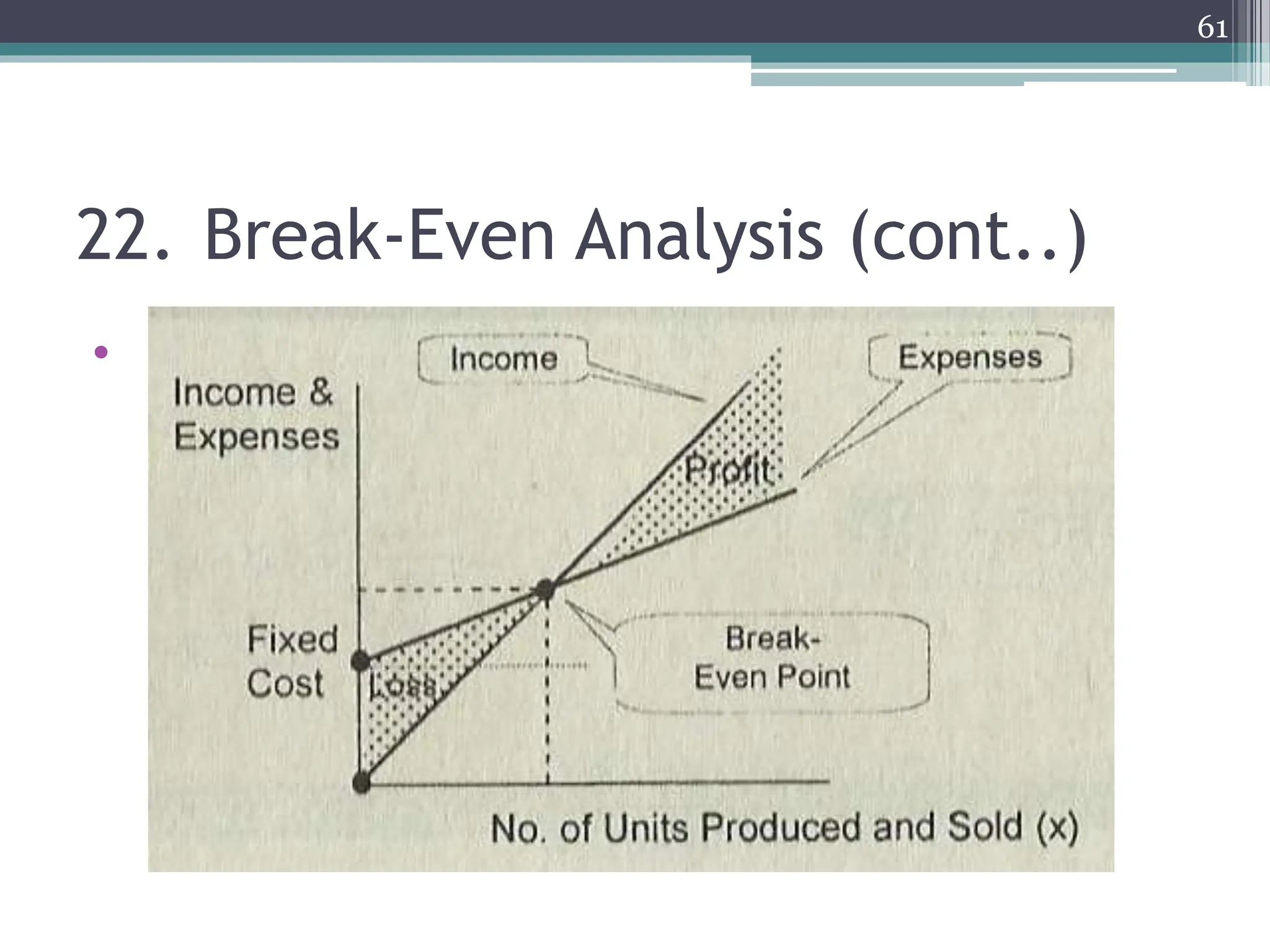

The document provides an overview of engineering economics, including definitions of key concepts such as investment, supply, demand, and market structures like perfect competition and monopoly. It covers financial calculations involving interest (simple and compound), cash flow diagrams, annuities, and methods for computing depreciation. Various types of depreciation and their implications for capital recovery and property valuation are also detailed.