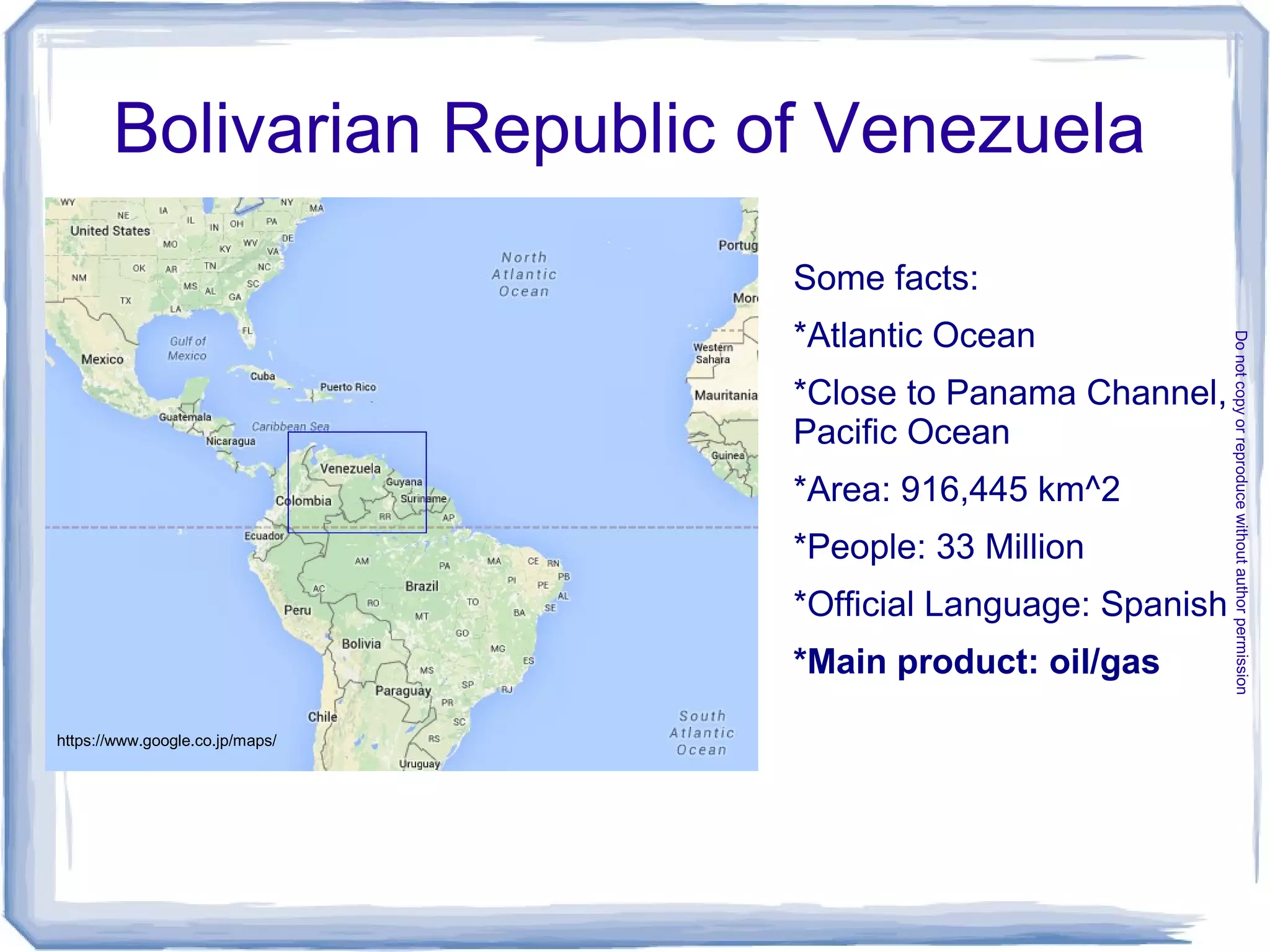

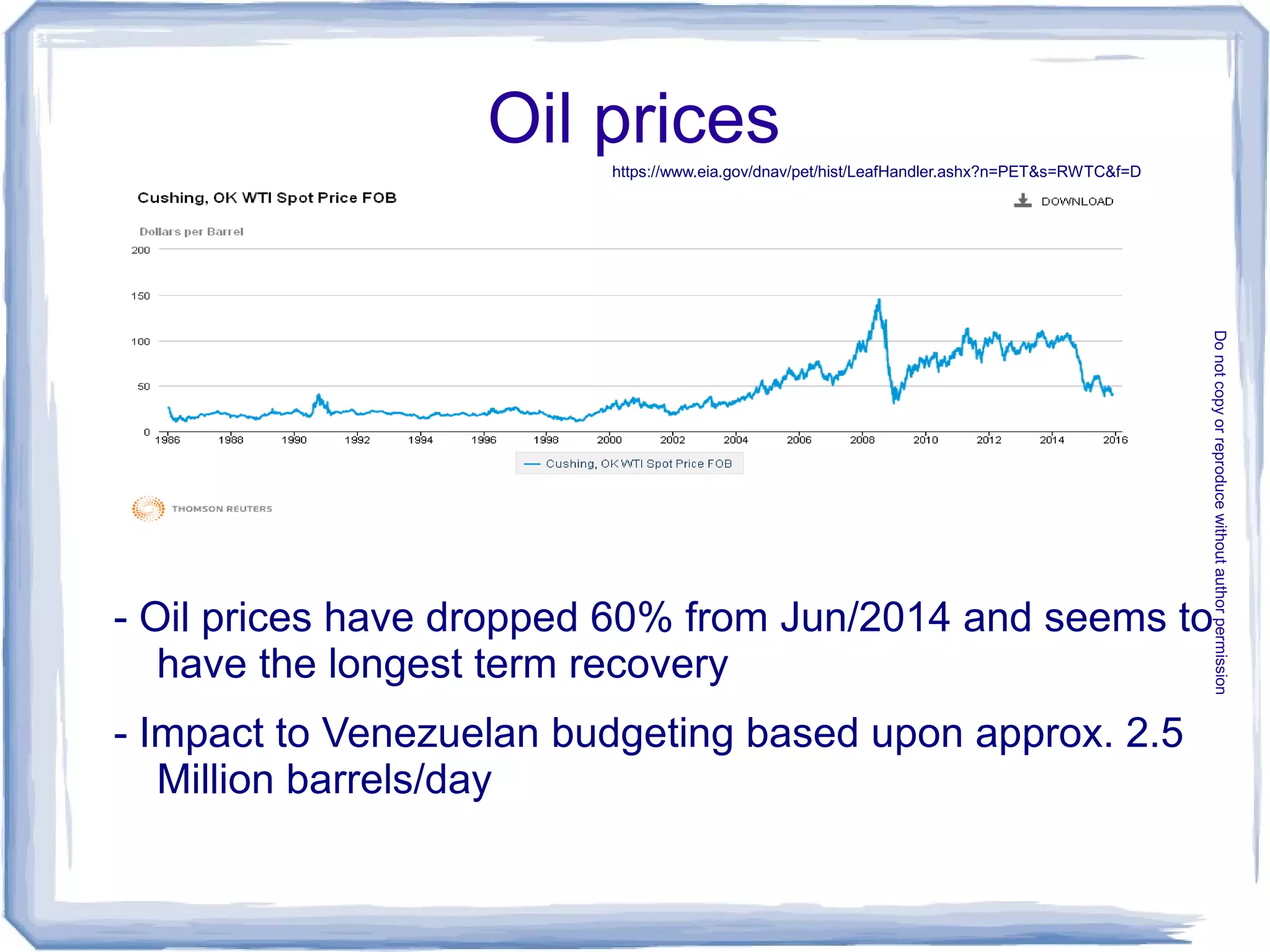

The document discusses the economic challenges facing Venezuela, focusing on its heavy reliance on oil revenue and the implications of nationalization on the private sector. It indicates a significant drop in oil prices and a decline in official development assistance, both contributing to fiscal instability and resource mobilization issues. The text emphasizes the need for policy reforms, including deregulation of gasoline prices and improvements in investment conditions to address these economic uncertainties.