Data extracted on 31 October 2025

Planned article update: 30 October 2026 (full update for 2025 figures)

Highlights

Source: Eurostat (gov_10a_taxag)

For recently updated data, please see hereafter the tables on National Tax List data. Last update for National Tax List data is 30 October 2025.

![]() National Tax Lists - individual taxes, updated 31 October 2025

National Tax Lists - individual taxes, updated 31 October 2025

This article presents recent data on tax revenue and its relationship to gross domestic product (GDP) in the European Union (EU) and the euro area (EA-20). The latest year for which detailed tax revenue statistics are available for all EU countries is 2024.

General overview

As a ratio of GDP, in 2024 tax revenue (including net social contributions) accounted for 40.4% of GDP in the European Union (EU), an increase compared with 2023 (39.9%). In the euro area (EA-20), tax revenue also increased from 40.5% in 2023 to 40.9% in 2024.

In absolute terms, in 2024, revenue from taxes and social contributions increased by €387 billion in the EU compared with 2023, to stand at €7 281 billion. In the euro area, revenue from taxes and social contributions increased by €291 billion compared with 2023, to stand at €6 226 billion.

In past years, tax revenue of the EU countries was significantly impacted by the COVID-19 pandemic. Almost all EU countries introduced measures for the deferral of tax and social contribution payments in 2020. This means that taxes were accrued as revenue in 2020 but only paid in following periods, leading to an increase in the accounts receivable of general government. Some of the tax deferral measures continued into 2021 and 2022. Additionally, a number of EU countries had introduced temporary tax cuts.

In 2021, tax revenue was impacted by the partial re-opening and recovery of the economy in the COVID-19 pandemic, while in 2022, the tax and social contribution revenue was impacted to a much lesser extent by the COVID-19 pandemic, while increasing energy prices and measures taken to mitigate their impact impacted the tax revenue strongly. The further increase in government total tax revenue in 2022 and 2023 was due to an economic recovery (automatic stabiliser effects) as well as higher inflation, while a number of EU countries took tax cutting measures to lower some taxes such as those on energy products. In 2024 the stable employment and wage increases continued to support revenue levels.

As a percentage of GDP, EU tax revenue increased in 2024, from 39.9% in 2023 to 40.4% in 2024. In 2021 (41.2%), the tax-to-GDP ratio had stood at its highest point since 1999 (41.7%). In the euro area, the tax-to-GDP ratio also increased from 40.5% in 2023 to 40.9% in 2024.

Tax revenue made up 87.8% of total general government revenue in 2024 in the European Union.

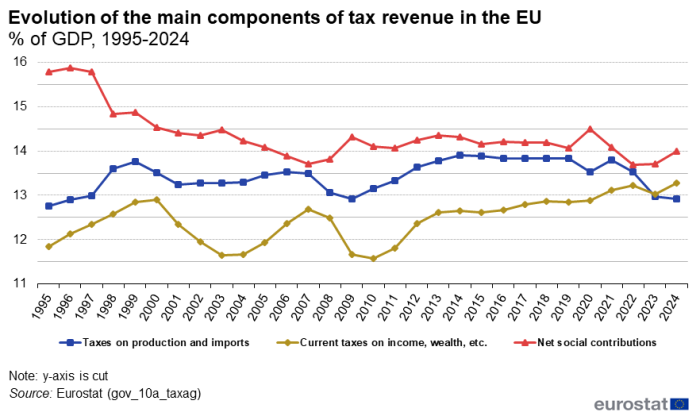

In 2024 in the EU, taxes on production and imports accounted for 12.9% of GDP and current taxes on income, wealth, etc. stood at 13.3% of GDP, while net social contributions stood at 14.0% of GDP.

Tax revenue-to-GDP ratio in 2024: highest tax-to-GDP ratio in Denmark, France and Belgium

In 2024, tax revenue (including social contributions) in the EU stood at 40.4% of GDP, and accounted for 87.8% of general government total revenue. The ratio of tax and social contributions revenue to GDP in the euro area was higher than in the EU, at 40.9%.

Source: Eurostat (gov_10a_taxag)

The tax-to-GDP ratio varied significantly between EU countries in 2024, with the highest shares of taxes and social contributions as a percentage of GDP being recorded in Denmark (45.8%), France (45.3%), Belgium (45.1%), Austria (43.8%), Luxembourg (42.7%), Italy (42.6%), Sweden (42.5%) and Finland (42.3%). At the opposite end of the scale, Ireland (22.4%), Romania (28.8%), Malta (29.3%) and Bulgaria (30.5%) as well as Switzerland (27.8%) registered the lowest ratios among the reporting EU and EFTA countries.

Source: Eurostat (gov_10a_taxag)

In 2024, tax revenue in absolute terms increased in nearly all EU countries

In absolute terms from 2023 to 2024, all of the EU and EFTA countries with the exception of Finland and Norway experienced an increase in tax revenue. For Norway, the decline between 2023 and 2024 (-1.6%) was mainly due to the relatively high amounts recorded in 2023 as a result of still high revenues from oil and gas producing companies. For Finland total tax and social contribution revenue decreased slightly (-0.1%) due to lower revenue from social contributions. Among EU countries, the strongest increases in absolute tax and social contribution revenue from 2023 to 2024 were observed for Malta (+21%), Romania (+16%), Croatia (+14%), Bulgaria (+13%), Poland (+12%) and Slovenia (+11%).

At the level of the EU, tax revenue increased by 5.6% from 2023 to 2024 or by around €387 billion euro (see Tables 2 and 4). At the level of the EU, decreases in absolute total tax revenue are observed in the available time series from 1995 to 2024 only in 2009 (-5.2%), due to the economic and financial crisis and in 2020 (-3.6%), due to the COVID-19 pandemic.

In 2024, compared with 2023, the tax-to-GDP ratio increased in 22 EU countries

In 2024, compared with 2023, the tax-to-GDP ratio increased in 22 EU countries as well as Iceland and Switzerland, with the largest increases being observed in Malta (from 26.7% in 2023 to 29.3% in 2024), Latvia (from 33.0% in 2023 to 35.5% in 2024), Slovenia (from 36.8% in 2023 to 38.8% in 2024) and Croatia (from 36.9% in 2023 to 38.6% in 2024). The increases in the tax-to-GDP ratios are due to the faster growth in tax and social contribution revenue as compared with the growth in GDP.

Source: Eurostat (gov_10a_taxag)

By contrast, decreases of between -0.1 percentage points (pp) and -0.5 pp of GDP were recorded in 5 EU countries, with the largest decreases noted in Finland (42.9% in 2023 to 42.3% in 2024), the Netherlands (39.7% in 2023 to 39.4% in 2024), France (45.6% in 2023 to 45.3% in 2024), Portugal (37.2% in 2023 to 37.1% in 2024) and Sweden (42.6% in 2023 to 42.5% in 2024). For Norway, a decrease in the tax-to-GDP ratio of -1.4 pp of GDP was observed between 2023 (41.8%) and 2024 (40.4%).

The effects of the economic and financial crisis on the tax-to-GDP ratio from 2007 onwards are apparent. From its last spike in 2007 (40.1% of GDP), the ratio of tax and social contribution revenue to GDP in the EU decreased strongly to 39.0% of GDP in 2010. The ratio for the euro area also decreased from its peak of 40.1% in 2007 to 39.2% of GDP in 2010. Tax revenue was decreasing more than GDP at that time. Between 2010 and 2013, tax revenue in terms of GDP increased substantially, which was due to absolute tax revenue increasing along the same path as in the previous years and GDP growth being lower. This reflects pro-active tax measures taken by EU countries during those years to correct their government deficits, such as VAT rate increases and new taxes, for example bank levies and taxes on property. From 2014 to 2015, tax revenue in the terms of GDP slightly decreased in both the EU and euro area, before increases from 2016 to 2018. In 2019, a slight decrease is observed for both the EU and euro area (see Figure 2). Euro area tax revenue as a percentage of GDP remains at a higher level than EU tax revenue.

In 2020 and 2021, the EU and euro area tax revenue increased as a percentage of GDP, despite the strong decrease in absolute tax revenue in 2020 as a result of the impact of the COVID-19 pandemic. The increase as a percentage of GDP implies a higher growth of tax revenue compared with the growth of the nominal GDP. In 2020, the increase as a percentage of GDP implies a less severe fall of tax revenue compared with the fall in nominal GDP. This can be attributed to policy measures to combat the economic fallout from the COVID-19 pandemic - notably measures to safeguard employment by introducing furlough schemes or expanding existing schemes as well as wide-spread measures to support businesses affected by the pandemic. While these increased government expenditure, they also served to keep certain tax categories such as personal income taxes and social contributions relatively stable. GDP was notably impacted by lockdowns leading to less economic activity. In 2021, the absolute increase in tax and social contribution revenue in the EU and euro area after the exceptional drop in 2020 due to COVID-19 pandemic was far stronger than the increase in nominal GDP. While all major tax categories show an increase at the level of the EU in 2021, different movements of the main tax categories can be observed.

In 2022, tax and social contribution revenue continued to increase in absolute terms at the level of the EU, however, this was influenced strongly by inflationary pressures. As a ratio to GDP, tax and social contribution revenue declined at the level of the EU. In 2023, the tax and social contributions at the level of the EU increased further in absolute terms, although at a slower pace, with the tax-to-GDP ratio declining further. The growth of tax and social contribution revenue in absolute terms accelerated again in 2024 coupled with an increase in the tax-to-GDP ratio for the EU.

Source: Eurostat (gov_10a_taxag)

There are many reasons why government tax revenue varies from year to year. In general, the main reasons are changes in economic activity (affecting levels of employment, sales of goods and services, etc.) and in tax legislation (affecting tax rates, the tax base, thresholds, exemptions, etc.) affecting revenue as well as changes in the level of GDP. The financial crisis from 2008 – together with measures of fiscal policy to stimulate the economy adopted in the countries – had a strong impact on the level and composition of tax revenue in 2009-2016, although the first effects had already become visible from the third quarter of 2008. It should be noted that, even when using accrual methods of recording as required by national accounts methodology, the effects of changes in legislation or economic activity tend to have a delayed impact on tax revenue. The purpose of accruing taxes and social contributions is to allocate the government revenue to the moment of the underlining economic activity (such as production or consumption) instead of the moment of cash receipts. Even in absolute terms, tax revenue fell in the EU and the euro area between 2008 and 2009 - for the first time since 1995 (the period for which data are collected), before steadily rising again to surpass pre-crisis levels in 2011 in both areas. The proportional increase in tax revenue was higher than the proportional increase in GDP, which resulted in an increase in the tax-revenue-to-GDP ratio in both the EU and the euro area. This recovery in tax revenue in most EU countries can at least partly be attributed to active revenue-raising measures in some EU countries, for example, increases in the VAT rate and the introduction of new taxes, such as bank and property taxes.

In 2021, still affected by the COVID-19 pandemic, a far quicker recovery of tax revenue than in the financial crisis, both in absolute terms and compared with nominal GDP, was observed. From 2022 to 2023, less affected by the COVID-19 pandemic, but affected by inflationary pressures in particular on energy prices, the tax-to-GDP ratio in the EU and euro area declined, before increasing in 2024.

Source: Eurostat (gov_10a_taxag)

Indirect taxes and net social contributions as percentage of GDP increased in 2024, while direct taxes decreased as a percentage of GDP

Revenue from taxes and social contributions can be grouped into 3 main categories or types: first, indirect taxes defined as taxes linked to production and imports (such as value added taxes - VAT), second, direct taxes consisting of current taxes on income and wealth, and third, net social contributions. The difference between direct taxes and indirect taxes is that for direct taxes, the burden of paying them cannot be shifted to other parties easily. For indirect taxes, such as VAT, who ends up paying the taxes depends de facto on the price elasticities of supply and demand.

In the ESA 2010 classification, these categories correspond to several transactions. Taxes on production and imports (D.2), current taxes on income, wealth, etc. (D.5), capital taxes (D.91), net social contributions (D.61) composed mainly of actual social contributions (D.611 + D.613) as well as imputed social contributions. Figure 7 shows the recent historical trend of taxes on production and imports (D.2), current taxes on income, wealth, etc. (D.5), and net social contributions (D.61) for the EU relative to GDP.

Source: Eurostat (gov_10a_taxag)

Net social contributions include actual social contributions (for paying into social security funds or other social insurance schemes) as well as imputed social contributions, imputed contributions relating to the property income of certain social insurance schemes deemed as being an additional contribution to the scheme (D.614 households' social contribution supplements). Imputed output of certain social insurance schemes (D.61sc social insurance scheme service charges) are excluded from net social contributions. In 2024, at the level of the EU, the share of net social contributions as a share of GDP increased (from 13.7% of GDP in 2023 to 14.0% of GDP in 2024).

As regards the other 2 major components of tax and social contribution revenue, taxes on production and imports decreased slightly from 13.0% of GDP in 2023 to 12.9% of GDP in 2024, while current taxes on income, wealth, etc. increased from 13.0% in 2023 to 13.3% of GDP in 2024.

Because of differing national tax structures, indirect taxes, direct taxes and net social contributions vary considerably in importance from country to country in terms of the tax revenue they generate.

For the EU, the ratio of current taxes on income, wealth, etc. to GDP decreased from 12.7% in 2007 to 11.6% of GDP in 2010, but showed an increase of 1.0 pp of GDP in between 2010 and 2013, stagnated between 2013 and 2015, before increasing slightly to 12.8% of GDP in 2017 and 12.9% of GDP in 2018. The ratio of current taxes on income and wealth etc. remained stable in the period from 2018-2020 in spite of the COVID-19 pandemic. This is likely to be due to the extensive measures in the EU countries to safeguard employment (furlough schemes). As a result, household income taxes did not decline as much as during the financial crisis. The ratio increased to 13.1% in 2021 and 13.2% in 2022 which was primarily due to strong increases in taxes on profits of corporations as well as increases in personal income taxes. In 2023, the share of current taxes on income, wealth, etc. decreased to 13.0% driven by lower personal income taxes, with corporate income taxes contributing to the decline to a lesser extent. The revenue from personal income taxes contributed to the increase by 0.3 pp of GDP of current taxes on income, wealth, etc. in 2024 as well.

As regards the economic and financial crisis, from 2008 to 2009, the share of direct taxes decreased more than GDP and the fall in direct taxes was more pronounced than the fall in indirect taxes. Direct taxes have also taken longer to recover. The main components of direct taxes are taxes on the income of individuals and corporations. In the crisis, taxes on the income or profits of corporations experienced a decline in 2008 and further decreased in 2009. Despite their lower relative weight in the tax burden, the decrease in 2009 was stronger than the decrease in taxes on individual or household income (which are affected by unemployment). This reflects the higher sensitivity of corporate profits to the economic climate and highlights the role of corporate income taxes as automatic stabilisers. The longer lag in recovery could also be partly due to taxation policies in many EU countries allowing losses to be carried forward and offset against profits.

Taxes on production and imports as a percentage of GDP at the level of the EU increased between 2009 and 2015 - from 12.9% of GDP to 13.9% of GDP. This was at least partly due to increases in the VAT rates in many countries and the introduction of new taxes. Indirect taxes are expected to have a shorter lag in reaction to the renewed growth in output. For indirect taxes there are no carrying forward possibilities as with some taxes on corporate profits, meaning that losses of the past reduce the tax liability of following years. Between 2016 and 2019, taxes on production and imports increased in line with nominal GDP, meaning that as a ratio to GDP they remained stable at 13.8%. In 2020, the ratio decreased to 13.5% of GDP as tax revenue - specifically from taxes on products such as VAT - declined faster than GDP. Due to the COVID-19 lockdowns there was a shift in consumption patterns, for example away from dining in a restaurant towards home cooking, the latter typically having a lower VAT rate on the basic ingredients. Additionally, in a number of countries, some relief from VAT was available during 2020. After the consumption partially revived in 2021, the ratio increased again to the level of 13.8%. In 2022 in the EU, compared with 2021, the ratio declined to 13.5% of GDP and further to 13.0% of GDP in 2023, implying that taxes on production and imports increased less strongly than nominal GDP. This is partly due to tax relief measures offered by a number of EU countries on taxes on energy products. In 2024, the ratio decreased at the level of the EU to 12.9% of GDP.

From 2008 to 2009, the share of (net) social contributions increased by 0.5 pp to 14.3% of GDP, then decreased from 2009 to 2010. Between 2011 and 2019 the share of (net) social contributions more or less remained stable before increasing by 0.4 pp in 2020 to stand at 14.5% of GDP. Typically, the continuation of payments of social contributions were part of furlough schemes that were introduced by the EU countries in response to the COVID-19 pandemic. This resulted in GDP declining faster than the (net) social contribution revenue. In 2021, the share of net social contributions decreased again by 0.4 pp in comparison with 2020 to 14.1% of GDP, equal to the level from before the COVID-19 pandemic. In 2022, net social contributions as a ratio to GDP decreased further to 13.7%, the lowest ratio observed since 2007. In 2023, the share of net social contributions again remained stable before increasing again to 14.0% of GDP in 2024.

Differences in the structure of tax revenue across the EU

Taxes on production and imports

Taxes on production and imports (D.2) are divided into taxes on products (D.21), which are payable per unit of some good or service produced or transacted, and other taxes on production (D.29). Taxes on products are further split into value added type taxes (VAT; D.211), taxes and duties on imports excluding VAT (D.212) and taxes on products except VAT and import taxes (D.214). The most important type of taxes on production and imports is VAT. In 2024 in the EU, revenue from VAT accounted for around 55% of the total taxes on production and imports.

In 2024, the highest ratios of taxes on production and imports relative to GDP were recorded in Sweden (21.1%), Croatia (19.3%), Hungary (17.3%) and Greece (17.1%), for Sweden in line with the relatively high overall level of taxation. The lowest ratios of these indirect taxes were recorded for Ireland (6.4%), Malta (9.3%), Germany (10.4%), Czechia (10.8%), Romania (11.1%), Spain (11.3%), Luxembourg (11.4%) as well as Switzerland (5.5%) and Norway (10.2%), with Ireland and Switzerland having a low overall level of taxation relative to GDP (see Table 5).

Current taxes on income, wealth, etc.

Current taxes on income, wealth, etc. (D.5) include taxes on income (D.51) and other current taxes (D.59). Taxes on income cover both taxes on individual or household income and the income or profits of corporations, and include taxes on holding gains. At the level of the EU in 2024, current taxes on income, wealth, etc. as a ratio to GDP amounted to 13.3%, while taxes on individual or household income made up the largest share of this (at 9.6% of GDP).

By far the highest importance of current taxes on income, wealth, etc. is noted for Denmark, which raised the equivalent of 31.3% of GDP from these taxes in 2024. The comparatively high ratio for Denmark is due to most social benefits being financed via taxes on income and, consequently, the figures for net social contributions are very low relative to other countries. The next highest ratios were recorded by Luxembourg (19.1%), Sweden (17.7%), Belgium (16.9%) and Finland (16.0%). Norway and Iceland also recorded high revenue from current taxes on income, wealth, etc. - at 20.6% of GDP and 19.1% of GDP respectively in 2024. At the other end of the scale in 2024, Romania (6.0% of GDP), Bulgaria (6.5% of GDP), Hungary (7.6% of GDP), Poland (7.8% of GDP), Croatia (7.9%), Slovakia (8.1%) and Slovenia (8.4% of GDP) had relatively less revenue from these taxes and also showed a generally low tax-to-GDP ratio.

Source: Eurostat (gov_10a_taxag)

Net social contributions

Actual social contributions (D.611 and D.613, representing respectively employers' and households' actual social contributions) are the main component of net social contributions. This source of government revenue covers the compulsory and voluntary contributions payable to government by employees, employers and self- and non-employed persons. It includes any amounts payable by government as an employer. In 2024, actual social contributions accounted for the highest ratios in GDP terms in Germany (17.5%), Slovenia (17.2%), France (16.5%), Slovakia (16.1%), Austria (16.0%) and Czechia (15.8%) and for the lowest ratios in Denmark (0.7%), Sweden (3.7%) and Ireland (4.1%) as well as Iceland (3.0%). In Denmark, social transfers are mainly funded through tax revenue.

In National Accounts, imputed social contributions (D.612) represent the counterpart of unfunded social benefits provided by government as an employer. In 2023, in terms of GDP, they accounted for 2.3% in Belgium, 1.9% in Portugal, 1.8% in France and 1.7% in Greece. In 9 EU and EFTA countries, the ratio (rounded) was 0.1% of GDP or less in 2024.

Net social contributions additionally contains households' social contribution supplements (D.614), representing the counterpart of the property income of funded social insurance schemes distributed to households and reinvested as well as social insurance scheme service charges (D.61sc), representing the output of funded social insurance schemes - this item enters negatively in net social contributions.

More detailed breakdowns of D.2, D.5 and actual social contributions (D.611 and D.613) by country for 2024 are shown in Tables 5, 6 and 7 (Excel file).

Other components of tax revenue

Besides the main tax revenue categories, Figure 8 also shows 2 minor components that are included in the definition of tax revenue: capital taxes (D.91) and capital transfers from general government to relevant sectors, representing taxes and social contributions assessed but unlikely to be collected (D.995).

Capital taxes (D.91) are taxes levied at irregular and infrequent intervals on the net worth or value of assets owned, or transferred in the form of legacies or gifts, an example being an inheritance tax. These taxes accounted for 0.3% of GDP in the EU in 2024. They range from 0.7% of GDP in France and in Belgium, 0.5% of GDP in Finland, to being non-existent in Estonia, Romania, Slovakia and Sweden.

For the countries that (partially) use the assessment method of accrual recording (see methodological notes), a capital transfer can be recorded from general government to other sectors of the economy. This represents taxes and social contributions assessed but unlikely to be collected (D.995), which have to be deducted from tax revenue in order to produce consistent data with countries that use the time-adjusted cash method or that combine a method based on assessments and declarations with coefficients. In 2024, for the EU, this adjustment amounted to around 0.04% of GDP, with the highest ratios being registered for Denmark (0.3%) and for France (0.2%). High amounts recorded in this category cannot be interpreted as a country having a less efficient tax collection system, since countries adopting the different method will not have any amounts recorded in this category.

Taxes and social contributions by subsector

Taxes and social contributions imposed at state and local government level made up 17.3% of total tax and social contribution revenue in 2024 in the EU.

At the level of the EU in 2024, tax revenue (incl. social contributions) of central government made up 46.8% of total tax and social contribution revenue, while state governments (existing only in Belgium, Germany, Spain and Austria among EU countries as well as Switzerland among EFTA countries) recorded a share of 7.8% of total tax revenue, local governments recorded 9.5% of the total and social security funds recorded 35.3% of the total (see Figure 9). The remainder (0.4% of the total) was recorded by the institutions and bodies of the European Union - these are mainly agricultural levies and import duties; which are the first and second own resources of the EU, as well as - up to 2023 - levies imposed in the context of the Single Resolution Mechanism.

Source: Eurostat (gov_10a_taxag)

Malta and Norway do not report a distinct social security funds subsector. In the other 28 EU and EFTA countries reporting a distinct social security funds subsector, the vast majority of revenue is made up of social contributions.

The social security funds subsector was relatively important in terms of tax revenue in France (54.0% of the total), followed by Slovenia (43.1%), Slovakia (42.6%), Germany (40.2%) and Poland (37.8%). On the other end of the scale, Denmark reported the lowest share (1.1% of the total) commensurate with the low importance of social contributions (see above), with the social security funds' subsector in Sweden also only receiving 6.3% of revenue from taxes and social contributions.

In Sweden (28.2% of the total) and Denmark (25.5%) as well as Iceland (28.4%), the local government subsector recorded over a fifth of total tax revenue in 2024. On the other hand, in Malta, all general government tax revenue is recorded by central government and the local government's share made up less than 5% of total tax revenue in Bulgaria, Czechia, Estonia, Ireland, Greece, Cyprus, Lithuania, Luxembourg, the Netherlands, Austria, Romania, Slovenia and Slovakia.

In federal countries reporting a state government, the importance of state government tax revenue in 2024 ranged from 24.3% recorded for the Länder in Germany, 25.1% for the cantons in Switzerland, 16.8% recorded for the Spanish Autonomous Communities, 12.8% recorded for the regions of Belgium to 2.1% recorded by Länder in Austria.

The lowest share of central government tax and social contribution revenue was recorded by Germany (27.2%), France (32.5%), Spain (41.7%), and Poland (48.5%) as well as Switzerland (35.3%).

Tax revenue should be recorded in the government subsector having the power to impose a tax and to set and vary the rate of the tax. Block transfers of tax revenue from one subsector to another frequently take place and are commonly enshrined in legislation. These are recorded as 'other current transfers' and may form an important part of revenue of the receiving subsector. Thus the distribution of tax revenue across subsectors is not on its own an indication of the importance of a subsector in terms of function and share of expenditure.

Source data for tables and graphs

Data sources

Reporting of data to Eurostat

Data are collected by Eurostat on the basis of the European system of national and regional accounts (ESA 2010) transmission programme: table 9, 'Detailed tax and social contributions receipts by type and receiving subsector'. The legal requirement for transmission of data by EU countries is 9 months after the end of the calendar year. The data in this publication corresponds to transmissions for the end-September 2025 deadline and updates during October.

In all cases, the data are consistent with the ESA table 2 'main aggregates of general government' data released on 21 October 2025. The GDP used corresponds to the GDP delivered in the context of EDP notifications coincident with the transmissions of ESA table 2 and 9.

Data were extracted on 31 October 2025.

This data is published in Eurostat's free dissemination database. In addition, Eurostat publishes revenue and economic function data for individual taxes (the National Tax Lists or NTL) delivered by EU countries as well as Iceland, Norway and Switzerland alongside the aggregated tax revenue data under the ESA 2010 transmission programme.

Definition of government

The data relate to the general government sector of the economy, as defined in ESA 2010, comprising the subsectors central government, state government (where applicable), local government, and social security funds (where applicable). Data for taxes collected on behalf of the institutions and bodies of the European Union is also included in the analysis.

Thus revenue data for taxes and social contributions represent all tax and social contributions revenues collected at the EU level.

Definition of tax revenue

The definition used in this article is 'total taxes and social contributions payable to general government, including voluntary contributions'. This corresponds to 'Indicator 4', the broadest of four indicators defined by the Eurostat National Accounts Working Group in June 2001. This indicator covers fully the series reported under table 9 of the ESA 2010 transmission programme. In particular it encompasses the wide diversity of social security systems in the EU.

The four indicators are defined as follows (the codes in brackets refer to ESA 2010 codes):

It has been found that, when comparing the four indicators, the trend in tax revenue is very similar. In terms of level of tax revenue, Indicator 4 is roughly 1 pp of GDP higher than the Indicator 2 measure, although this difference varies across countries.

Time of recording

According to ESA 2010, taxes and social contributions should be recorded on an accrual basis. ESA 2010 details the rules to be followed on the time of recording and the amounts to be recorded. Two methods can be used:

- 'time-adjusted' cash − the cash is attributed when the activity took place to generate the tax liability or when the amount of taxes was determined in the case of some income taxes. This adjustment may be based on the average time difference between the activity and cash receipt;

- a method based on declarations and assessments. In this case, an adjustment needs to be made for amounts assessed or declared but unlikely to be collected. These amounts have to be eliminated from government revenue, either by using a tax-specific coefficient based on past experience and future expectations or by recording a capital transfer for the same adjustment (ESA 2010 code D.995) to the relevant sectors.

ESA 2010 classifications and codes

- D.2: TAXES ON PRODUCTION AND IMPORTS

- D.21: Taxes on products

- D.211: Value added type taxes (VAT)

- D.212: Taxes and duties on imports excluding VAT

- D.214: Taxes on products, except VAT and import taxes

- D.29: Other taxes on production

- D.5: CURRENT TAXES ON INCOME, WEALTH, ETC.

- D.51: Taxes on income

- D.59: Other current taxes

- D.91: Capital Taxes

- D.61: NET SOCIAL CONTRIBUTIONS

- D.611: Employers' social contributions

- D.612: Imputed social contributions

- D.613: Households' social contributions

- D.614: Households' social contribution supplements

- D.61sc Social insurance scheme service charges

- D.995: Capital transfers from general government to relevant sectors representing taxes and social contributions assessed but unlikely to be collected;

TOTAL (D.2_D.5_D.91_D.61_M_D.995): total receipts from taxes and social contributions (including imputed social contributions) after deduction of amounts assessed but unlikely to be collected;

Total general government revenue (TR) includes total taxes and social contributions as well as market output (P.11), output for final use (P.12), payments for other non-market output (P.131), other subsidies on production, revenue (D.39r), property income, revenue (D.4r), other current transfers, revenue (D.7r) and capital transfers, revenue (D.9r);

For ratios to GDP, GDP at current prices (nominal GDP) is used throughout. For EU countries, the GDP transmitted in the context of the end-September 2024 EDP notification is used.

Symbols:

":" not available

"pp" percentage points

Context

As a ratio of GDP, in 2024 tax revenue (including net social contributions) stood at 40.4% of GDP in the European Union (EU) and at 40.9% of GDP in the euro area (EA-20). Compared with 2023, increases are observed at the level of the EU (2023: 39.9%) and the euro area (2023: 40.5%). In absolute terms, tax revenue increased in 2024 in the EU and the euro area.

In 2024, tax revenue made up 88.7% of total general government revenue in the European Union.

Explore further

Other articles

Database

- Annual government finance statistics (gov_10a)

- Main national accounts tax aggregates (gov_10a_taxag)

Thematic section

Publications

- National Tax Lists - Excel publications

![]() National Tax Lists - individual taxes, updated 31 October 2025

National Tax Lists - individual taxes, updated 31 October 2025

Selected datasets

- Annual government finance statistics (t_gov_a)

- Total general government revenue (tec00021)

- Total general government expenditure (tec00023)

- Taxes on production and imports (tec00020)

- Current taxes on income, wealth, etc. (tec00018)

- Net social contributions (tec00019)

Methodology

- Government revenue, expenditure and main aggregates (ESMS metadata file — gov_10a_main_esms)

- Main national accounts tax aggregates (ESMS metadata file — gov_10a_taxag_esms)

External links

- European Commission - DG Taxation and Customs Union:

- Database of main taxes in Europe

- Website dedicated to the Taxation trends report, including the full methodological annex to the Taxation trends report and the National Tax Lists for the 2021 edition of the Taxation trends report (based on data delivered in 2021).