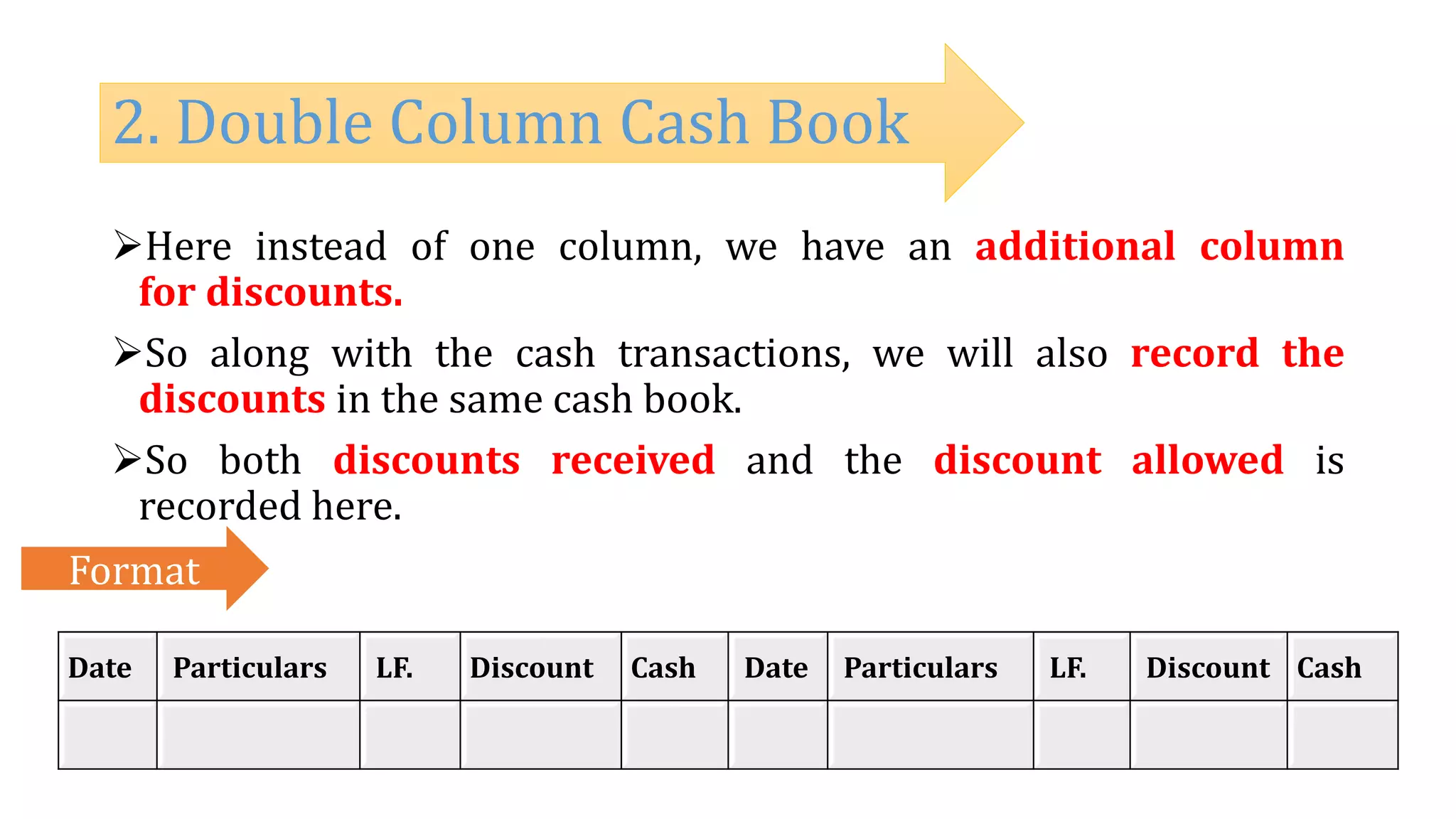

The document discusses subsidiary books in accounting, which are original entry books that categorize transactions by nature to enhance efficiency and error detection. It details various types of subsidiary books, including cash books, purchase and sales journals, purchase and sales returns books, and bill receivable and payable books, along with their formats and purposes. Additionally, it explains the cash book types—single, double, and triple column—and the concept of contra entries.