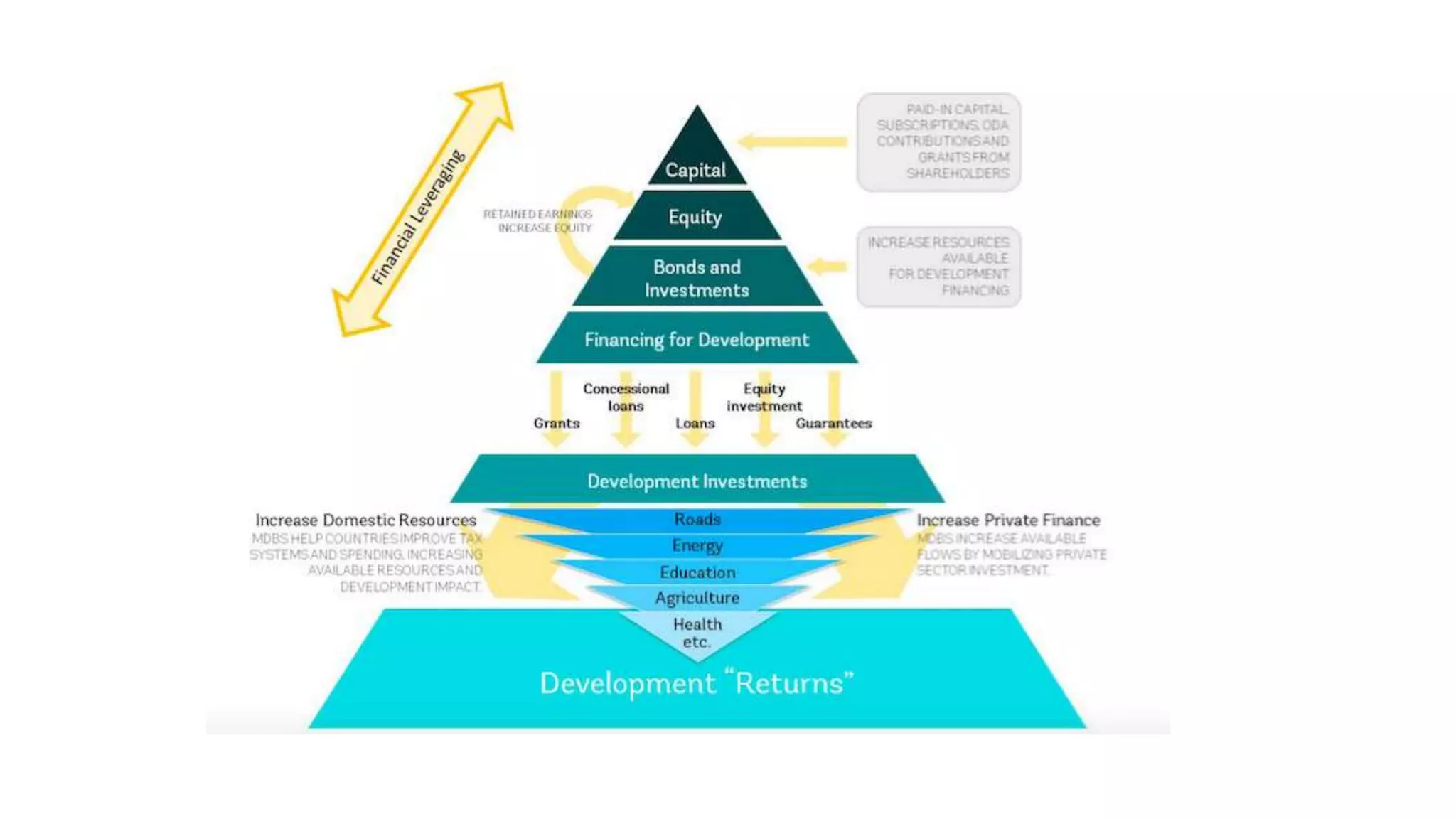

The document discusses the substantial financing needs required to meet the 2030 Agenda for Sustainable Development, highlighting a shortfall of trillions of dollars annually, particularly affecting low- and middle-income countries like Kenya. It reviews historical financing frameworks and challenges, emphasizing the importance of domestic resource mobilization and innovative funding solutions to achieve sustainable development goals. Key issues include the significance of political will, effective public financial management, and addressing international financial flows and corruption to increase revenue for development.