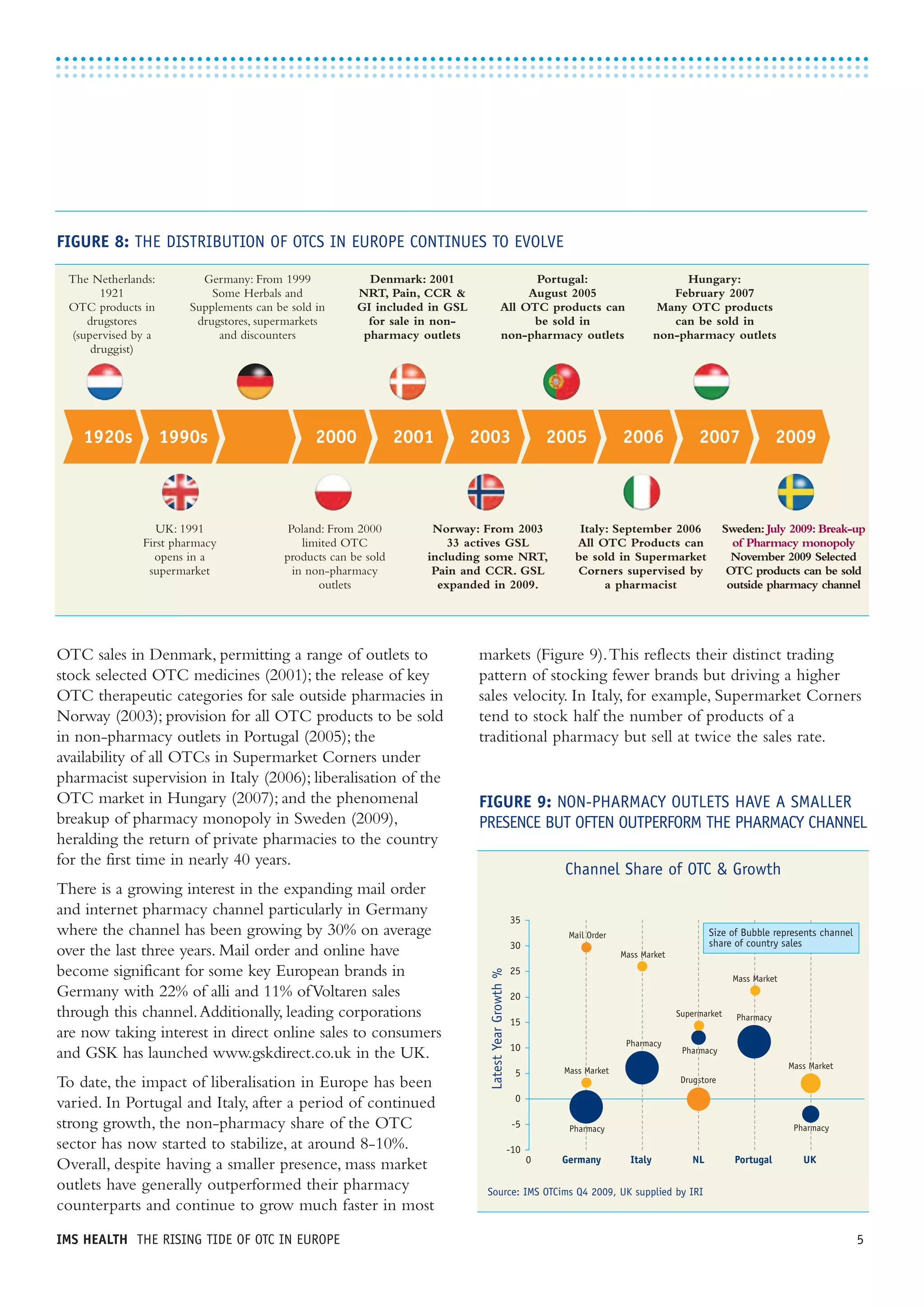

The OTC market in Europe is experiencing significant growth, driven by innovation, self-medication promotion, and expanding distribution channels, with a notable rise from €73bn in 2008. Emerging markets, particularly in Central and Eastern Europe, are becoming key growth drivers, representing 77% of global OTC growth despite accounting for 36.3% of total sales. However, companies must navigate increasing complexity and competition as established and new players invest in the OTC space to capitalize on these opportunities.