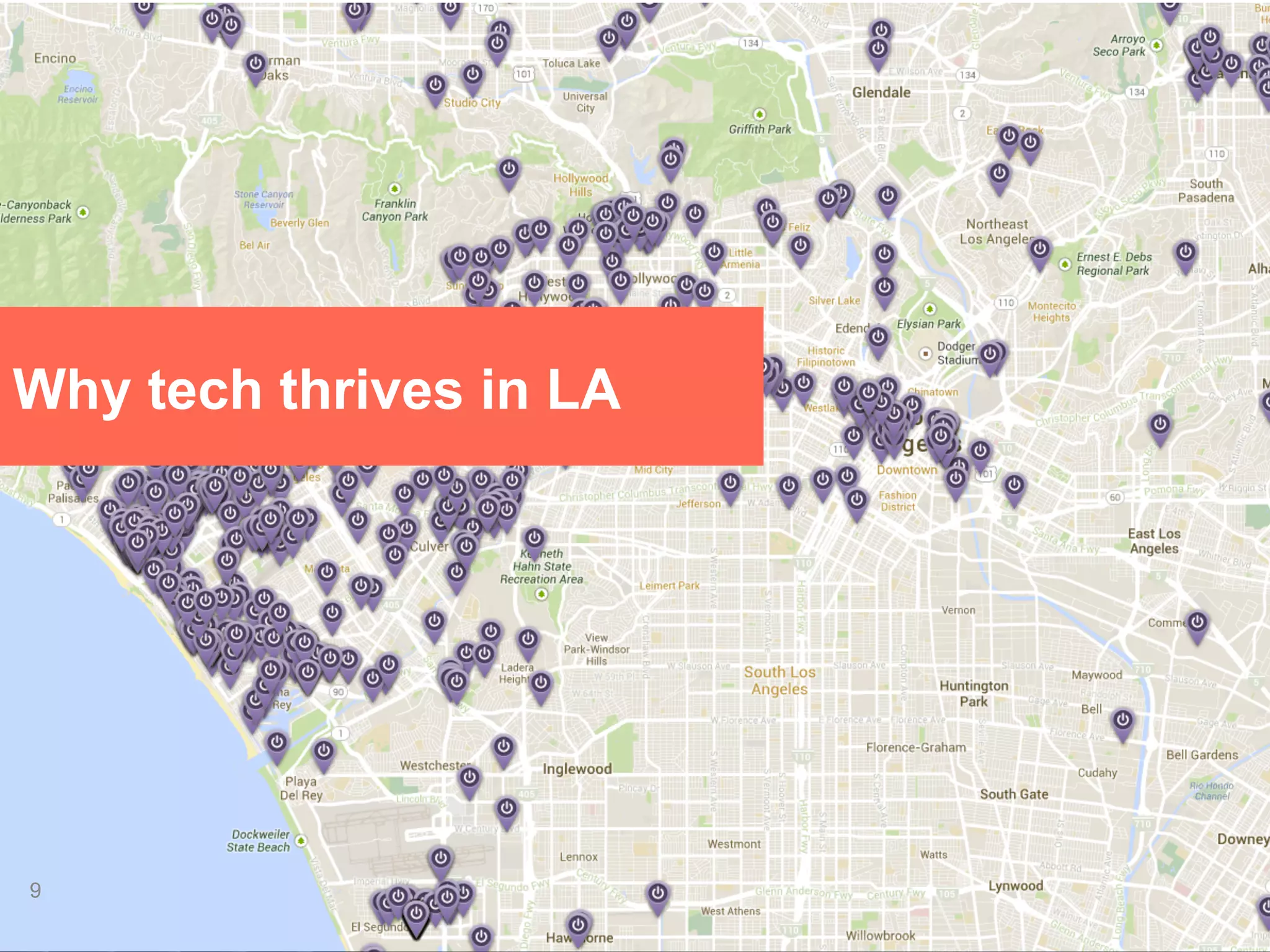

The Los Angeles technology market is one of the largest and fastest growing in the US. It is the third largest tech ecosystem and has grown 4 times faster than the national average in recent years. Capital investment in LA startups has also increased significantly, with over $1.5 billion invested in 2013. LA has a strong talent base and is a leader in the key industries of the future, particularly content, commerce, and communication. The future looks bright for continued growth and success of the LA tech sector.