure-5.12: Percentage of Investment in Bai Mujjal

- 28. Investment in HPSM Year 2009 2010 2011 2012 2013 Investment in HPSM (Million tk.) 63159 73871 80093 89070 96056 Percentage of Total Investment 35.08% 34.42% 30.42% 29.12% 25.76% Percentage of Investment in HPSM 35.08% 34.42% 30.42% 29.12% 25.76% 40.00% 30.00% 20.00% 10.00% 0.00% 2009 2010 2011 2012 2013 Trend of Percentage of Total Investment in HPSM Table: 5.6 Year Wise Investment in HPSM Figure-5.9 Year Wise Investment in HPSM (Million tk.) Figure-5.10: Percentage of Investment in HPSM

- 29. Investment in Bai Mujjal Year 2009 2010 2011 2012 2013 Investment in Mujjal (Million tk.) 6550 7318 12393 15912 18296 Percentage of Total Investment 3.64% 3.41% 4.71% 5.20% 4.91% Percentage of Investment in Bai Mujjal 3.64% 3.41% 4.71% 5.20% 4.91% 6.00% 4.00% 2.00% 0.00% 2009 2010 2011 2012 2013 Trend of Percentage of Total Investment in Bai Mujjal Table: 5.7: Year Wise Investment in Bai Mujjal Source: Annual Report (2009-2013) Figure-5.11: Amount of Investment in Bai Mujjal Figure-5.12: Percentage of Investment in Bai Mujjal

- 30. Investment in Bill Purchase & Nego Year 2009 2010 2011 2012 2013 Percentage of Investment in Bill Purchase & 5.68% 5.26% 1.95% Nego 0.91% 2.56% 6.00% 4.00% 2.00% 0.00% 2009 2010 2011 2012 2013 Trend of Percentage of Total Investment in Bill Purchase & Nego Investment in Bill Purchase & Nego (Million tk.) 10223 11289 5141 2744 9531 Percentage of Total Investment 5.68% 5.26% 1.95% 0.91% 2.56% Table: 5.8: Year Wise Investment in Bill Purchase & Nego Source: Annual Report (2009-2013) Figure-5.13: Amount of Investment in Bill Purchase & Nego Figure-5.14: Percentage of Investment in Bill Purchase & Nego

- 31. Investment in Quard E Hasana Year 2009 2010 2011 2012 2013 Investment in Quard E Hasana (Million tk.) 2151 2833 2095 5614 9156 Percentage of Total Investment 1.19 1.32% 0.80% 1.83% 2.46% Percentage of Investment in Quard E Hasana 1.19% 1.32% 0.80% 1.83% 2.46% 3.00% 2.00% 1.00% 0.00% 2009 2010 2011 2012 2013 Trend of Percentage of Total Investment in Quard E Hasana Table: 5.9 Year Wise Investment in Quard E Hasana Source: Annual Report (2009-2013) Figure-5.15: Amount of Investment in Quard E Hasana Figure-5.16 : Percentage of Investment in Quard E Hasana

- 32. Investment in Bai Salam Year 2009 2010 2011 2012 2013 Investment in Bai Salam (Million tk.) 1719 2082 3624 3528 4532 Percentage of Total Investment 0.95% 0.97% 1.38% 1.15% 1.22% Percentage of Total Investment in Bai Salam 0.95% 0.97% 1.38% 1.15% 1.22% 1.50% 1.00% 0.50% 0.00% 2009 2010 2011 2012 2013 Trend of Percentage of Total Investment in Bai Salam Table: 5.10: Year Wise Investment in Bai Salam Source: Annual Report (2009-2013) Figure-5.17: Amount of Investment in Bai Salam Figure-5.18: Percentage of Investment in Bai Salam

- 33. Investment in Mudaraba Year 2009 2010 2011 2012 2013 Investment in Mudaraba (Million tk.) - 0 1500 2266 - Percentage of Total Investment - 0.00% 0.57% 0.74% 0.00% Percentage of Total Investment in Mudaraba 0.00% 0.00% 0.57% 0.74% 0.80% 0.60% 0.40% 0.20% 0.00% 0.00% 2009 2010 2011 2012 2013 Trend of Percentage of Total Investment in Mudaraba Table: 5.11: Year Wise Investment in Mudaraba Source: Annual Report (2009-2013) Figure-5.19: Amount of Investment in Mudaraba Figure-5.20: Percentage of Investment in Mudaraba

- 34. Investment in Musharaka Year 2009 2010 2011 2012 2013 Investment in Musharaka (Million tk.) 35 43 12244 9571 13719 Percentage of Total Investment 0.02% 0.02% 4.65% 3.13% 3.68% Percentage of Investment in Musharaka 0.02% 0.02% 4.65% 3.13% 3.68% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% 2009 2010 2011 2012 2013 Trend of Percentage of Total Investment in Musharaka Table: 5.12: Year Wise Investment in Musharaka Source: Annual Report (2009-2013) Figure5.21: Amount of Investment in Musharaka Figure-5.22: Percentage of Investment in Musharaka

- 35. Sector Wise Investment in 2013 Sector Industry Commerce Real Estate Agriculture Transport SME Amount (TK in Millions) 108930 44488 23231 20992 6887 168393 In percentage 29.21% 11.26% 5.46% 5.78% 1.90% 46.39% Table: 5.13: Sector Wise Investment in 2013 Source: Annual Report (2013) Figure-5.23: Sector Wise Investment of IBBL in 2013 (in Million Taka and Percentage)

- 37. Industry Investment Year 2009 2010 2011 2012 2013 Investment in Industry (Million tk.) 99233 101020 113979 122270 108930 Percentage of Total Investment 55.11% 47.07% 43.30% 39.98% 29.21% 55.11% Table: 5.14: Year Wise Trend of some Industry investment of IBBL Percentage of Total Investment in Industry 47.07% 43.30% 39.98% 29.21% 60.00% 40.00% 20.00% 0.00% 2009 2010 2011 2012 2013 Trend of percentage of Total Investment in Industry Source: Annual Report (2009-2013) Figure-5.24: Amount of Investment in Industry Figure-5.25: Percentage of Investment in Industry

- 38. Commerce Investment Year 2009 2010 2011 2012 2013 Investment in Commerce (Million tk.) 51332 37502 46142 38234 44448 Percentage of Total Investment 28.51% 17.47% 17.53% 12.50% 11.26% 28.51% Percentage of Total Investment in Commerce 17.47% 17.53% 12.50% 11.26% 30.00% 20.00% 10.00% 0.00% 2009 2010 2011 2012 2013 Trend of Percentage of Total Investment in Commerce Table: 5.15: Year Wise Commerce Investment Source: Annual Report (2009-2013) Figure-5.26: Amount of Investment in Commerce Figure-5.27: Percentage of Investment in Commerce

- 39. Real Estate Investment Year 2009 2010 2011 2012 2013 Investment in Real Estate (Million tk.) 10172 8649 11336 16966 23231 Percentage of Total Investment 5.65% 4.03% 4.31% 5.55% 5.46% 5.65% Percentage of Total Investment in Real Estate 4.03% 4.31% 5.55% 5.46% 6.00% 4.00% 2.00% 0.00% 2009 2010 2011 2012 2013 Trend of Percentage of Total Investment in Real Estate Table: 5.16: Year Wise Real Estate Investment Source: Annual Report (2009-2013) Figure-5.28: Amount of Investment in Real Estate Figure-5.29: Percentage of Investment in Real Estate

- 40. Agriculture Investment Year 2009 2010 2011 2012 2013 Investment in Agriculture (Million tk.) 9110 14057 14252 20923 20992 Percentage of Total Investment 5.06% 6.55% 5.41% 6.84% 5.78% Percentage of Total Investment in Agriculture 5.06% 6.55% 5.41% 6.84% 5.78% 8.00% 6.00% 4.00% 2.00% 0.00% 2009 2010 2011 2012 2013 Trend of Percentage of Total Investment in Agriculture Table: 5.17: Year Wise Agriculture Investment Source: Annual Report (2009-2013) Figure-5.30: Amount of Investment of Agriculture Figure-5.31: Percentage of Investment in Agriculture

- 41. Transport Investment Year 2009 2010 2011 2012 2013 Investment in Transport (Million tk.) 4082 3520 4583 6457 6887 Percentage of Total Investment 2.27% 1.64% 1.74% 2.11% 1.90% 2.27% Percentage of Investment in Transport 1.64% 1.74% 2.11% 1.90% 3.00% 2.00% 1.00% 0.00% 2009 2010 2011 2012 2013 Trend of Percentage of Total Investment in Transport Table: 5.18: Year Wise Transport Investment Source: Annual Report of IBBL (2009-2013) Figure-5.32: Amount of Investment of Transport Figure-5.33: Percentage of Investment in Transport

- 42. SME Investment Year 2009 2010 2011 2012 2013 Investment in SME (Million tk.) - 49337 72933 100991 168393 Percentage of Total Investment - 22.99% 27.99% 33.02% 46.39% 0.00% Percentage of Investment in SME 22.99% 27.99% 33.02% 46.39% 60.00% 40.00% 20.00% 0.00% 2009 2010 2011 2012 2013 Trend of Percentage of Total Investment in SME Table: 5.19: Year Wise SME Investment Source: Annual Report of IBBL (2009-2013) Figure-5.34: Amount of Investment of SME Figure-5.35: Percentage of Investment in SME

- 43. Income from Investment Year 2009 2010 2011 2012 2013 Amount (Million tk.) 19543.84 21370.53 24766.26 32019.53 43672.23 19543.84 21370.53 Amount (Million tk.) 24766.26 32019.53 43672.23 50000 45000 40000 35000 30000 25000 20000 15000 10000 5000 0 2009 2010 2011 2012 2013 Amount (Million tk.) Table: 5.20: Year Wise Income from Investment Source: Annual Report of IBBL (2009-2013) Figure-5.36: Amount of Income from Investment

- 45. Income from Murabaha mode Percentage of Investment Income 62.33% 57.59% 57.10% 61.21% 63.03% 65.00% 60.00% 55.00% 50.00% 2009 2010 2011 2012 2013 Income Year In Percentage Year 2009 2010 2011 2012 2013 Investment Income( in Million Tk ) 11,726 11,716 13,436 18,634 25,625 Investment Income of total % 62.33% 57.59% 57.10% 61.21% 63.03% Source: Annual Report of IBBL Page-260, (2009-2013) Table -5.21: Murabaha Total Investment IncomeinMillion Tk and the percentage of Income Figure-5.37 :Amount of Murabaha Total Investment Income in Million Tk Figure 5.38 : Murabaha Total Investment Income in percentage

- 46. Investment Income from Musaraka Year 2009 2010 2011 2012 2013 Investment Income( in Million Tk ) 322 551 891 1608 1650 Investment Income of total % 1.71% 2.71% 3.79% 5.28% 4.06% Source: Annual Report of IBBL (2009-2013) Table 4.22: Musaraka Total Investment Income in Million Tk and the percentage of Income Figure 5.39:Amount of Musaraka Total Investment IIncome in Million Taka Percentage of Investment Income 1.71% 2.71% 3.79% 5.28% Figure 5.40 : percentage of Musaraka Total Investment Income 4.06% 6.00% 4.00% 2.00% 0.00% 2009 2010 2011 2012 2013 Investment… Year In Percentage

- 47. Investment Income from Bai-Muajjal Percentage of Investment Income 5.03% 4.66% 4.97% 5.38% 5.86% 8.00% 6.00% 4.00% 2.00% 0.00% 2009 2010 2011 2012 2013 Income Year In Percentage Year 2009 2010 2011 2012 2013 Investment Income( in Million Tk ) 947 947 1170 1638 2382 Investment Income of total % 5.03% 4.66% 4.97% 5.38% 5.86% Source: Annual Report of IBBL (2009-2013) Table 5.23: Bai-Muajjal Total Investment Income in Million Tk and the percentage of Income Figure 5.41: Bai-Muajjal Total Investment Income in Million Tk Figure 5.42: Bai-Muajjal Total Investment Income in percentage

- 48. Investment Income from HPSM Total Year 2009 2010 2011 2012 2013 Investment Income(in Million Tk ) 5,817 7,129 8,032 8,562 11000 Investment Income of total % 30.92% 35.04% 34.14% 28.13% 27.05% Percentage of Investment Income 30.92% 35.04% 34.14% 28.13% 27.05% 40.00% 30.00% 20.00% 10.00% 0.00% 2009 2010 2011 2012 2013 Income Year In Percentage Source: Annual Report of IBBL (2009-2013) Table 5.24: HPSM Total Investment Income in Million Tk and the percentage of Income Figure 5.43: HPSM Total Investment Income in Million Tk Figure 5.44: HPSM Total Investment Income in Percentage

- 49. Classified Investment as a Percentage of Total Investment Years 2009 2010 2011 2012 2013 Classified Investment(in Million Tk) 4,311.13 5,063.40 4,655.63 8,292.32 14,212.8 0 Total Investment(in Million Tk) 1,80,054 2,14,616 2,63,225 3,05,841 3,72,921 Classified Investment as a % of Total Investment 2.39% 2.36% 1.77% 2.71% 3.81% Table: 5.25: Year Wise Classified Investment as a Percentage of Total Investment Percentage of Classified Investment 2.39% 2.36% 1.77% 2.71% 3.81% 6.00% 4.00% 2.00% 0.00% 2009 2010 2011 2012 2013 Classified Investment Source: Annual Report (2009-2013) Figure-5.45: Amount of Classified Investment Figure-5.46: Percentage of Classified Investment

- 50. Bad or Loss as a Percentage of Total Investment Years 2009 2010 2011 2012 2013 Bad or Loss (in Million Tk) 2810 2735 3238 4337 10823 Total Investment(in Million Tk) 1,80,054 2,14,616 2,63,225 3,05,841 3,72,92 1 Bad or Loss as a % of Total Investment 1.56% 1.27% 1.23% 1.42% 2.90% Table: 5.26: Bad or Loss as a Percentage of Total Investment Source: Annual Report (2009-2013) Figure-5.47: Bad or Loss as a Percentage of Total Investment

- 51. Return on Investment (ROI) of IBBL Years Return on Investment (in Percentage) 2009 10.67% 2010 10.40% 2011 10.08% 2012 10.87% 2013 12.21% Table 5.27: Percentage of Return on Investment Figure 5.48: Percentage of Return on Investment

- 53. Deposit of IBBL as % of total National Deposit Year 2009 2010 2011 2012 2013 National deposit (Billion Taka) 2603.1 3037.8 3858.9 4484.4 5130.3 Deposit of IBBL (TK in Millions) 202115 244292 291,935 341853 417844 Deposit IBBL as % of total National Deposit 7.76% 8.04% 7.57% 7.62% 8.14% Table 6.1: Deposit IBBL as % of total National Deposit Source: Annual report of IBBL & Bangladesh Bank (2009-2013) Figure 6.1: Deposit IBBL as % of total National Deposit

- 54. Investment of IBBL as % of total Investment Year 2009 2010 2011 2012 2013 National (Billion Taka) 1939.9 2439.8 3297.5 3642.6 4743.8 Amount(TK in Millions) 1,80,054 2,14,616 2,63,225 3,05,841 3,72,921 Investment of IBBL as % of total Investment 9.28% 8.80% 7.98% 8.40% 7.86% Table 6.2: Investment of IBBL as % of total Investment Source: Annual report of IBBL & Bangladesh Bank (2009-2013) Figure 6.2: Investment of IBBL as % of total Investment

- 55. Comparison of Investment to Deposit Ratio of IBBL & National Investment to Deposit Ratio: Year 2009 2010 2011 2012 2013 Industry Average (%) 75 80.3 85.5 79.7 86.7 IBBL (%) 89.08 87.85 90.17 87.29 85.18 Table 6.3: Comparison of Investment to Deposit Ratio of IBBL & National Investment to Deposit Ratio Source: Annual report of IBBL & Bangladesh Bank (2009-2013) Figure 6.3: Comparison of Investment to Deposit Ratio of IBBL & National Investment to Deposit Ratio

- 56. Non- performing Investment of IBBL as % of total Investment Year 2009 2010 2011 2012 2013 Industry Average 10.8 9.2 7.3 6.1 5.6 NPI OF IBBL 2.39 2.36 1.77 2.71 3.81 Table 6.4: Non- performing Investment of IBBL as % of total Investment Source: Annual report of IBBL & Bangladesh Bank (2009-2013) Figure 6.4: Non- performing Investment of IBBL as % of total Investment

- 57. • The total deposit of IBBL has increased over the years and the deposit of IBBL as percentage of total national deposit has increased over the years from 7.57% in 2011 to 8.14% in 2013. This indicates that comparative deposit performance of IBBL has increased over the years. • Investment during the year 2009 to 2013 has increased over the years. The investment has increased from taka in Millions 1,80,054 to 3,72,921. In the year 2013, IBBL invested their maximum portion in Bai – Murabaha mode (59%) which is amount of TK 2, 21,632 million that means sale for which payment is made at a future fixed date or within a fixed period in short, it is a sale on credit. The second maximum portion of investment is in HPSM mode which amount in TK 96,056 million & in percentage is 26%. The bank invests in other modes at lower percentage. The lowest portion was invested in Bai- Salam at 1%.

- 58. • The deposit as percentage of total national investment has decreased in the years from 9.28% in 2009 to 7.86% in 2013. This indicates that comparative investment performance of IBBL has decreased over the years. It is not satisfactory position of IBBL so it should try to increase its investment. • The total investment of IBBL has increased over the years but the investment as percentage of total national investment has decreased over the years from 9.28% in 2009 to 7.86% in 2013.This downward trend of invest is negative sign for the bank. • There is a fluctuating trend in investment to deposit ratio of IBBL. However, the investment to deposit ratio of IBBL is higher than industry average over each year of analysis except in 2013. • This Bank revalues its investment operations within limited number of investment modes and does not initiate investment modes according to changing diverse needs of people.

- 59. • Annual income of IBBL is massive comparing to other commercial banks. • ATM service is very poor. • Server is very slow. • This Bank can’t invest in all economic sectors which are prohibited by the law of Islam.

- 60. • IBBL should increase investment in agricultural sector because Bangladesh is an agricultural country. • IBBL should initiate different investment modes according to changing / diverse needs of clients by conducting huge research and study. • Investment power should be decentralized. • Bangladesh is rural base country. So IBBL should increase their investment in rural area. • IBBL should increase its investment in public sector, i. e. the bank should involve profitably in this sector for the development of the bank as well as the economy. • Bank should take corrective actions to reduce its upward trend of outstanding amount of investment and careful to take investment decision.

- 61. • Attempt should be made for an improved information system within the bank and within the investment clients unit. • Consider offering growth pre-investment and post investment counseling to both potential and existing investors according to their needs. • Repayment behavior of different types of clients play a important role not only in the successful implementation of investment plan but also in the cost-benefit analysis for the banks, there is need to analysis in detail the repayment behavior at micro level. Such a study provides proper guidance for the banks to be associated with the clients at various stages of utilization of investment and its repayment. • Investment plan commitment should be included in the budget of each branch of the bank and progress should be regularly monitored.

- 62. • The productivity of the bank may be raised by better funds management and portfolio management improving recycling of funds and developing other income from the business activities of the bank • It could increase its advertising as well as awareness regarding Islamic investment modes. • The authority of IBBL should introduce more innovative and modern customer service. • Investment should be provided in the SMEs sector for developing entrepreneur investment. • IBBL should try to improve the deposit investment ratio for higher productivity. • IBBL should encourage the people for Mudaraba & Musharaka Investment.