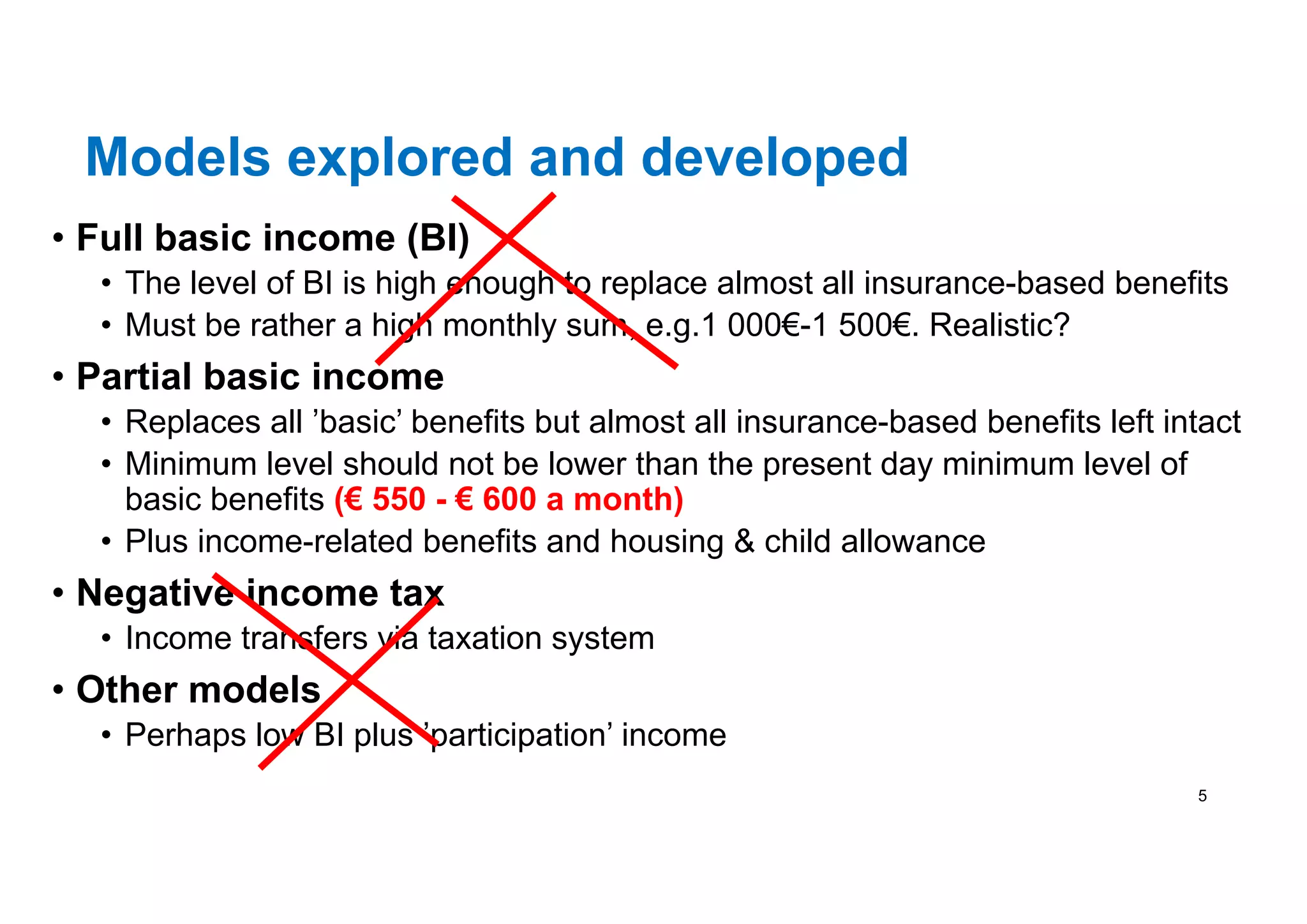

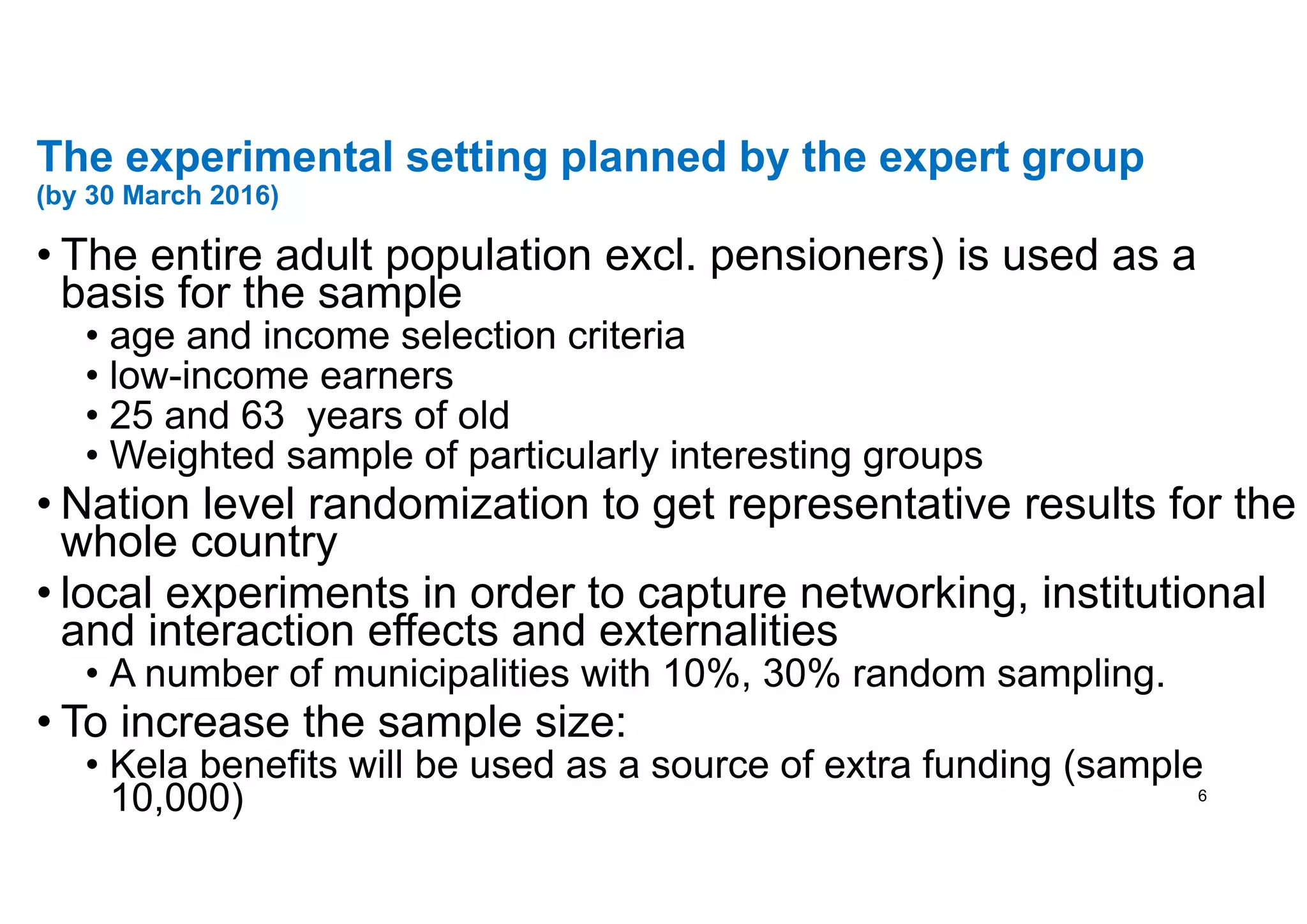

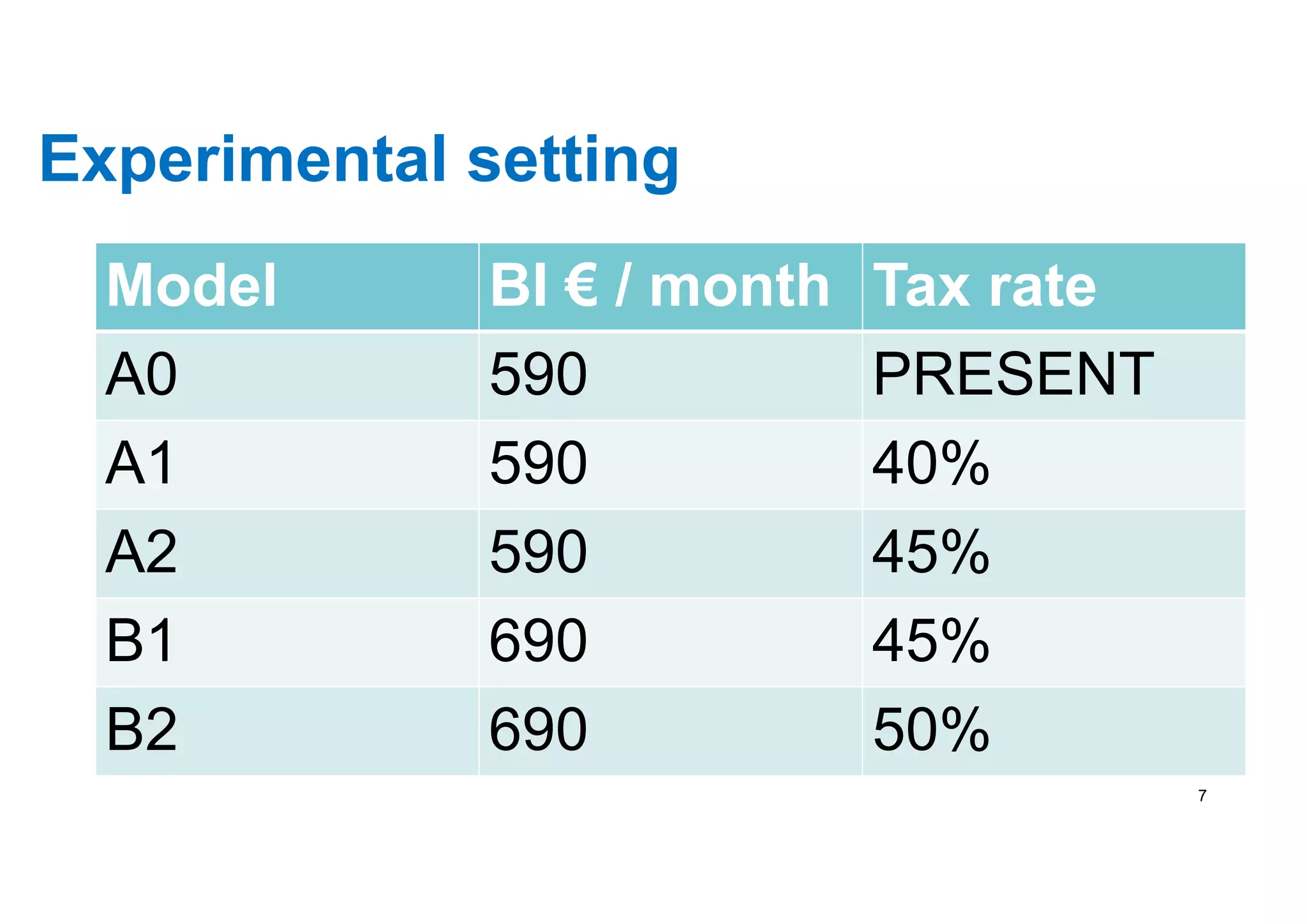

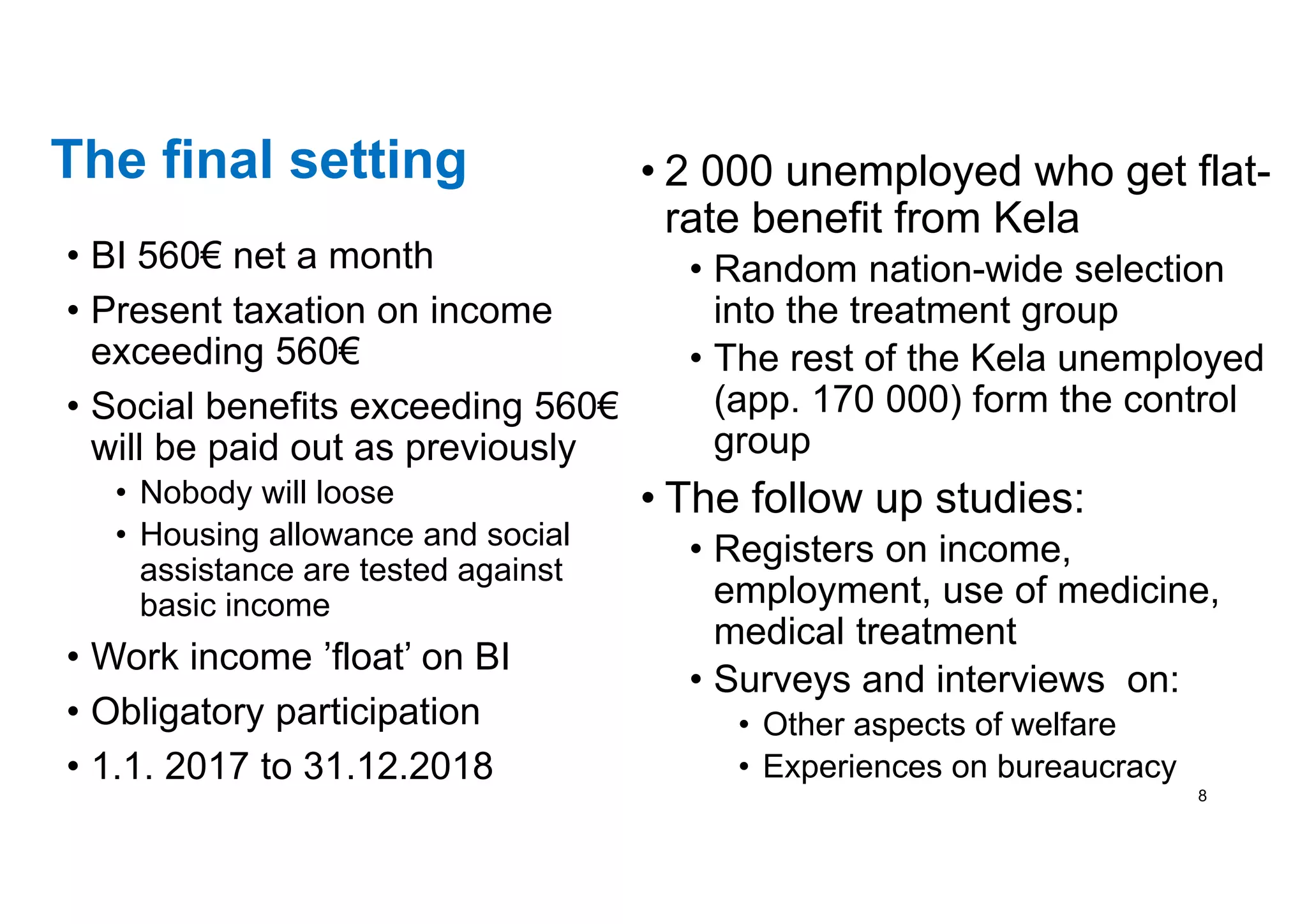

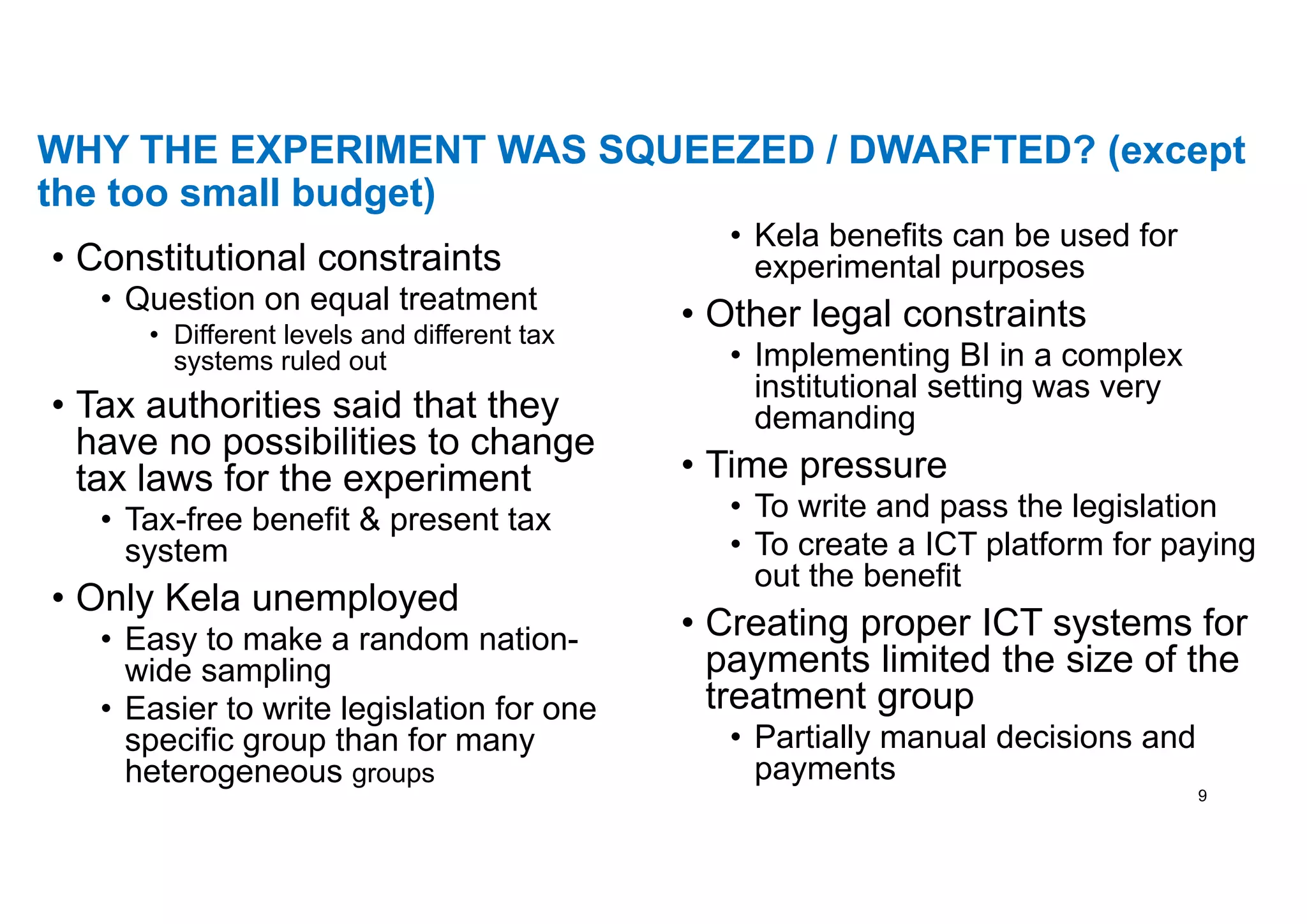

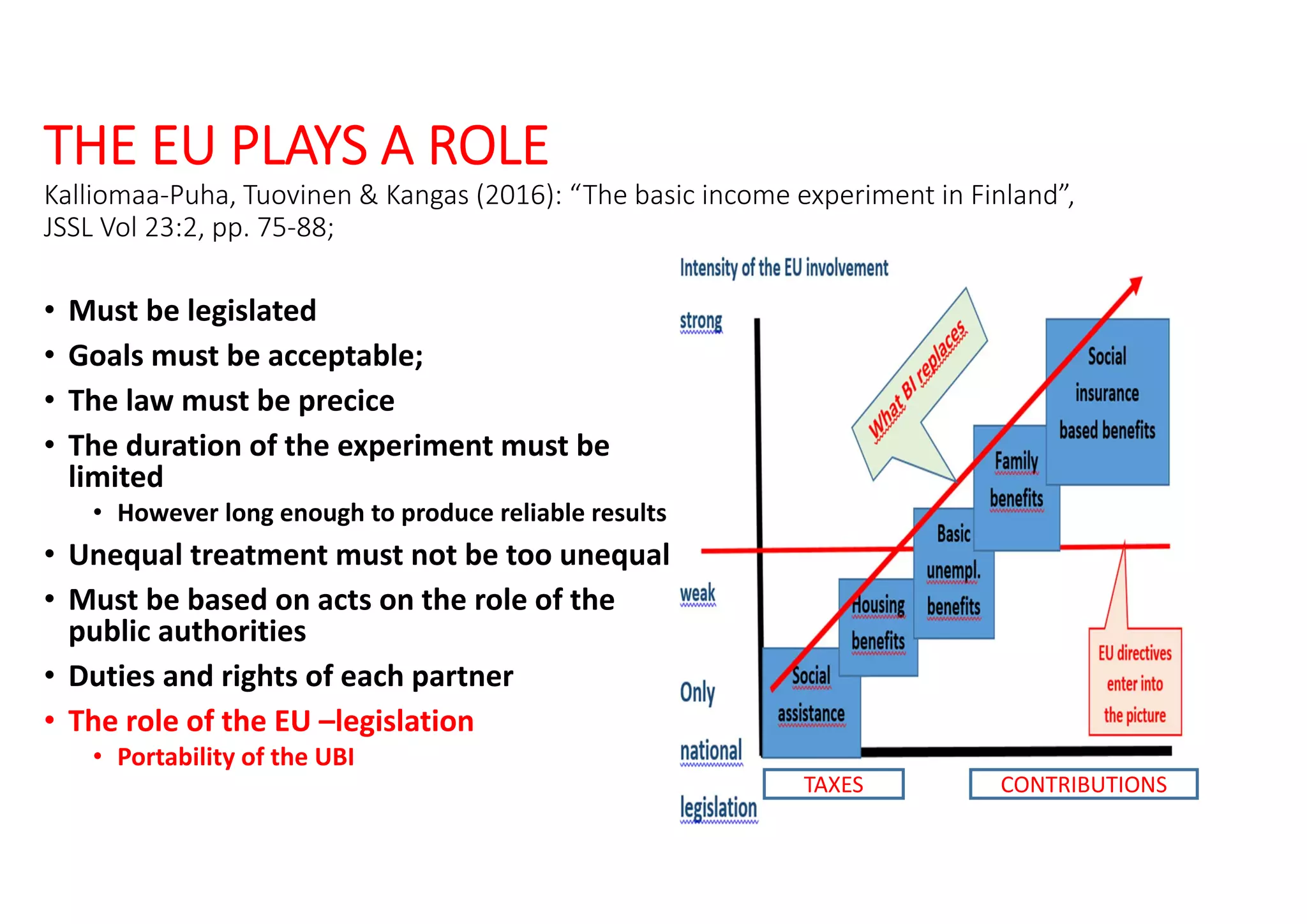

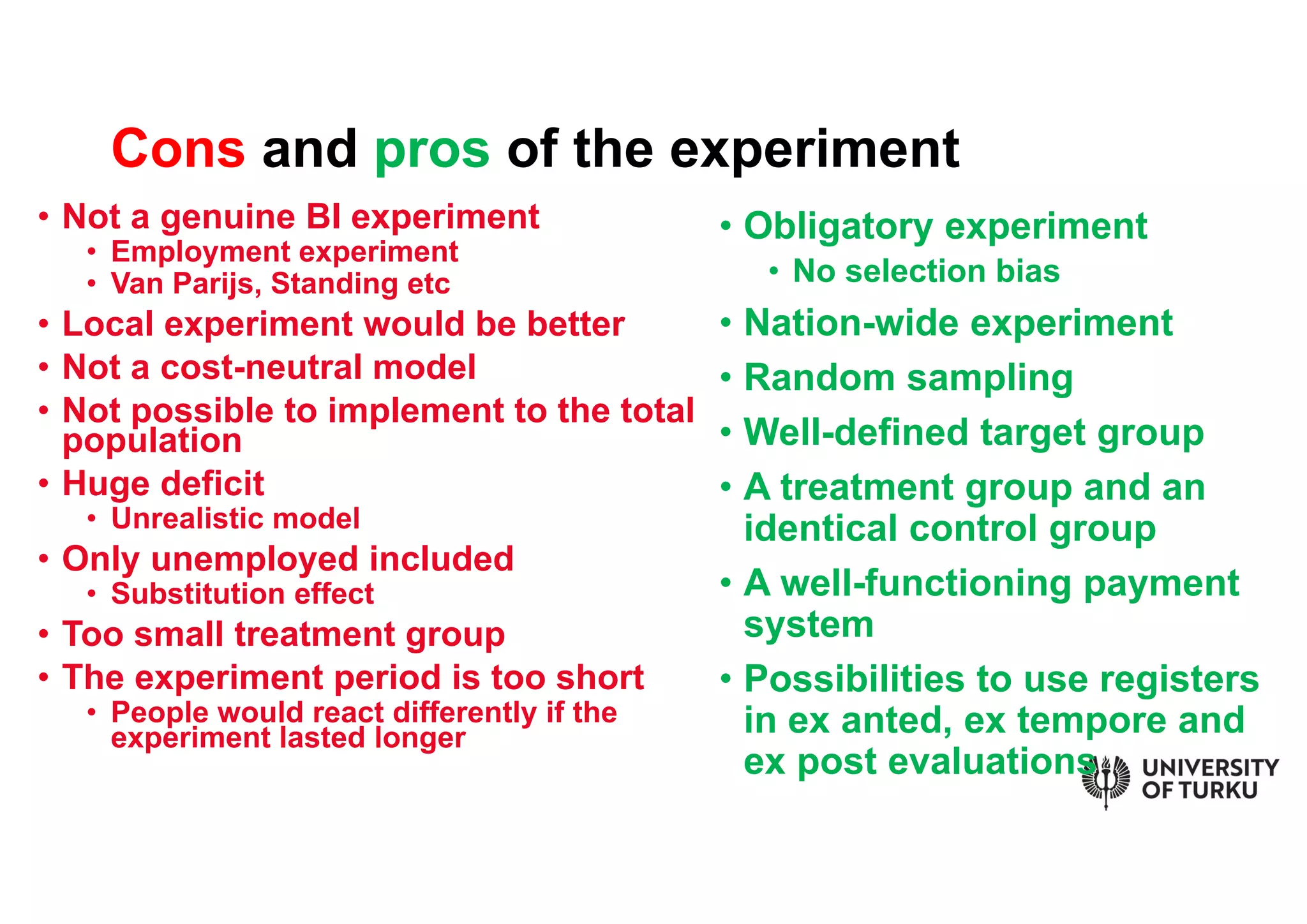

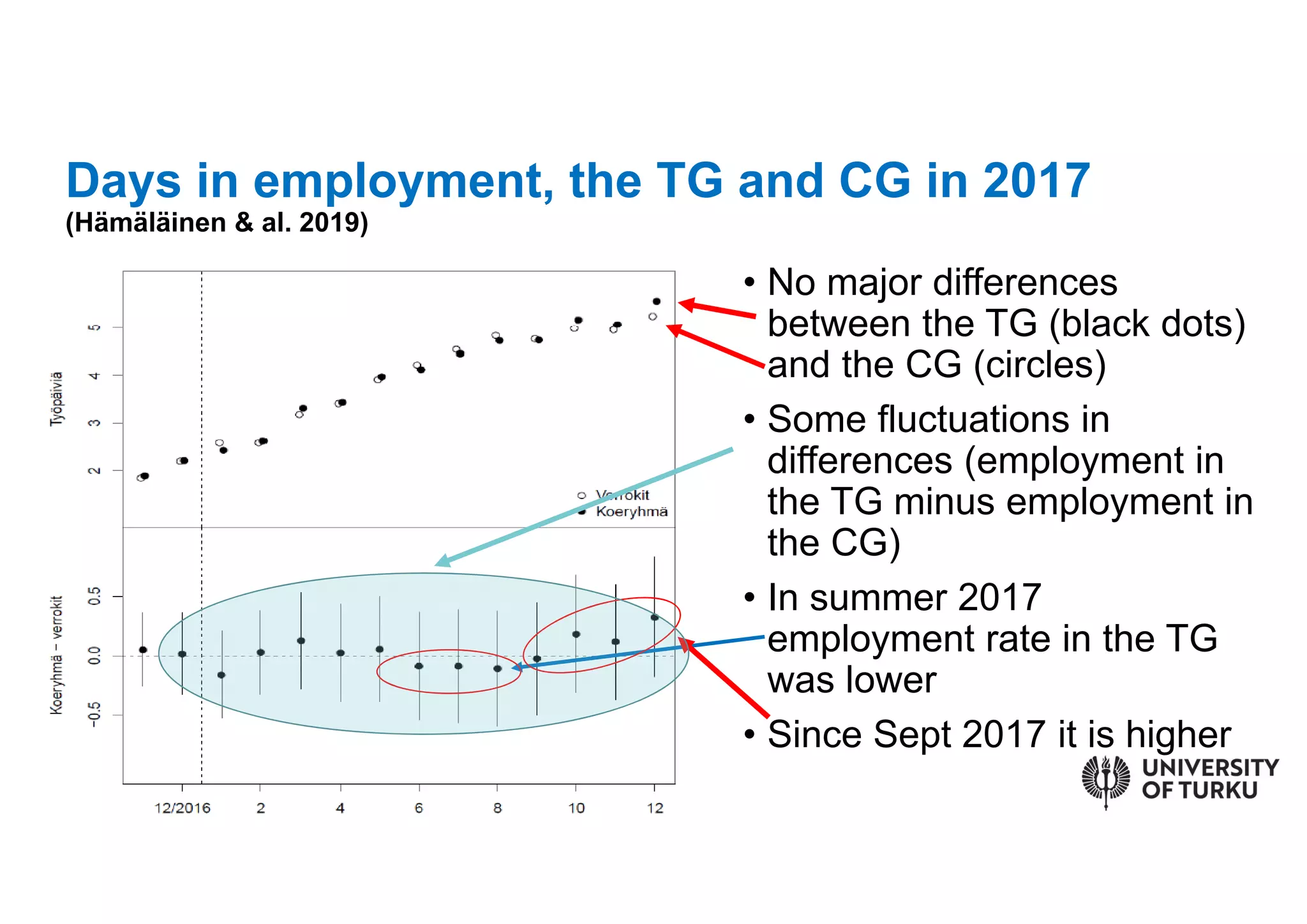

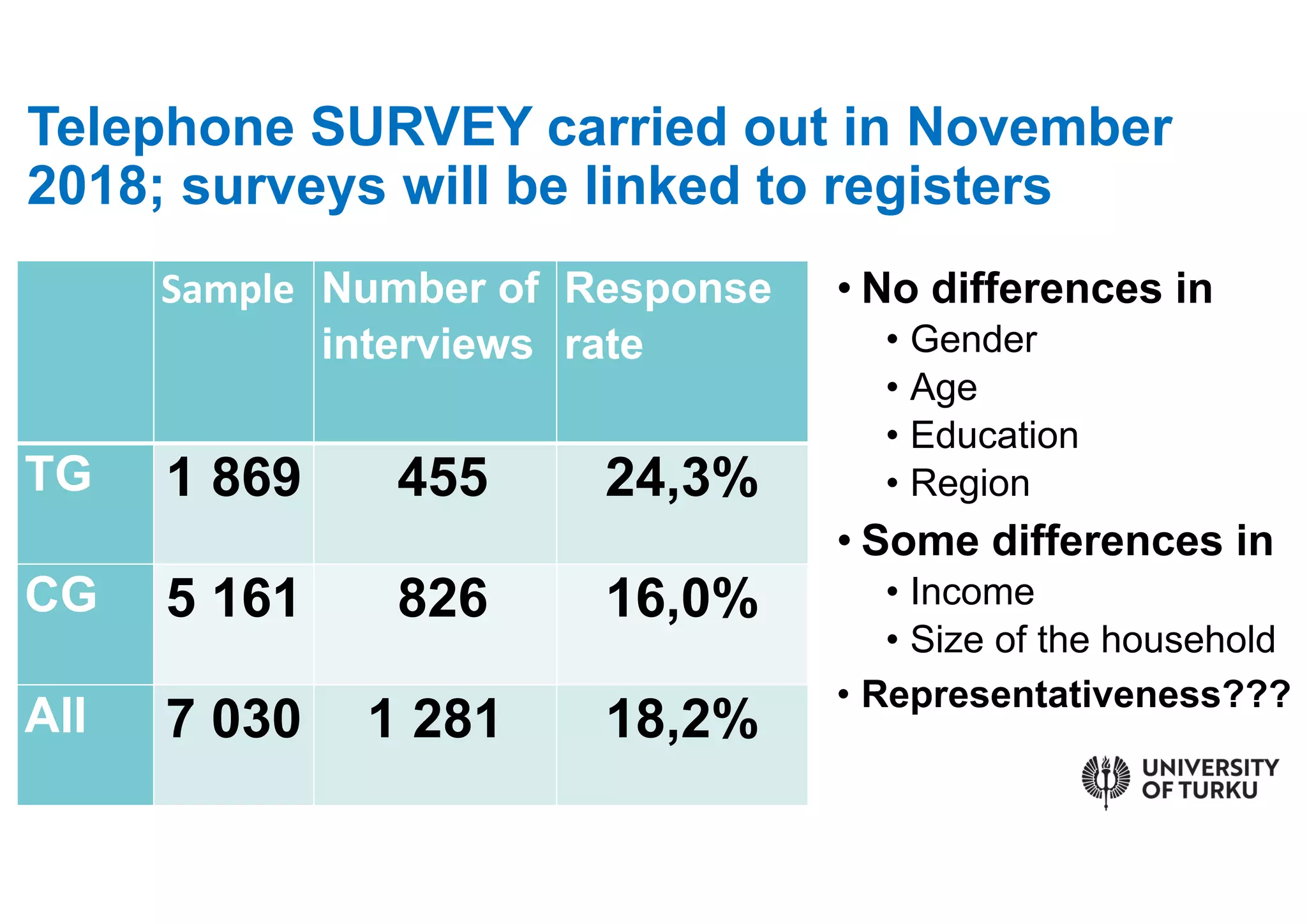

The document discusses the basic income experiment in Finland, initiated by the government to address changes in labor markets and social security systems. The experiment evaluated various models of basic income, including full and partial options, and aimed to analyze the effects on employment and welfare during its two-year duration from January 2017 to December 2018. Key findings highlighted constitutional constraints, budget limitations, and noted that the results showed no significant differences in employment outcomes between the treatment and control groups.