The document provides an overview of the Mundell-Fleming model, which examines how fiscal and monetary policy impact output and exchange rates under different exchange rate regimes. Key points:

1) Under floating exchange rates, fiscal policy has no effect on output while monetary policy is powerful. Under fixed rates, the reverse is true - fiscal policy is powerful while monetary policy has no effect.

2) A country cannot have free capital mobility, an independent monetary policy, and a fixed exchange rate at the same time. It must choose two of the three.

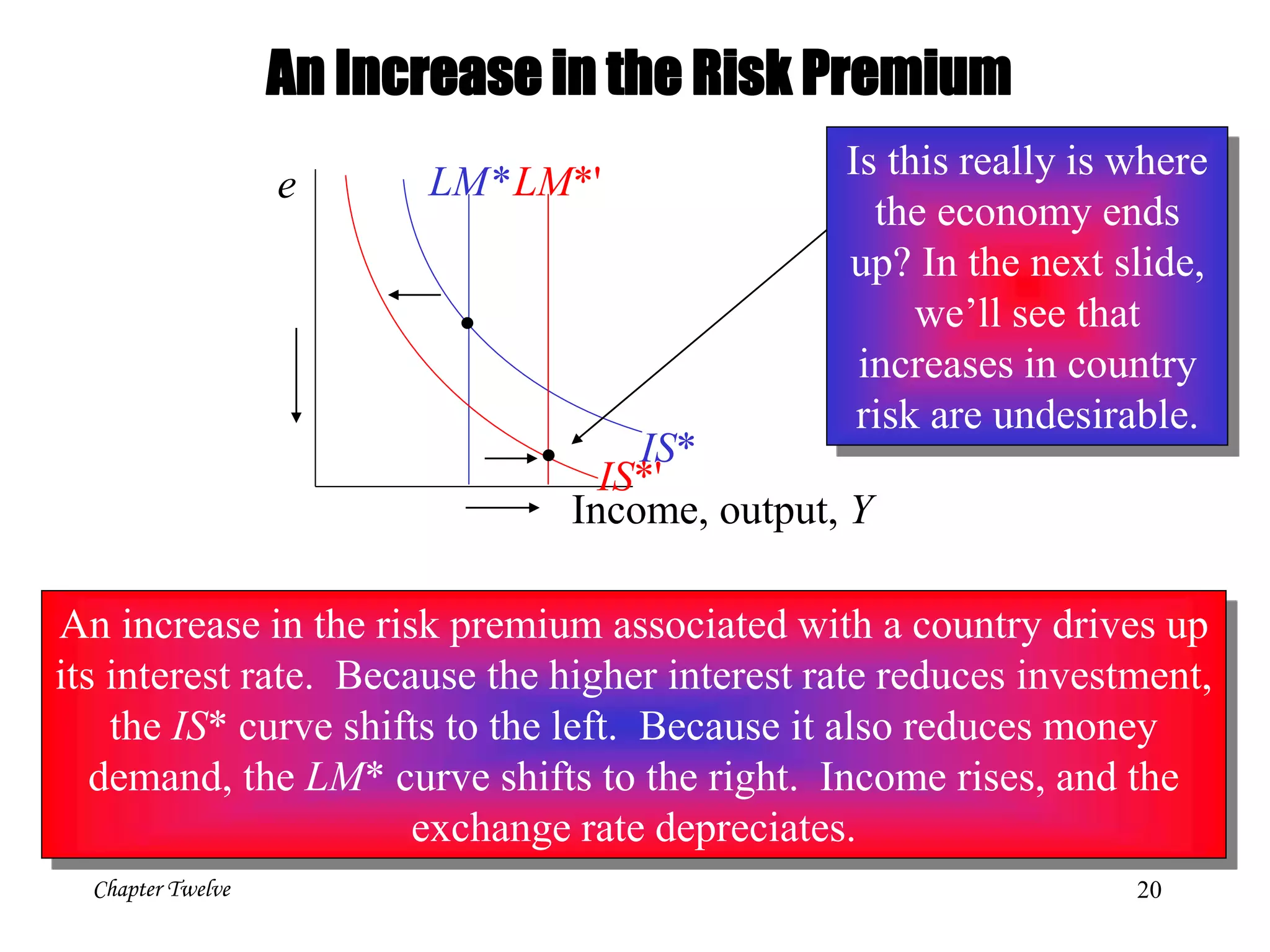

3) Expectations about exchange rate changes can become self-fulfilling prophecies that impact interest rates and currency values in the present. Increased risk perceptions push up