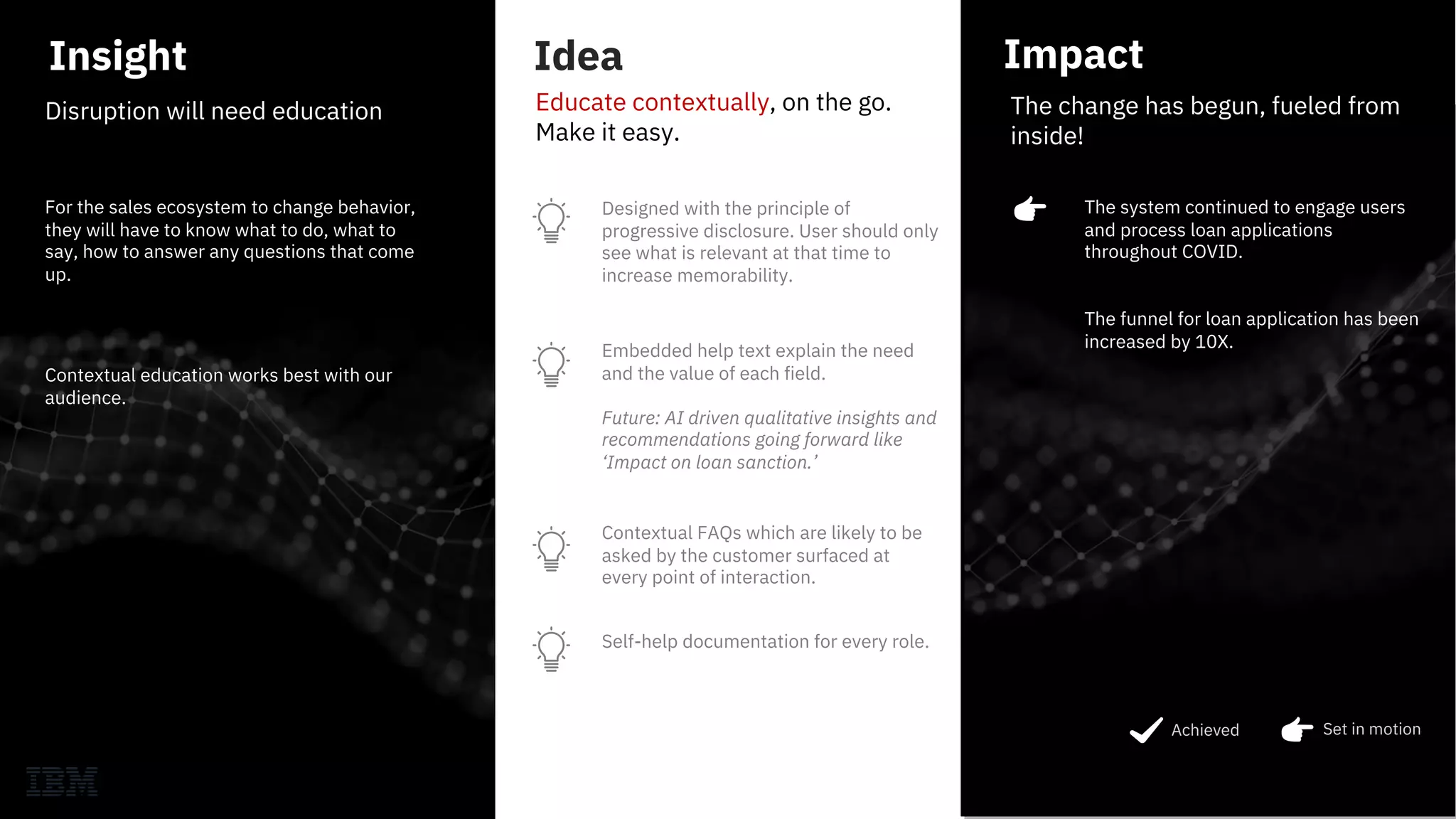

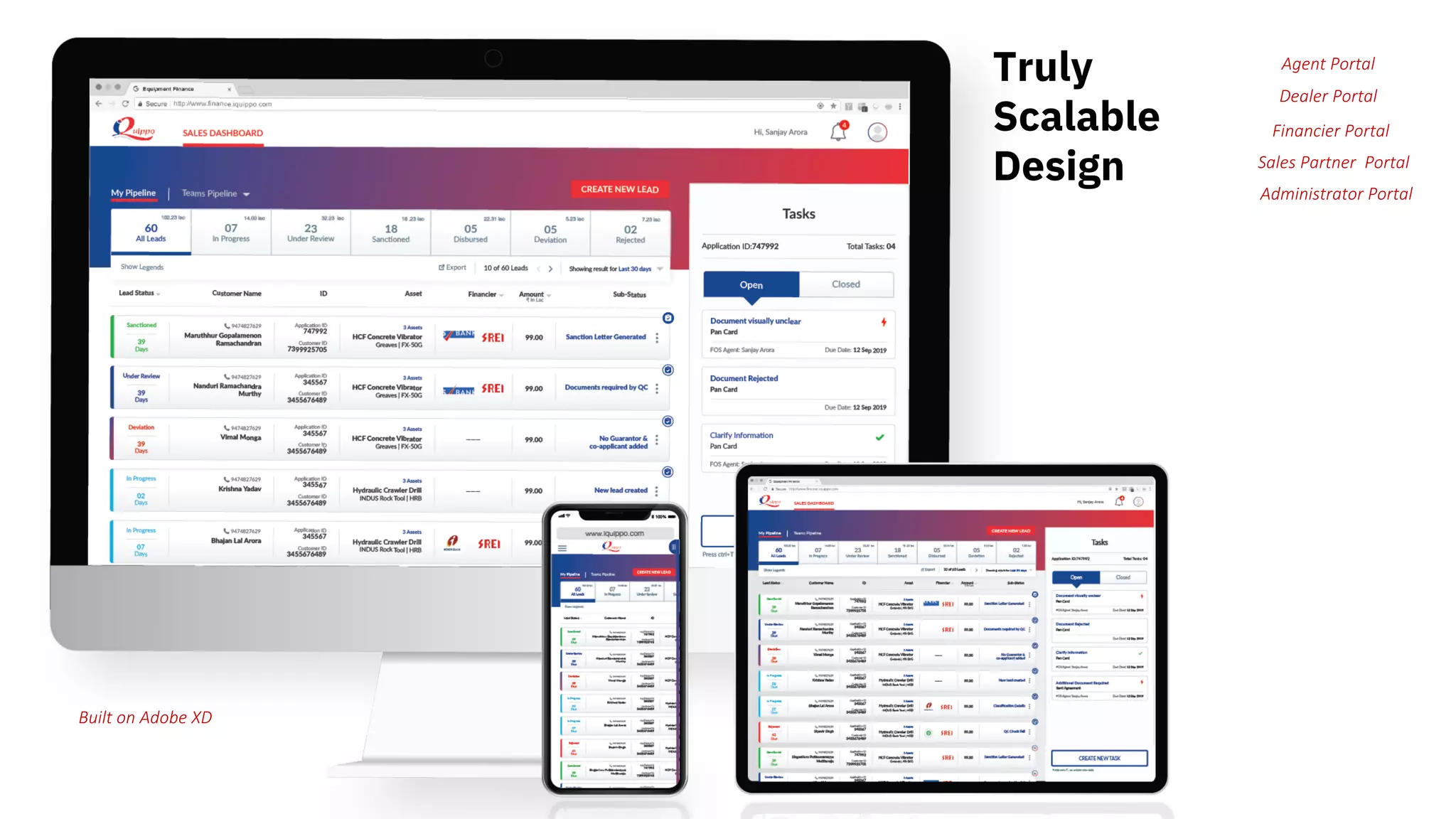

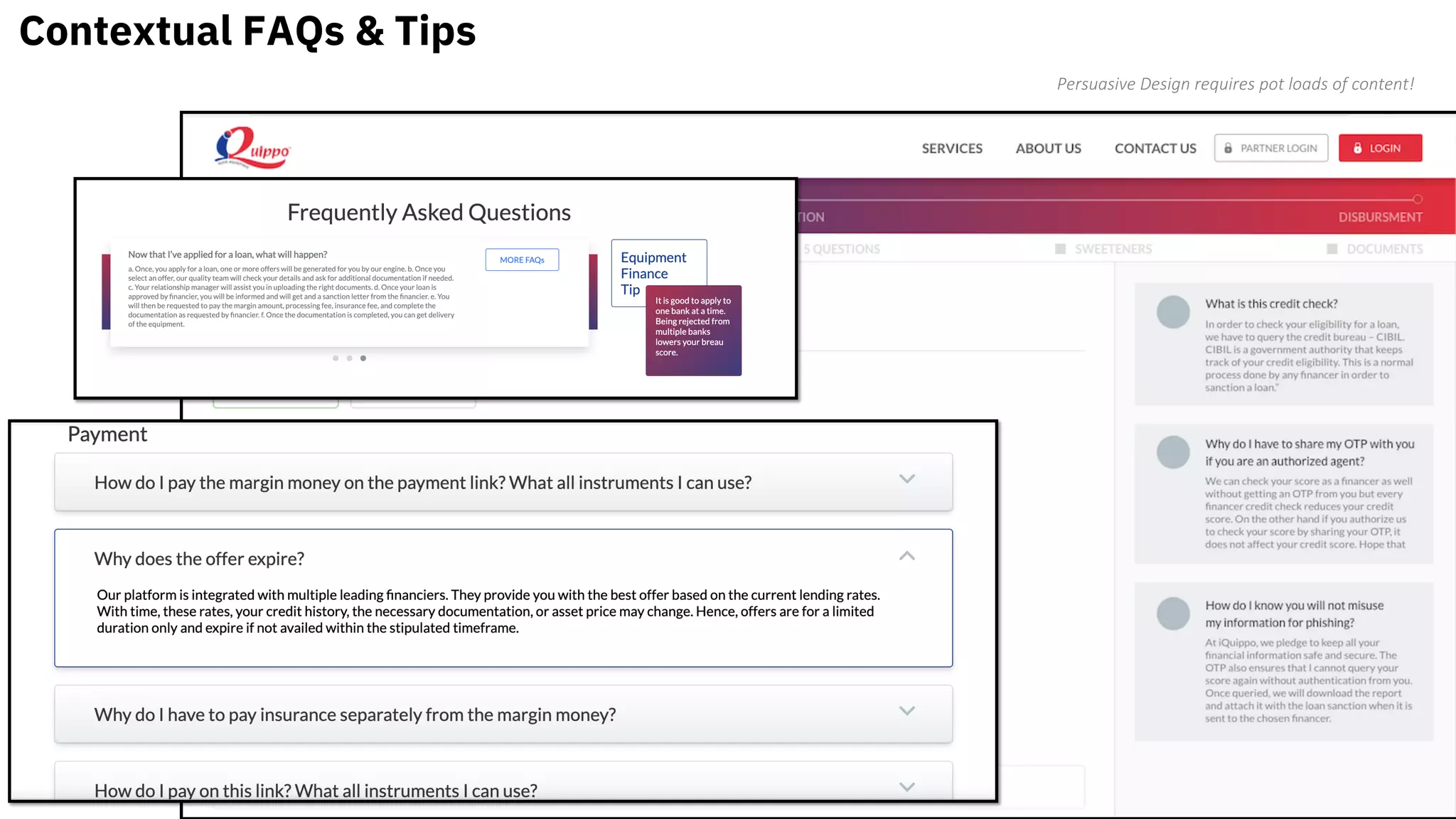

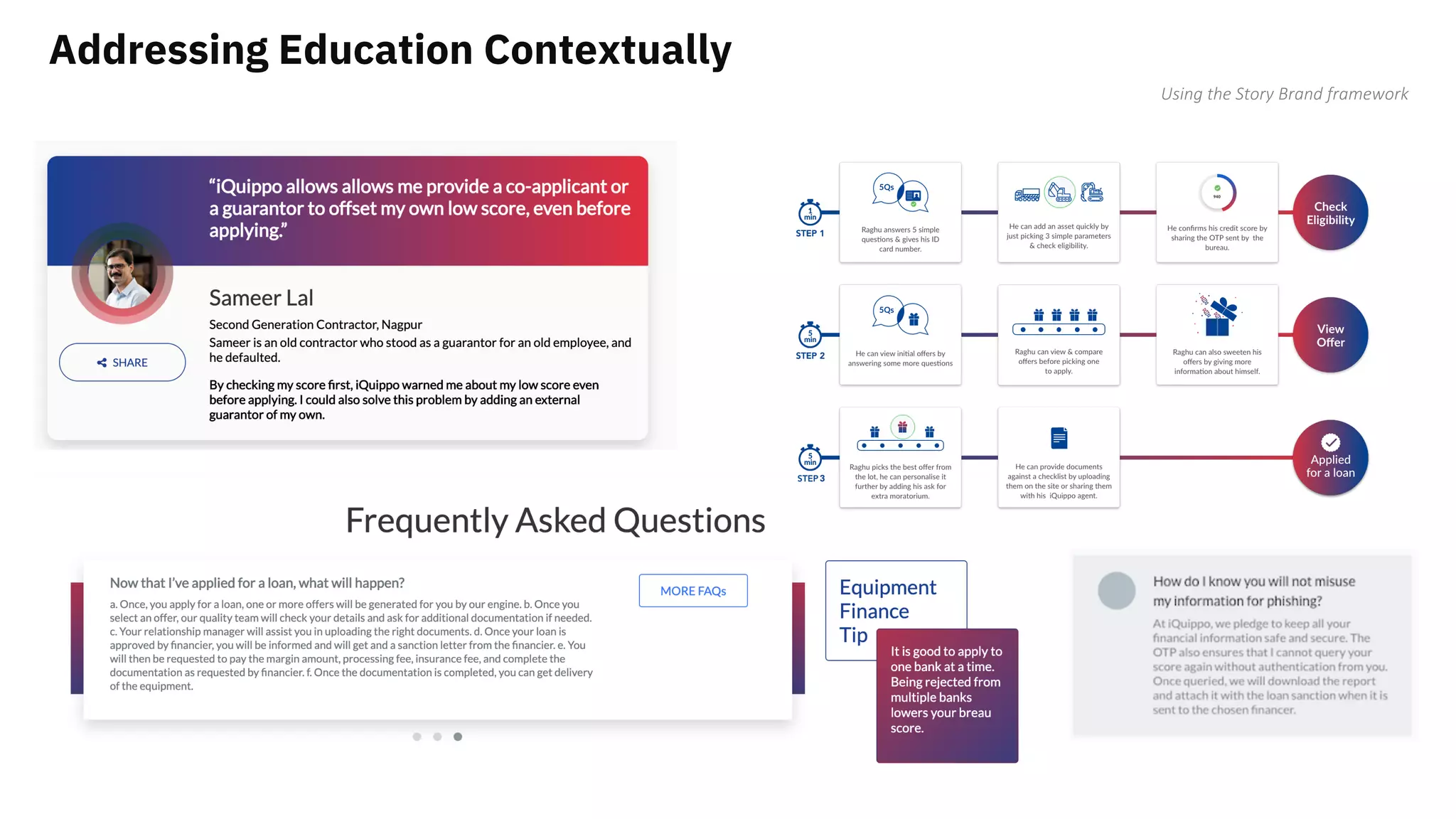

The document outlines the evolution of a heavy equipment finance platform aimed at creating a seamless, data-driven experience for customers in an otherwise fragmented industry. It highlights key insights derived from research and design workshops that emphasize the importance of speed, collaboration, and transparency to enhance decision-making processes for users. The future vision includes AI-driven insights and contextual education to foster informed choices and streamline loan processing across various stakeholders in the ecosystem.