This report summarizes a study on the Indian telecom industry and the impact of price wars. It provides an overview of the industry, major players and their market shares. Price wars led to tariffs dropping from Rs. 16.80 per minute to half a paisa per second, making India's telecom rates among the lowest globally. While this boosted subscriber growth, it reduced profits and ARPU for operators. The report suggests value-added services as an avenue for revenue growth and overcoming the effects of price wars. It analyzes the marketing mix and potential of VAS, as well as opportunities and threats facing the industry.

![P a g e | 20

In December 1947, Douglas H. Ring and W. Rae Young, Bell Labs engineers, proposed

hexagonal cells for mobile phones in vehicles.[1] Philip T. Porter, also of Bell Labs, proposed

that the cell towers be at the corners of the hexagons rather than the centers and have

directional antennas that would transmit/receive in three directions (see picture at right)

into three adjacent hexagon cells. The technology did not exist then and the frequencies

had not yet been allocated. Cellular technology was undeveloped until the 1960s, when

Richard H. Frenkiel and Joel S. Engel of Bell Labs developed the electronics.

Recognizable mobile phones with direct dialing have existed at least since the 1950s. In the

1954 movie Sabrina, the businessman Linus Larrabee (played by Humphrey Bogart) makes a

call from the phone in the back of his limousine.

The first person to have a mobile phone in the United Kingdom was reputedly Prince Philip,

who had a system fitted into the trunk of his Aston Martin in 1957. The Prince could make

phone calls to the Queen while driving, which was thought to be quite amazing at the time.

The Duke of Gloucester heard about the mobile phone and tried to obtain one, but the Post

Office denied his request. They were prepared to indulge the husband of Her Majesty, but

nobody else, as the system used an entire dedicated radio frequency.

The first fully automatic mobile phone system, calledMTA (Mobile Telephone system A), was

developed by Ericsson and commercially released in Sweden in 1956. This was the first

system that did not require any kind of manual control in base stations, but had the

disadvantage of a phone weight of 40 kg (90 lb.). MTB, an upgraded version with transistors,

weighing 9 kg (20 lb.), was introduced in 1965 and used DTMF signaling. It had 150

customers in the beginning and 600 when it shut down in 1983.

In 1957 young Soviet radio engineer Leonid Kupriyanovich from Moscow created the

portable mobile phone, named after himself as LK-1 or "radiophone". This true mobile

phone consisted of a relatively small-sized handset equipped with an antenna and rotary

dial, and communicated with a base station. Kupriyanovich's "radiophone" had 3 kilogram of

total weight, could operate up to 20 or 30 kilometers, and had 20 or 30 hours of battery

lifespan. LK-1 and its layout was depicted in popular Soviet magazines as Nauka i zhizn, 8,

1957, p. 49, Yuniytechnik, 7, 1957, p. 43–44. Engineer Kupriyanovich patented his mobile

phone in the same year 1957 (author's certificate (USSR Patent) # 115494, 1.11.1957). The

base station of LK-1 (called ATR, or Automated Telephone Radio station) could connect to

local telephone network and serve several customers.

In 1958, Kupriyanovich resized his "radiophone" to "pocket" version. The weight of

improved "light" handset was about 500 grams.

In 1958 the USSR also began to deploy the "Altay" national civil mobile phone service

especially for motorists. The newly-developed mobile telephone system was based on

Soviet MRT-1327 standard. The main developers of the Altay system were the Voronezh

Science Research Institute of Communications (VNIIS) and the State Specialized Project

Institute (GSPI). In 1963 this service started in Moscow, and in 1970 the Altay service already

was deployed in 30 cities of the USSR. The last upgraded versions of the Altay system are

still in use in some places of Russia as a trunking system.

A study report on Indian Telecom Industry: “Price-War and its impact”

Prepared by: Rajshee R. Bhuvar](https://image.slidesharecdn.com/indiantelecomindustryfinal23-8-2010bhuvarrajseer-100907062917-phpapp01/85/Indian-telecom-industry-final-bhuvar-rajsee-r-20-320.jpg)

![P a g e | 21

In 1959 a private telephone company located in Brewster, Kansas, USA, the S&T Telephone

Company, (still in Business today) with the use of Motorola Radio Telephone equipment and

a private tower facility, offered to the public mobile telephone services in that local area of

NW Kansas. This system was a direct dial up service through their local switchboard, and

was installed in many private vehicles including grain combines, trucks, and automobiles.

For some as yet unknown reason, the system after being placed online and operated for a

very brief time period was shut down. The management of the company was immediately

changed, and the fully operable system and related equipment was immediately dismantled

in early 1960, not to be seen again.

In 1966, Bulgaria presented the pocket mobile automatic phone RAT- 0.5 combined with a

base station RATZ-10 (RATC-10) on Interorgtechnika-66 international exhibition. One base

station, connected to one telephone wire line, could serve up to six customers.

In 1967, each mobile phone had to stay within the cell area serviced by one base station

throughout the phone call. This did not provide continuity of automatic telephone service to

mobile phones moving through several cell areas. In 1970 Amos E. Joel, Jr., another Bell Labs

engineer invented an automatic "call handoff" system to allow mobile phones to move

through several cell areas during a single conversation without loss of conversation.

In December 1971, AT&T submitted a proposal for cellular service to the Federal

Communications Commission (FCC). After years of hearings, the FCC approved the proposal

in 1982 for Advanced Mobile Phone System (AMPS) and allocated frequencies in the 824–

894 MHz band.[6] Analog AMPS was superseded by Digital AMPS in 1990.

One of the first successful public commercial mobile phone networks was the ARP network

in Finland, launched in 1971. Posthumously, ARP is sometimes viewed as a zero generation

(0G) cellular network, being slightly above previous proprietary and limited coverage

networks.

First generation:

On April 3, 1973, Motorola employee Dr. Martin Cooper placed a call to Dr. Joel S. Engel,

head of research at AT&T's Bell Labs, while walking the streets of New York City talking on

the first Motorola DynaTAC prototype in front of reporters. Motorola has a long history of

making automotive radios, especially two-way radios for taxicabs and police cruisers.

Second generation:

In the 1990s, 'second generation' (2G) mobile phone systems such as GSM, IS-136

("TDMA"), iDEN and IS-95 ("CDMA") began to be introduced. In 1991 the first GSM network

(Radiolinja) opened in Finland. 2G phone systems were characterized by digital circuit

switched transmission and the introduction of advanced and fast phone-to-network

signaling. In general the frequencies used by 2G systems in Europe were higher than those

in America, though with some overlap. For example, the 900 MHz frequency range was used

for both 1G and 2G systems in Europe, so the 1G systems were rapidly closed down to make

space for the 2G systems. In America the IS-54 standard was deployed in the same band as

AMPS and displaced some of the existing analog channels.

A study report on Indian Telecom Industry: “Price-War and its impact”

Prepared by: Rajshee R. Bhuvar](https://image.slidesharecdn.com/indiantelecomindustryfinal23-8-2010bhuvarrajseer-100907062917-phpapp01/85/Indian-telecom-industry-final-bhuvar-rajsee-r-21-320.jpg)

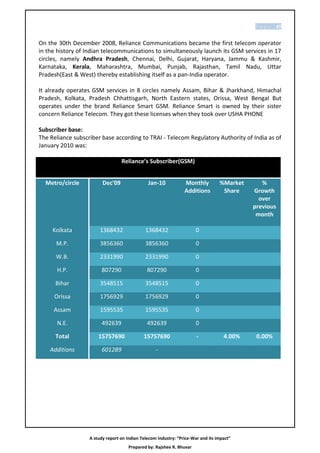

![P a g e | 37

::: Cellular Service providersOverview :::

India is the developing country and so all the industry in India are developing day by day,

but cellular service industry in India is in emerging stage. So, there are much chances of

development in this industry and chances of new players to enter into this industry. In India,

more than 45% people have mobiles and the others do not have mobiles.The mobiles are

useless without SIM card and the companies who provide the SIM card are known as cellular

service companies. In India, public companies as well as private companies are in this

business. The companies who provide cellular services are as follows.

List of cellular operator

Rank Operator Technology Frequency Subscribers Ownership

(in millions)

(As of

January

2010)

1 Airtel GSM GSM 900/1800 118.864031 Bharti

Enterprises

(64.76%)

SingTel (30.84%)

Vodafone (4.4%)

2 Reliance CDMAOne CDMA2000 1x 93.795613 Reliance - Anil

Communication GSM, DhirubhaiAmbani

Group

3 Vodafone Essar GSM GSM 900/1800 91.401959 Vodafone (67%)

Essar Group

(33%)

4 BSNL GSM, GSM 900, 62.861214 State-owned

CDMAOne, CDMA2000 1x

5 Idea Cellular GSM GSM 1800 57.611872 Aditya Birla

Group

Axiata Group

Berhad (15%)

6 Tata CDMA, CDMA2000 1x 57.329449 [Tata Indicom--

Teleservices GSM, Tata Group]

(Tata Indicom)

A study report on Indian Telecom Industry: “Price-War and its impact”

Prepared by: Rajshee R. Bhuvar](https://image.slidesharecdn.com/indiantelecomindustryfinal23-8-2010bhuvarrajseer-100907062917-phpapp01/85/Indian-telecom-industry-final-bhuvar-rajsee-r-37-320.jpg)

![P a g e | 38

(Tata DoCoMo) [Tata DoCoMo--

Tata Group,

(74%) &NTT

DoCoMo, (26%)]

[Virgin Mobile

(Virgin mobile) (50%)

Tata Tele. (50%)]

7 Aircel GSM GSM 900/1800 31.023997 Maxis

Communication

(74%)

Apollo Hospital

(26%)

8 MTNL GSM, GSM 900, 4.875913 State-owned

CDMA CDMA2000 1x

9 MTS India CDMA CDMA2000 1x 3.042741 Sistema (73.71%)

Shyam Group

(23.79%)

10 Loop Mobile GSM GSM 2.649730 Essar Group

900(Mumbai)/1800

11 Uninor GSM - 1.208130 Telenor (67.25%)

Unitech Group

(32.75%)

12 HFCL Infotel CDMA - 3.41862 HFCL Group

13 S Tel GSM - 1.41411 Siva Group (51%)

Batelco (49%)

A study report on Indian Telecom Industry: “Price-War and its impact”

Prepared by: Rajshee R. Bhuvar](https://image.slidesharecdn.com/indiantelecomindustryfinal23-8-2010bhuvarrajseer-100907062917-phpapp01/85/Indian-telecom-industry-final-bhuvar-rajsee-r-38-320.jpg)

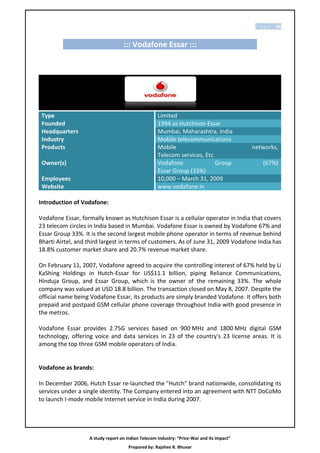

![P a g e | 44

::: Reliance communications :::

Type Public (BSE: RCOM)

Founded 2004

Headquarters Navi Mumbai, Maharashtra, India

Key people Anil Ambani

(Chairman) & (MD)

Industry Telecommunications

Products Wireless

Telephone

Internet

Television

Revenue US$ 4.26 billion (2008)

Net income US$ 1.35 billion (2008)

Total assets US$ 19.31 billion (2008)

Employees 33,000

Website www rcom.co.in

Introduction:

Reliance Communications, formerly known as Reliance Infocomm, along with Reliance

Telecom and Flag Telecom, is part of Reliance Communications Ventures (RCoVL). It is the

second largest mobile operator in India, based on number of subscribers. According to

National Stock Exchange data, Anil DhirubhaiAmbani controls 66.77 per cent of the

company, which accounts for more than 1.36 billion shares. It is the flagship company of the

Reliance-Anil DhirubhaiAmbani Group, comprising of power (Reliance Energy), financial

services (Reliance Capital) and telecom initiatives of the Reliance ADAG. It uses CDMA2000

1x technology for its existing CDMA mobile services, and GSM-900/GSM-1800 technology

for its existing/newly launched GSMservices.RelCom is also into Wire line Business

throughout India and has the largest optical fiber communication (OFC) backbone

architecture [roughly 110,000 km] in the country.Reliance Communications has launched its

Direct To Home (DTH) TV also, known as "Big TV". RelCom have presence across all B2C

communications channel in one of the fastest growing markets in the world.

Bid for Hutch:

In 2007, Reliance Communications had bid for 67% of Hutch but lost to Vodafone.

Reliance GSM:

A study report on Indian Telecom Industry: “Price-War and its impact”

Prepared by: Rajshee R. Bhuvar](https://image.slidesharecdn.com/indiantelecomindustryfinal23-8-2010bhuvarrajseer-100907062917-phpapp01/85/Indian-telecom-industry-final-bhuvar-rajsee-r-44-320.jpg)

![P a g e | 52

::: Idea cellular :::

Type Public

Founded 1995

Headquarters Santacruz East, Mumbai, India[1]

Key people Kumar Mangalam Birla

(Chairman)

Sanjeev Aga

(MD)

RajatMukharjee

(VP Corporate Affairs)

Industry Telecommunications

Products Mobile

Owner(s) Aditya Birla Group (49.05%)

Axiata Group Berhad (15%)

Providence Equity (10.6%)

Website IdeaCellular.com

Introduction:

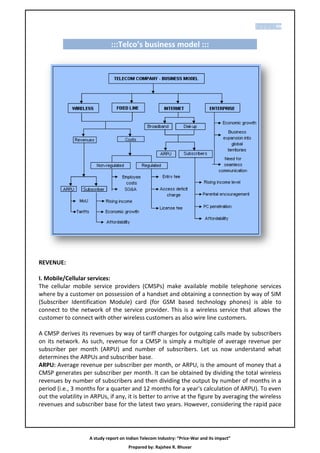

Idea Cellular is a wireless telephony company operating in all the 22 telecom circles in India

based in Mumbai. It is the 3rd largest GSM company in India, behind Airtel and Vodafone

and ahead of state run player BSNL.

In 2000, Tata Cellular was a company providing mobile services in AP. When Birla-AT&T

brought Maharashtra and Gujarat to the table, the merger of these two entities was a

reality. Thus Birla-Tata-AT&T, popularly known as Batata, was born. In 2001, the Batata

triumvirate agreed to merge its operations with the Rajeev Chandrasekhar promoted BPL

Communications. The merger could have brought in regions like Mumbai, Maharashtra,

Kerala and Tamil Nadu, which seemed to be a perfect accompaniment to what it already

had. This was critical with the bid for the fourth operator license round the corner.

However, the engagement with BPL was broken. Then Idea set sights on RPG’s operations in

Madhya Pradesh which was successfully acquired, helping Batata have a million subscribers,

and the license to be the fourth operator in Delhi was clinched. In 2004, Idea (the company

had by then been rechristened) bought over the Escorts group’s Escotel gaining Haryana,

Uttar Pradesh (West) and Kerala — and licenses for three more — UP (East), Rajasthan and

Himachal Pradesh. By the end of that year, four million Indians were on the company’s

network. In 2005, AT&T sold its investment in Idea, and the year after Tata’s also bid good

bye to pursue an independent telecom business. And Idea was left only with one promoter,

A study report on Indian Telecom Industry: “Price-War and its impact”

Prepared by: Rajshee R. Bhuvar](https://image.slidesharecdn.com/indiantelecomindustryfinal23-8-2010bhuvarrajseer-100907062917-phpapp01/85/Indian-telecom-industry-final-bhuvar-rajsee-r-52-320.jpg)

![P a g e | 56

Company background:

Tata Teleservices is part of the Tata Group. Tata Teleservices spearheads the Group’s

presence in the telecom sector. Incorporated in 1996, Tata Teleservices was the first to

launch CDMA mobile services in India with the Andhra Pradesh circle.

The company acquired Hughes Telecom (India) Limited [now renamed Tata Teleservices

(Maharashtra) Limited] in December 2002. With a total Investment of Rs 19,924 Crore, Tata

Teleservices has created a Pan India presence spread across 20 circles that include Andhra

Pradesh, Chennai, Gujarat, J & K, Karnataka, Delhi, Maharashtra, Mumbai, North East, Tamil

Nadu, Orissa, Bihar, Rajasthan, Punjab, Haryana, Himachal Pradesh, Uttar Pradesh (E), Uttar

Pradesh (W), Kerala, Kolkata, Madhya Pradesh and West Bengal.

Having pioneered the CDMA 3G1x technology platform in India, Tata Teleservices has

established 3G ready telecom infrastructure. It partnered with Motorola, Ericsson, Lucent

and ECI Telecom for the deployment of its telecom network.

The company is the market leader in the fixed wireless telephony market with a total

customer base of over 3.8 million.

Tata Teleservices’ bouquet of telephony services includes Mobile services, Wireless Desktop

Phones, Public Booth Telephony and Wire line services. Other services include value added

services like voice portal, roaming, post-paid Internet services, 3-way conferencing, group

calling, Wi-Fi Internet, USB Modem, data cards, calling card services and enterprise services.

Some of the other products launched by the company include prepaid wireless desktop

phones, public phone booths, new mobile handsets and new voice & data services such as

BREW games, Voice Portal, picture messaging, polyphonic ring tones, interactive

applications like news, cricket, astrology, etc.

Tata Indicom "Non Stop Mobile" allow pre-paid cellular customers to receive free incoming

calls.

Tata Teleservices Limited along with Tata Teleservices (Maharashtra) Limited have a

subscriber base of 57 million customers (as of Jan 2010) in more than 5,000 towns. Tata

Teleservices has also acquired GSM licenses for specific circles in India.

Tata Teleservices is an unlisted entity. Tata Group and group firms own the majority of the

company; NTT DoCoMo holds 26% while investor C. Sivasankaran holds 8%.

Market Data:

Tata Indicom in Jan 2010 crossed the 57 million subscribers mark in the wireless category

with an overall subscriber base of over 57 million.

Tata Teleservices is no. 2 slot in terms of Market Share in Delhi NCR region with a subscriber

base of 5.4 million.

A study report on Indian Telecom Industry: “Price-War and its impact”

Prepared by: Rajshee R. Bhuvar](https://image.slidesharecdn.com/indiantelecomindustryfinal23-8-2010bhuvarrajseer-100907062917-phpapp01/85/Indian-telecom-industry-final-bhuvar-rajsee-r-56-320.jpg)

![P a g e | 71

Uninor's strategy:

Uninor is India's eighth nation-wide mobile operator, in a competitive landscape of 13

nation-wide or regional mobile operators. The company is targeting an 8 % pan-Indian

market share, and the opening of one million retail points and breaking even on EBITDA

within three years. It will provide mobile communication and Value Added Services.

In order to reduce time-to-market, Uninor will outsource infrastructure and back-end

services to partner organizations with established core competencies.[5] The operational

model is low-cost with a gradual network-build up, infrastructure sharing, GSM equipment

at competitive cost, full-scale IT-outsourcing and a long termcost and capex efficiency.

Uninor will organize with headquarters just outside Delhi (Gurgaon), and 11 regional hubs

covering one or more of the total of 22 telecom circles.

To quickly launch mobile services only nine months after the foundation of the new

company, Uninor has entered into network and base station service agreements with

partners. Tower sharing agreements are concluded with Wireless-TT Info Service Limited

and Quippo Telecom Infrastructure Limited. Telecommunications, network and radio

equipment is to be supplied by Alcatel-Lucent, Huawei Technologies India, Nokia Siemens

Networks and Ericsson. The company's IT services and infrastructure is to be shared with

Wipro Technologies.

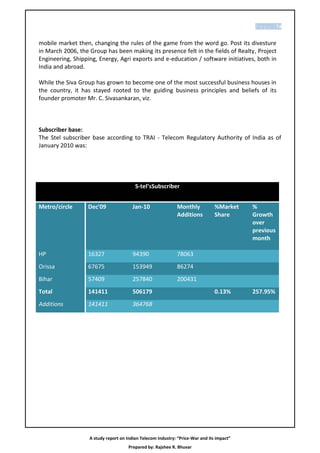

Subscriber base:

The Uninor subscriber base according to TRAI - Telecom Regulatory Authority of India as of

January 2010 was:

Uninor’s Subscriber

Metro/circle Dec'09 Jan-10 Monthly %Market % Growth over

Additions Share previous month

Kerala 90210 151970 61760

T.N. 202032 391708 189676

Karnataka 264141 510250 246109

A.P. 157065 440011 282946

Orissa 44071 124926 80855

Bihar 127261 307379 180118

U.P.(E) 172288 319259 146971

UP (W) 151062 292903 141841

Total 1208130 2538406 0.64% 110.11%

Additions 1208130 1330276

A study report on Indian Telecom Industry: “Price-War and its impact”

Prepared by: Rajshee R. Bhuvar](https://image.slidesharecdn.com/indiantelecomindustryfinal23-8-2010bhuvarrajseer-100907062917-phpapp01/85/Indian-telecom-industry-final-bhuvar-rajsee-r-71-320.jpg)